The railway tracks forex pattern trading strategy is another price action strategy based on analyzing the lengths of two candlesticks of similar sizes. One of the candlesticks must be bullish, and the other is bearish.

When you see both of them together, they look like railway tracks, thus the name.

There are two types of railway track patterns: bullish and bearish.

Consider the forex railway tracks pattern as trend reversal patterns.

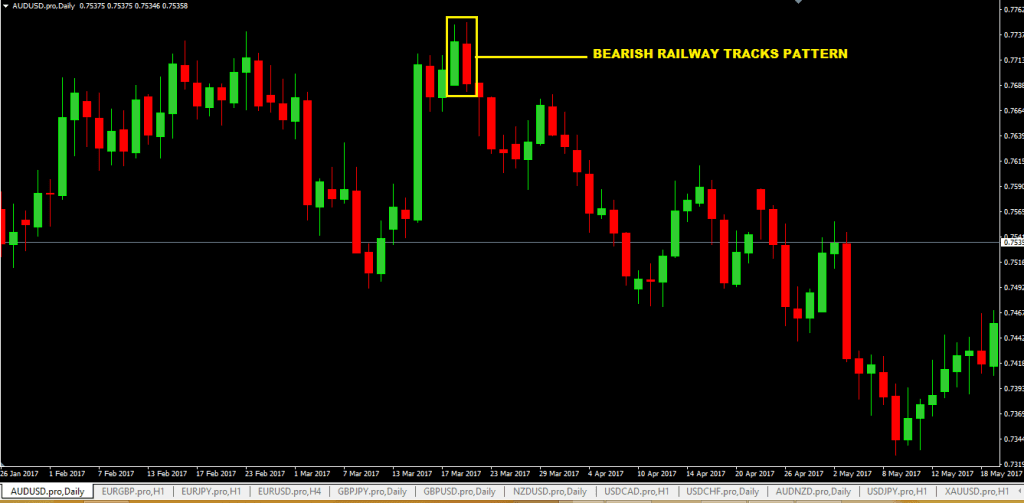

Bearish Forex Railway Track Pattern

- A bearish railway track forex pattern has the first candlestick bullish and the second candlestick pattern bearish.

- The fact that there’s a sudden change from bullish to bearish chart candlestick should be a very good indication that there might be a bearish market trend forming if you see it in levels of chart resistance, downward trendlines, Fibonacci levels, etc.

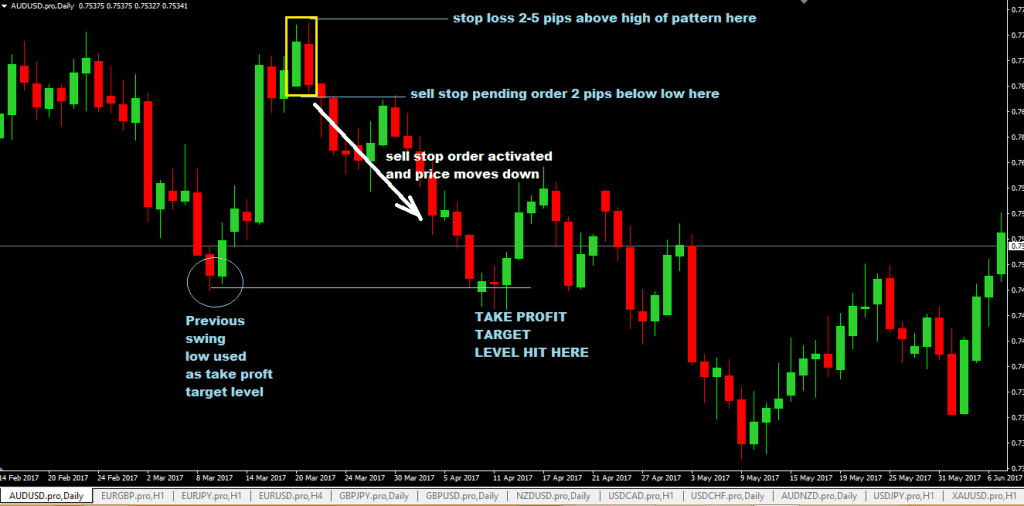

Here is an example of a bearish railway tracks pattern on the AUDUSD daily chart:

