The straddle trading forex strategy is a neutral forex news trading strategy.

What do I mean by “neutral?”.

Well, it’s this:

You don’t care about what direction the price will move after the news is released.

All you care about is that whichever direction it moves after the news release, you want to be able to catch that price move.

So how do we do that?

we do that by what’s called a forex straddle trade.

A straddle trade is, in fact, a forex breakout trade:

- you place two opposite chart pending orders and wait for a breakout in one direction

- when one chart pending order is activated on the chart breakout, you immediately cancel the other market pending order.

Currency Pairs: EURUSD, AUDUSD, NZDUSD, GBPUSD, EURGBP, USDJPY, USDCAD, USDCHF

Timeframes: 5 minutes or 15 minutes.

Trading Rules

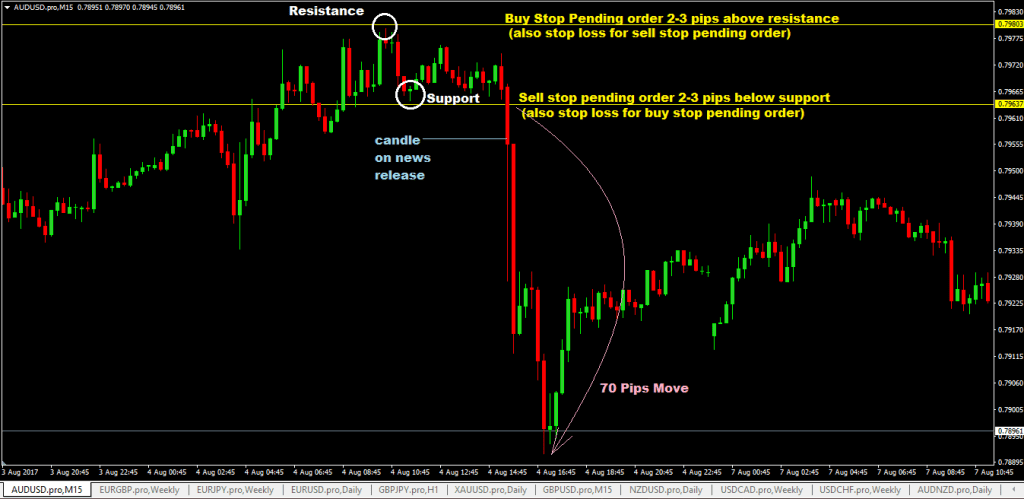

- Identify the nearest resistance level in the 5-minute or 15-minute timeframe. Also, identify the closest support level in the five or 15-minute timeframe.

- About 1 minute before the forex news is released, place a buy stop pending order 2-3 pips above the resistance line. Also, put a sell stop order 2-3 pips below the support line.

- Stop loss: for the buy stop order, place 3-5 pips below the support line. For the sell stop order, place its stop loss 3-5 pips above the chart resistance level.

- Take Profit Targets(TP): Aim for 60-100 Pips or use a risk: reward ratio(R:R) of 1:3 to calculate your own take profit.

Advantages of The Straddle Trading Forex Strategy

- an easy forex news trading strategy

- It is a reliable trading system if there are no price whipsaws before or just after the news is released, and also if the price does not move past the chart support and resistance levels before the forex news is released.

- quick profits, anywhere from 50-100 pips in just a few minutes

Disadvantages of The Straddle Trading Strategy

- Price whipsaws can activate your trades before or immediately after a news release and knock out your stop losses.

- This can also happen when market spreads are increased during news-times.

- If the range distance between the chart support and resistance level exceeds 50 pips, consider not trading.

- There will be times when the price will pretend to move in the right direction based on the forex news, but just a few minutes later, it will make a complete turn and can hit your chart stop loss. So if you don’t cancel your other market pending order quickly, it can also activate it, and then if it changes market direction after that, you can have two stop losses being activated.