If you are like to know about the ross hook pattern and how to trade it, this ross Hook pattern forex trading strategy will put you in the right direction.

I must warn you, though: finding a ross hook pattern on your chart may be complicated if you are a new forex trader.

Why?

Because first, you have to identify the 123 patterns, and then once that happens, the next thing you need to look for is a ross hook pattern.

And a ross hook pattern only forms after the 123 patterns.

That is what makes it a bit confusing for many.

So if you are going to find it difficult, try using this ross hook pattern indicator mt4.

I am going to present here the most basic form of ross hook pattern trading because If I were to write in detail about how to trade the ross hook pattern, it would be too much information, and I don’t want to confuse the heck out of you.

So What Is A Ross Hook Pattern?

To understand the ross hook pattern, you need to know what a 123 chart pattern is, and in the 123 chart pattern forex trading strategy, I’ve explained what that is.

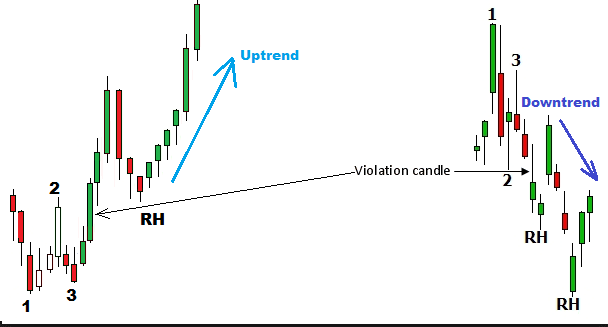

This chart below shows what a ross hook pattern is in a downtrend and uptrend:

- note that first comes the 123 pattern, and second, comes the ross hook pattern.

- Note that the violation candlestick is the candlestick that breaks past point 2 of the 123 patterns.

Ross Hook Pattern Simplified

Most explanations tend to confuse the ross hook pattern, but my description will take the confusion out once and for all.

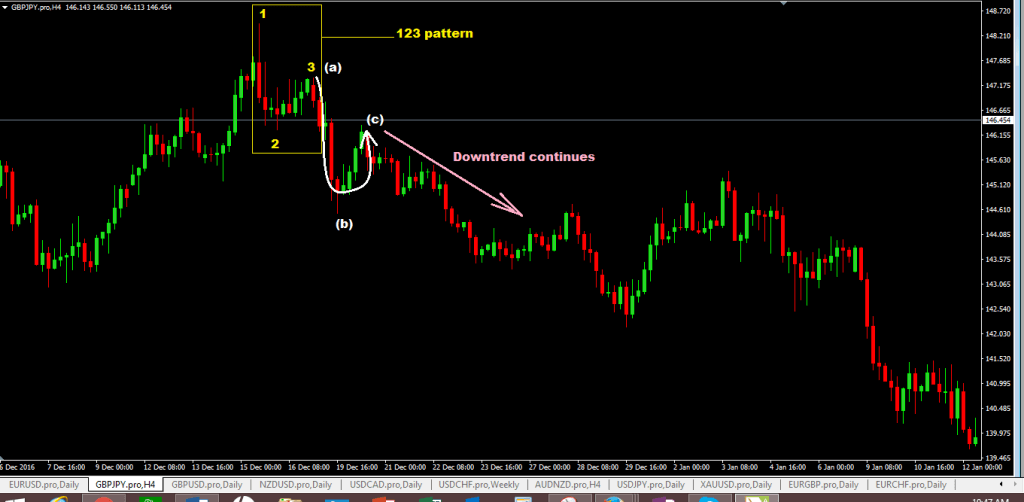

Look at the ross hook pattern, and can you see a similarity between it and the 123 patterns? you cannot, then have a look at the chart below:

- the first part is the 123 pattern

- then the second part is the ross hook pattern that I’ve marked as “a-b-c.”

Here’s the thing:

the “a-b-c” would be another 123 patterns if you were to mark “a” with 1, “b” with 2, and “c” with 3.

So in simple terms, a ross hook is another 123 pattern that forms right after the first 123 patterns. That’s basically what a ross hook pattern is: two 123 patterns forming right after the other.

How To Trade The Ross Hook Pattern

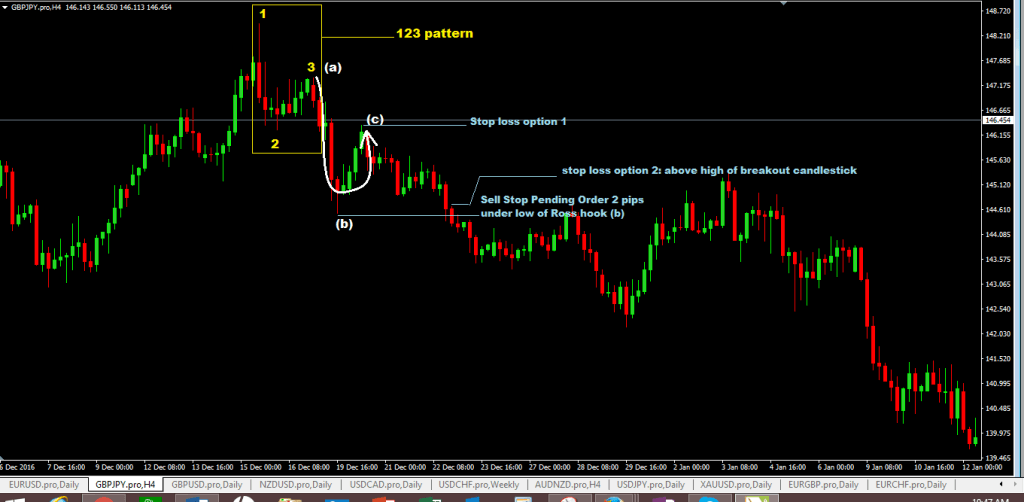

There are a few ways to trade the ross hook pattern, but I’d like to show you the simplest one: trading the breakout of the ross hook:

- Place a sell stop order at least two pips below the low of the ross hook, which is marked as “b” on the chart below. In a downtrend situation or for an uptrend market, place a pending buy stop order two pips above the high.

- There are two stop loss placement options: place above the high of the breakout candlestick or just above point “c” for a downtrend. Do the exact opposite for a pending buy stop order.

- For-profit targets, use a previous swing low as a profit target for a sell order and the last swing high for buy orders. If these swing lows/highs can be found or are too far away, use the risk: reward ratio of 1:3 to calculate your profit target.

Disadvantages of The Ross Hook Pattern Forex Strategy

- Notice that the price has moved already after it made the 123 patterns, and you’d be jumping in a bit late if the start of a new trend was confirmed after the 123 patterns.

- It can be challenging for beginner forex traders to identify and trade.

- If the distance “stretches” between the formation of the 123 patterns and the ross hook pattern, avoid trading it.

- Nothing is ever perfect in forex trading, there will be false breakouts of ross’s hook, and your stop loss can get hit.

Advantages Of The Ross Hook Pattern Forex Trading Strategy

- Trading raw price action without the clutter of indicators.

- a simple breakout trading with the same king of trading rules as the 123 pattern forex trading strategy

Don’t forget to share by clicking those sharing buttons below. Thanks

In retrospect, the Ross Hook strategy is more or less a confirmation entry for order block trading.

Combined with the OB strategy, I think it’s a robust system