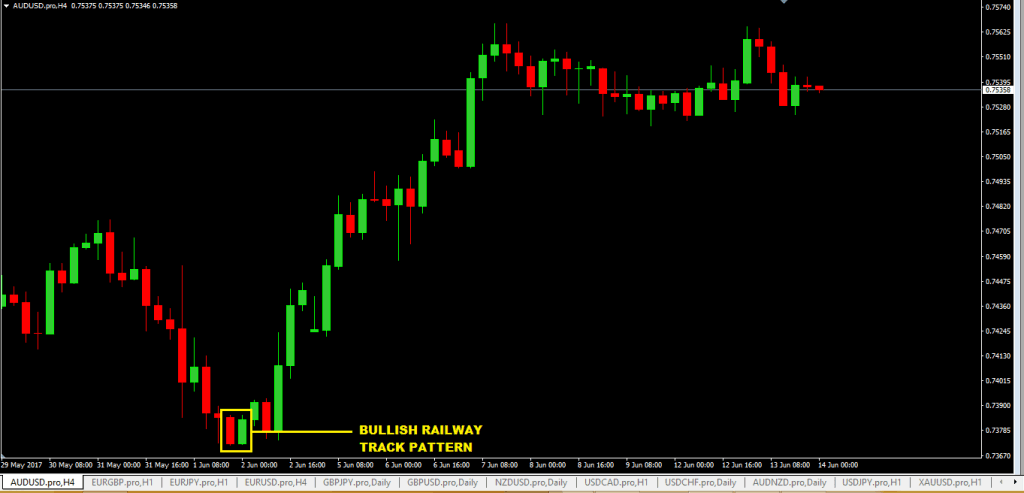

Bullish Railway Track Pattern

- A bullish railway track pattern has the first candlestick bearish and the second candlestick bullish.

- The fact that there’s a sudden change should alert you to the possibility of a chart bullish market trend starting, especially if you see this chart pattern form in the level of support, upward trendlines, Fibonacci levels, etc.

Currency Pairs To Trade?

You can trade any currency pair with this trading strategy.

Timeframes Required To Trade?

We suggest you use the daily, mt4 4hr, and 1 hr timeframes only.

Any Other Forex Indicators Required?

You don’t need any other forex indicators for this.

Anything Else?

We suggest you only trade forex railway track patterns based on support and resistance levels, chart trendlines, and major Fibonacci levels.

If they form any level on the mt4 chart with no significance, then always avoid trading them.

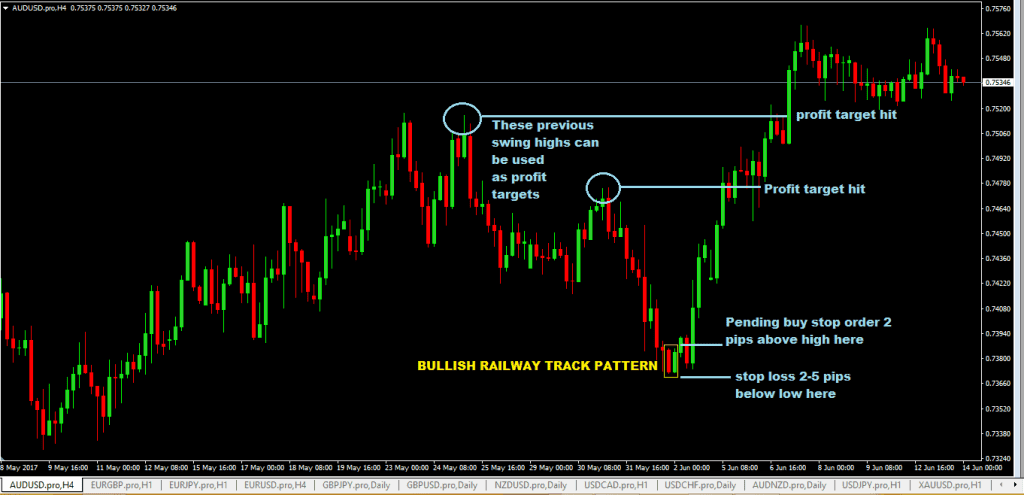

Buy Trading Rules Of The Railway Tracks Pattern Forex Strategy

- Place a buy stop order 1-2 pips above the chart high of the bullish railway tracks chart pattern, or to allow for larger spreads, increase to 3-5 pips.

- Put your stop loss 2-5 pips below the pattern’s low or increase it slightly more if you want to avoid getting stopped out early.

- For take profit(TP), you can use risk: reward(R: R) 1:3, or you can also use previous chart swing highs as your take profit target levels. Additionally, you can use trailing stop loss and ride out the trend if you want.

Sell Trading Rules Of The Railway Tracks Pattern Forex Strategy

- put a sell stop order 1-2 pips below the low of the bearish forex railway tracks pattern

- Stop-loss can be placed 2-5 pips above the high of the railway tracks pattern.

- Risk-reward of 1:3 can be used to calculate your take profit(TP) target level or if you want to aim for a bit more, use previous chart swing lows as your take profit target levels. Or you can also use a trailing stop to ride out the trend.

Advantages of The Railway Tracks Forex Strategy

- Good risk: reward (R: R) ratio

- Railway track patterns are relatively easy to spot if you are looking for them.

- If your analysis is correct, you can get into a trade at the very start of a new chart trend and ride it out for maximum profits.

Disadvantages Of The Railway Tracks Forex Strategy

- Not all railway track forex patterns are created equal, so do not take every railway track chart pattern that forms on your charts. The ones you should be trading include levels of significance like support and resistance levels, Fibonacci levels, major trendlines, channels, etc.

- A false spike can happen only to take out your stop loss(SL) and head in the direction that you anticipated the mt4 market to go in the first place. Such is the nature of forex trading, so be prepared for that.