In forex trading, mastering the art of position sizing is as crucial as developing a profitable strategy. Position sizing determines how much of your account balance you allocate to a single trade. This critical component affects your profits and plays a pivotal role in risk management and the overall success of your trading strategy.

In this article, we’ll explore what position sizing is, why it’s crucial for forex trading, and how to calculate it effectively. Additionally, we’ll explain how improper position sizing can disrupt your strategy and risk-reward ratio, ultimately jeopardizing your trading success.

What Is Position Sizing in Forex Trading?

Position sizing in forex refers to calculating the number of lots (standard, mini, or micro) to trade based on your account balance, risk tolerance, and the trade’s stop-loss distance. Unlike other markets, forex offers leverage, which makes position sizing even more critical. With leverage amplifying both potential gains and losses, proper sizing ensures you don’t overexpose your account to unnecessary risk.

For example:

- If you have a $10,000 account and decide to risk 1% per trade, your maximum risk is $100.

- Based on the pip value and the stop-loss distance, you calculate the number of lots to trade.

Why Position Sizing Matters in Forex Trading

1. Risk Management

Without proper position sizing, you risk losing more than you can afford. Inconsistent or oversized positions can lead to catastrophic losses, wiping out your account. Effective sizing aligns with your risk tolerance, protecting your capital.

2. Consistent Strategy Execution

A forex trading strategy is built on probabilities and risk-reward ratios. If you don’t position size correctly:

- You might risk more on losing trades and less on winning trades.

- This inconsistency can skew your risk-reward ratio, making your strategy ineffective over time.

For instance, if your strategy targets a risk-reward ratio of 1:2 but you don’t size your positions properly, you may end up risking $100 to gain $50, which defeats the purpose of your plan.

3. Maintaining the Risk-Reward Ratio

Position sizing ensures that your risk-reward ratio remains intact. For example:

- If your strategy risks 30 pips to gain 60 pips, position sizing calculates the lot size that keeps this ratio consistent, regardless of the currency pair or account size.

Without proper sizing, you might overexpose yourself to risk on one trade and underutilize another, leading to erratic results.

4. Psychological Stability

Large positions can lead to emotional trading, where fear and greed dominate decisions. Proper position sizing keeps trades manageable, allowing you to stick to your plan with discipline.

How Improper Position Sizing Affects Forex Trading

If you fail to size your positions correctly:

- You’ll risk losing more than you gain – Overexposure to losing trades can quickly deplete your account.

- Your strategy may fail – Forex strategies rely on consistent application. Incorrect position sizing disrupts your ability to execute your plan effectively.

- It compromises your edge – A strategy with a win rate of 50% and a 1:2 risk-reward ratio only works if position sizes are consistent across trades.

Key Factors for Forex Position Sizing

- Account Balance – Your account size dictates how much you can risk per trade. A common rule is to risk no more than 1-2% of your account on a single trade.

- Pip Value – In forex, pip value varies depending on the currency pair and lot size. Knowing the pip value for your trade is essential for accurate position sizing.

- Stop-Loss Distance – The number of pips between your entry price and stop-loss determines your trade risk. Wider stop-losses require smaller position sizes to maintain the same risk level.

- Risk Per Trade – Determine the percentage of your account balance you’re willing to risk. For instance, risking 1% of a $10,000 account means risking $100 per trade.

How to Calculate Position Size in Forex Trading

Use this simple formula for position sizing:

Step-by-Step Example:

- Determine Account Risk – Decide the percentage of your account you’re willing to risk. For a $10,000 account risking 1%, your account risk is $100.

- Calculate Trade Risk – Find the number of pips between your entry and stop-loss. For example, if your entry is 1.2000 and your stop-loss is 1.1980, the trade risk is 20 pips.

- Determine Pip Value – For standard lots, the pip value is typically $10 for most currency pairs (for USD accounts). For mini lots, it’s $1, and for micro lots, it’s $0.10.

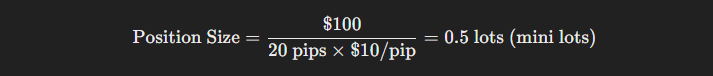

- Calculate Position Size – Using the formula:

This means you can trade 0.5 standard lots or 5 mini lots while staying within your risk tolerance.

Position Sizing Strategies for Forex Traders

1. Fixed Percentage Risk

Risk a fixed percentage (e.g., 1-2%) of your account on every trade. This method ensures your risk scales with your account size.

2. Volatility-Based Position Sizing

Adjust your position size based on market volatility. Use indicators like the Average True Range (ATR) to measure volatility and set appropriate stop-losses and position sizes.

