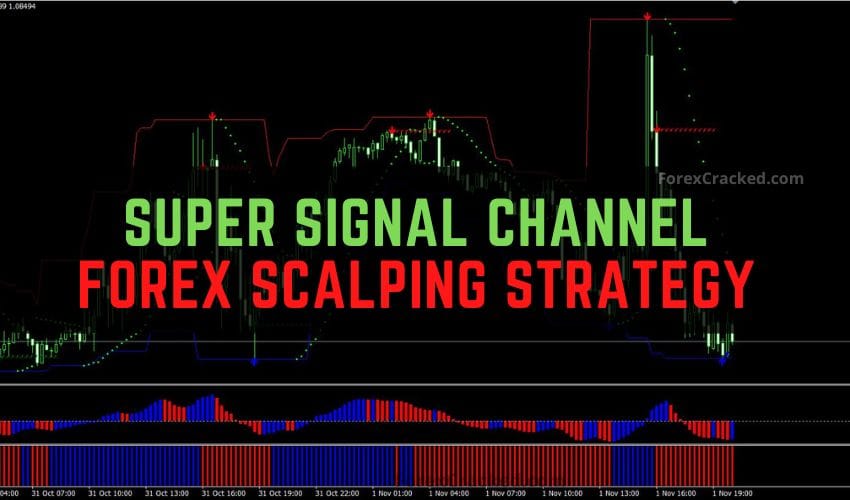

The Super Signal Channel Forex Scalping Strategy is used with 15-minute timeframe, mainly for major currency pairs. It uses multiple indicators to find entry and exit points in the Forex market, relying on momentum and trend signals. This scalp trading strategy uses repainting forex indicators to provide scalping trade entries within short market moves, aiming for quick, small profits.

Strategy Overview and Indicators

The Scalp strategy uses the following indicators for identifying entry and exit points:

- Super Signals Channel Indicator: The primary trend identifier. It provides blue arrows for buy signals and red arrows for sell signals.

- ArZZx2 Indicator: works as a trend confirmation tool, displaying green arrows for support in uptrends and red arrows for resistance in downtrends.

- Awesome Oscillator: Used to gauge market momentum, with blue bars indicating bullish momentum and red bars indicating bearish momentum.

- Parabolic SAR (0.03, 0.2): Assesses trend direction. A position below the price signals an uptrend, while a position above the price indicates a downtrend.

- Goldminer 2 Indicator: Confirms the overall trend, with blue bars for bullish conditions and red bars for bearish conditions.

Trade Setup and Rules

Long Entry (Buy) Setup

- Super Signals Channel Indicator shows a blue arrow, indicating a buy signal.

- ArZZx2 Indicator displays a green arrow, signaling support.

- Parabolic SAR is positioned below the price, indicating an upward trend.

- Awesome Oscillator is showing blue bars, which supports bullish momentum.

- Goldminer 2 Indicator displays blue bars, confirming the trend direction.

Once these conditions are met, enter a buy position, as this setup confirms a bullish trend with momentum in the upward direction.

Short Entry (Sell) Setup

- Super Signals Channel Indicator shows a red arrow, indicating a sell signal.

- ArZZx2 Indicator displays a red arrow, signaling resistance.

- Parabolic SAR is positioned above the price, indicating a downtrend.

- Awesome Oscillator is showing red bars, supporting bearish momentum.

- Goldminer 2 Indicator displays red bars, confirming the trend direction.

Once these conditions match, open a sell trade, as this setup indicates a bearish trend with momentum in the downward direction.

Exit Strategy

- Parabolic SAR Change: Exit the open trade when the indicator changes direction, signaling a trend reversal.

- Take Profit Option: Consider taking profits quickly when reaching a modest pip target for scalping.

- Stop Loss: Set the stop loss 3 pips above the upper channel line (for a sell) or 3 pips below the lower channel line (for a buy) to limit downside risk.

Download a Collection of Indicators, Courses, and EA for FREE

Example of a Buy Trade with the Super Signal Channel Forex Scalping Strategy

Consider a EUR/USD 15-minute chart where:

- The Super Signals Channel Indicator displays a blue arrow.

- The ArZZx2 Indicator confirms the support with a green arrow.

- The Parabolic SAR is below the price.

- The Awesome Oscillator has blue bars.

- The Goldminer 2 Indicator shows blue bars.

With these confirmations, you can open a buy trade, with the stop loss set at 3 pips below the channel.

Example of a Sell Trade with the Super Signal Channel Forex Scalping Strategy

Using a GBP/USD 15-minute chart where:

- The Super Signals Channel Indicator displays a red arrow.

- The ArZZx2 Indicator confirms resistance with a red arrow.

- The Parabolic SAR is above the price.

- The Awesome Oscillator has red bars.

- The Goldminer 2 Indicator shows red bars.

With these Conditions You can Open a buy trade, with SL placed 3 pips above the channel.

Free Download Super Signal Channel Forex Scalping Strategy

Read More Trend Squeezer Forex System MT4 FREE Download

Strategy Conclusion

The Super Signal Channel Forex Scalping Strategy is profitable for traders looking fast entries and exits based on trend and momentum indicators. While the repainting nature of some indicators used in this strategy may lead to some difficulties, it remains a powerful tool for scalping during periods of high market liquidity. This strategy works best when used during the active hours of the major trading sessions, making it very good for traders aiming to capture short bursts of price movement within a short timeframe.