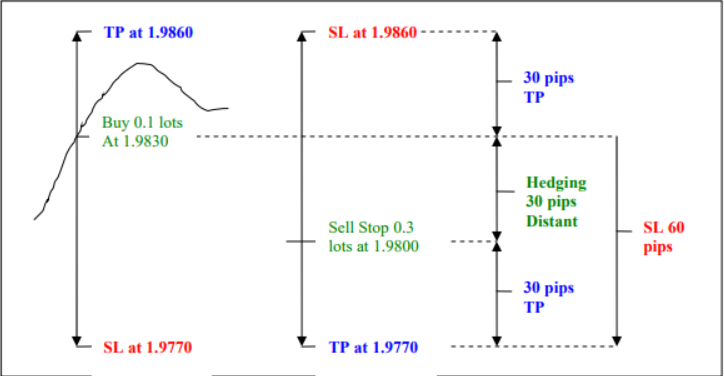

Just for a simple explanation, I assume there is no spread. Take a position at any point in the direction you like. Example: Buy 0.1 lots at 1.9831. At the same time or a seconds after placing Buy, put Sell Stop 0.3 lots at 1.9801. Look at the Lots.

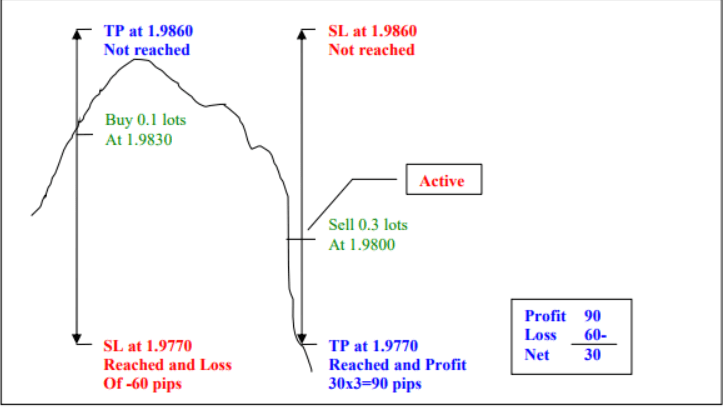

If the TP at 1.9861 is not reached, and the price goes down and gets the SL or TP at 1.9771. Then, you have a nice profit of 30 pips because the pending Sell Stop had become an active Order (Short) earlier in the move at 0.3 lots.

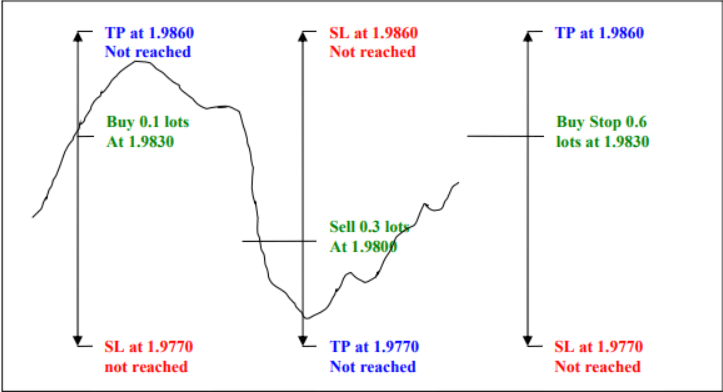

But if chart TP and SL at 1.9771 are not reached, and the market price goes uptrend again, you have to have a Buy Stop in place at 1.9830 in anticipation. When Sell Stop was reached and became active Sell order 0.3 lot (picture: number 2), you have to immediately place a pending Buy Stop of 0.6 lots at 1.9831 (pic: number 3).