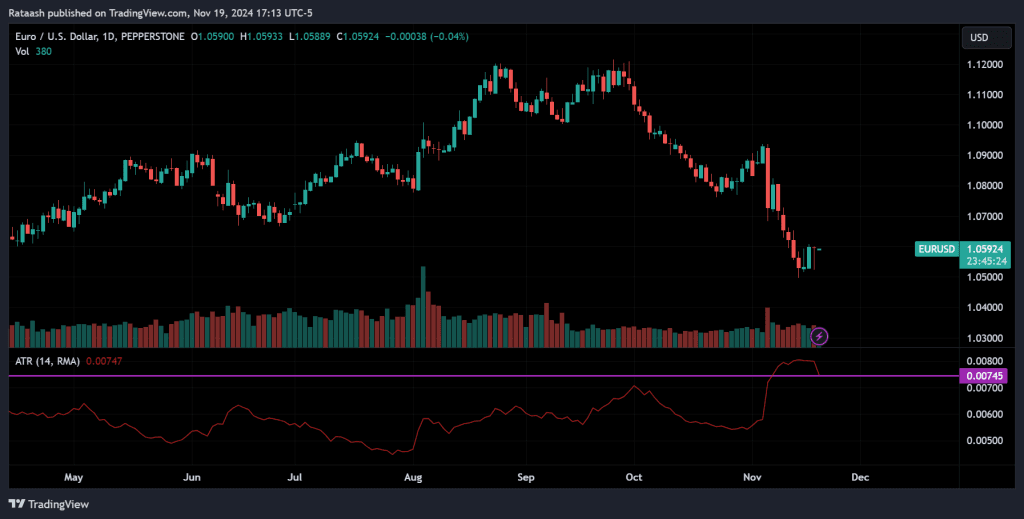

The chart shows the daily price action of the EUR/USD currency pair with the ATR (14) indicator plotted below. The ATR (Average True Range) value is currently at 0.00747, indicating an average daily price range of approximately 74.7 pips over the last 14 days.

This means that the EUR/USD pair has been experiencing moderate volatility, with daily price movements averaging around 74.7 pips.

3. Dynamic Position Sizing

As your account grows, adjust your position sizes dynamically to compound gains while keeping risk constant.

Tools for Position Sizing in Forex

- Forex Calculators – Online position size calculators simplify the process, saving time and reducing errors.

- Trading Platforms – Many forex brokers provide tools to calculate position sizes directly on their platforms.

- Custom Spreadsheets – Create your own spreadsheet to calculate position sizes based on your specific trading parameters.

Common Mistakes in Forex Position Sizing

- Ignoring Pip Value Variations Pip values differ for various currency pairs. Ensure you account for this when sizing your positions.

- Risking Too Much Per Trade Over-leveraging is a common mistake, especially in forex. Stick to the 1-2% rule to avoid significant losses.

- Inconsistent Sizing Using random lot sizes across trades disrupts your strategy and skews your risk-reward ratio.

- Neglecting Volatility High-volatility pairs require smaller positions to control risk, while low-volatility pairs allow slightly larger sizes.

Frequently Asked Questions (FAQs) About Position Sizing in Forex

Q1. What is the ideal percentage of my account to risk per trade?

A: Most professional traders recommend risking 1-2% of your account per trade. This percentage strikes a balance between limiting losses and allowing for account growth.

Q2. Does position sizing vary for different currency pairs?

A: Yes. Pip values and volatility differ among currency pairs, which can affect the position size. Always calculate position size specifically for the pair you’re trading.

Q3. How does position sizing affect my risk-reward ratio?

A: Proper position sizing ensures your risk-reward ratio remains consistent, regardless of the currency pair or trade setup. Without it, your strategy may fail due to inconsistent risk and reward.

Q4. Can I use leverage with position sizing?

A: Yes, but be cautious. Leverage amplifies both gains and losses. Proper position sizing ensures you don’t over-leverage and risk more than you can afford to lose.

Q5. What happens if I don’t use proper position sizing?

A: Without proper position sizing, you may risk too much or too little on trades. This inconsistency can lead to excessive losses, disrupt your strategy, and negatively impact your risk-reward ratio.

Q6. Are there tools to help calculate position size in forex?

A: Yes. Many forex brokers provide built-in position size calculators, and there are numerous free online tools and apps specifically for forex position sizing. You can also create custom spreadsheets.

Q7. How do I adjust my position size for volatile markets?

A: Use volatility-based position sizing. Tools like the Average True Range (ATR) indicator can help you measure market volatility and adjust your position size accordingly.

Q8. Should I change my position size as my account grows?

A: Yes. Dynamic position sizing adjusts the size of your trades based on your current account balance, allowing you to compound your gains while maintaining consistent risk management.

Final Thoughts

Position sizing is a fundamental skill every forex trader must master. It protects your account from large losses, ensures the consistency of your trading strategy, and maintains your risk-reward ratio. Calculating position sizes correctly aligns your trades with your financial goals, risk tolerance, and market conditions.

In forex trading, survival is key. Proper position sizing safeguards your capital and sets you on the path to long-term profitability. Remember, a small account with proper position sizing can outperform a large account with poor risk management.

Master this skill, and you’ll trade confidently, knowing your strategy has the best chance of succeeding in the volatile forex market.