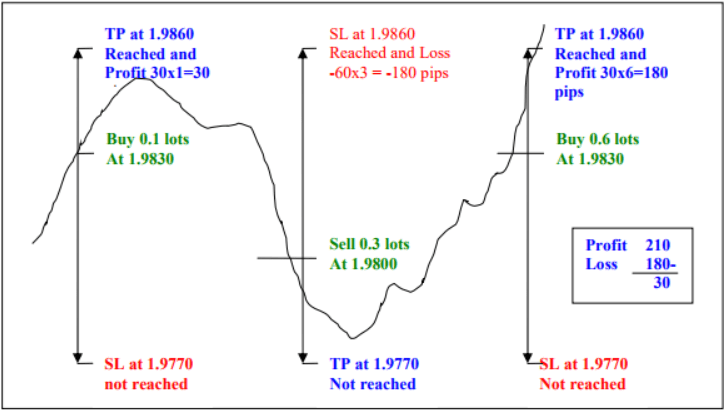

If the price goes up and hits SL or TP at 1.9860, you have a profit of 30 pips.

If the market price goes down again without reaching any of the TPS, then continue anticipating with pending Sell Stop of 1.2 lots, then Buy 2.4 lot, then Continue this until we meet the expected profit. Lots: 0.3, 0.1, 0.6, 1.2, 2.4, 4.8, 9.6, 19.2, 76.8 and 38.4.

. In this example, I use 30; 60; 30 configurations (TP 30 pips, SL 60 pips, and Current Hedging Distant 30 pips).but you can try 15; 30; 15, 60; 120; 60. Also, we can maximize profits by testing 60; 120; 30 or 30; 60; 15 configurations.

With the spread, choose the pair with the tightest spread like Eur/Usd. Usually, the spread is only around two pips. When The tighter the chart spreads, the more sure that you win. I think this is the “Never Lose in Forex Strategy“…let the chart price move to anywhere it likes; we still get the good profits anyway.

The whole “secret” (if there is any secret) is to find a “good time period” that the market will move good enough to guarantee the pips for your profit. This strategy works with any trading method. (SEE COMMENTS BELOW)

Asian Breakout using Line-1 and Line-4.

You can use any range you want.

You need to know which time period the market has enough movements for the pips you need. And, the most important thing is not to end up with buy-sell-buy-sell too often till you run out of margin.

Sorry, the above forex chart doesn’t mark up the last trade “Buy-6”,

Comments: now, I hope that you see the incredible possibilities of this forex strategy. In summary, you open a potential trade in the direction of the prevailing trend. I would suggest using the H1 and H4 charts to determine this direction. Further, I would recommend using the M30 or M15 as your trading and timing chart. With this, you will usually hit your TP target 92% of the time, and your Forex hedge won’t be activated. As mentioned in the #7 topic above, keeping spread low is imperative when using hedging forex strategies. But also, learning how to get the advantage of volatility and momentum is even more critical. So, along with this line, I would suggest looking at some of the most volatile pairs such as the Eur/Jpy, GBP/Jpy, Aud/Jpy, Eur/CHF, GBP/CHF, GBP/Usd, etc. These pairs will give up 40 to 30 pips. So, the extra amount of spread you will pay for these pairs will be worth it. I would still suggest looking for a forex broker with low spreads. The trading model that I’m telling you with this forex strategy is based on MetaTrader 4 indicators, so I suggest checking our recommended broker list. They have some of the lowest spread among MT4 and mt5 brokers. Typically, their spread on the GBP/Jpy is 5 to 4 pips; whereas, most other brokers get 5 to 8 pips. In addition, all MT4 and mt5 platforms allow for true hedging and have two opposing positions open simultaneously on the same pair, and most brokers don’t let this.

Trading Line-2 and Line-1 (10 pips) will also win.

Don’t be confused; this method is straightforward, only two things:

- choose two price levels (H, L, you decide) at a certain time (you decide); if breakout L, then sell; if breakout H, then buy. TP=SL= (H-L).

- Every time you have a some loss, increase the buy/sell lots in this number sequence: 1, 3, 6, 12, 24. etc. If you choose your time and price ranges correctly, there should not be a need for this many trades. You should never need more than one to two trade entries if you properly time the market.

- Correctly Learning to take advantage of momentum and volatility is a key element in using this strategy. As mentioned earlier, timing and Periods can be crucial ingredients for your success. Even though this forex strategy can be traded during any forex market session or the time of day, it needs to be understand that when you trade during off-hours or lower volatile sessions such as the Asian and New York Session, it will take longer to achieve your daily profit goal. so, it’s always best to trade during the prime hours of the European/London Session and the New York Session. In addition, we know that the strongest momentum usually occurs during the opening of any market session. So, these times can help you trade with a much high probability of success. TIMING+ MOMENTUM = SUCCESS

March 28, 2007, is a typical example of a bad day because markets did not move very much. The best way to win this is to recognize current market conditions and learn when to stay out of them. Ranging, small oscillation, or consolidating markets will kill anyone if not recognized and appropriately traded. However, having a suitable trading method to help you identify good setups will help to eliminate any need for multiple trade entries. This strategy will become more of a forex insurance policy guaranteeing you a profit. I include an excellent trading model with instructions on how to use it that will help you identify suitable opportunities.

Suppose you learn to enter the markets using the signals generated by the trading model included with this strategy. In that case, you will find that you will usually hit your initial TP target 90% of the time, and the price will not get anywhere close to your forex hedge trade or initial stop loss.. In this case, the forex hedging strategy replaces the need for a standard stop loss and acts more as a guarantee of profits.

The above examples illustrate using mini-lots; however, as you become more comfortable and proficient with this strategy, you can gradually increase the number of lots trades with an initial goal of working your way up to standard lots. The consistency that you will achieve by making 30 pips any time you want to will lead to the feeling necessary to trade multiple standard lots. when you get to this level of proficiency, your profit potential is unlimited. Whether you realize it yet or not, but this strategy will enable you to trade with virtually no risk.

Read More: ThunderBird EA V10 – [Cost $199]- For FREE

Download a Collection of Indicators, Courses, and EA for FREE

Would be great if this startegy could be automated

youcan make it inEA … it would be great

Thank you very much. I have created an EA from your strategy and it is very profitable and great!!!! On short and long term!!! I I have find my EA!!! Thank you!

Can you share it with me? Please message me on Telegram @danielfx62

Hi

Can you please share Ea with me: [email protected]

Can anyone plz send me this bot

Can you share the EA for this please – [email protected]

please share for me @Ayoub Chavoshi in telegram . thanks

Dear Please Share the EA…

hello Please share me the EA, my email is

DON’T BOTHER TO MAIL “Rems” He is not giving it out for free. He will ask you to pay 250 Euro. That’s not nice. This same guy gets free stuffs here. The image was the screenshot of the mail i got from him when i asked for the e.a. Don’t waste your time in mailing him.

There should be a recommendation to beginners and even intermediates here about the cost involved. Transactions are happening so this isn’t something which can often be easily handled; especially when initially hedging should be used to counter the risk or too much loss.

But this is a very good strategy if someone knows what they are doing and also keep an eye on the EA.

Haii..can you share the EA to [email protected] Thanks a lot

please can you share the ea with me @[email protected]

Greetings,

Can you also share the EA with me as well @ [email protected]? Thank

Please share me the EA, my email is

Please share me the EA, my email is [email protected]

Please kindly share ea [email protected]

I will appreciate if you can share the e.a with me please [email protected]

appreciate if you can share this e.a with me [email protected]

DON’T BOTHER TO MAIL “Rems” He is not giving it out for free. He will ask you to pay 250 Euro. That’s not nice. This same guy gets free stuffs here. The image was the screenshot of the mail i got from him when i asked for the e.a. Don’t waste your time in mailing him.

Proof2

Please what is minimum balance that i can use for this strategies.

Very nice, what is the trading model you use in the first place? I can’t seem to spot where you put the link. Thanks!

Brilliant strategy. My question is when all your indicators say price will go down and it does as per my image here.

As soon as your buy order for 0.1 is placed. You place a Sell Stop of 0.3 lots. As soon as you put this pending order you need to be ready with a buy stop order of 0.6 lots. You dont have to place it until your pending order of 0.3 lots is active. As soon as your 0.3 lots sell stop order gets activated you need to immediately place pending buy stop order of 0.6 lots. Thank You.

Dont think this is a profitable strategy, in opposit, it is low reward high risk strategy. The reason is obvious. As the author agrees, this strategy requires very tight spread, that means you cannot use cent/micro account. And after 5 “turns”, you are playing with 2.43lot, 6th is 7.29 lot, you need at least 10000USD to trade 0.01 lot with this strategy.

please share this EA to [email protected]