In the competitive world of binary options trading, having a reliable strategy can be the key to success. The RSI Strength Binary Options Strategy offers traders a sophisticated way to harness the Relative Strength Index (RSI) to identify potential entry points with high profitability while maintaining effective risk management. This article delves into how the RSI Strength Strategy can be implemented to optimize trading outcomes in binary options.

Introduction to the RSI Strength Binary Options Strategy

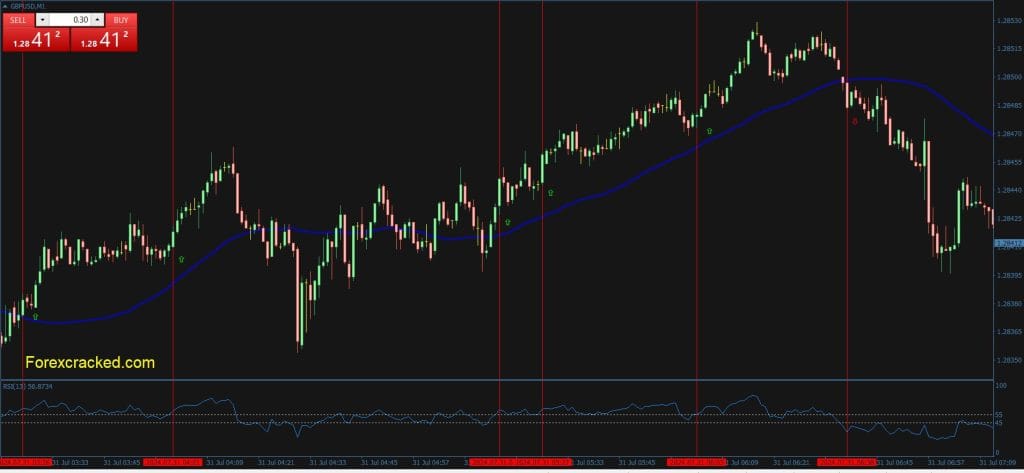

The RSI Strength Strategy uses the RSI indicator, a popular tool in technical analysis that measures the speed and change of price movements. By setting specific RSI levels, traders can identify significant market breakouts, providing clear signals for binary options trading.

Setup and Configuration

Timeframe: 1 minute or higher, adaptable based on the trader’s preference and style.Expiry Time: 1 to 5 candlesticks, allowing for quick decisions and short-term trading benefits.Indicators:

- RSI (Relative Strength Index): This indicator is configured to a 13-period close, with levels set at 55 for potential buy signals and 45 for sell signals.

- Moving Average: A 50-period close moving average helps determine the overall market trend to align the RSI signals.

Trading Rules

For Call Options:

- Trigger: Initiate a buy or call option when the RSI breaks above the 55 level.

- Confirmation: Look for an acceleration in the candlestick pattern or increased volume to confirm the bullish intent.

- Execution: Enter a call option with an expiry time of 1 to 5 minutes, depending on the market dynamics.

For Put Options:

- Trigger: Place a sell or put option when the RSI drops below 45.

- Confirmation: Confirm the bearish move with a surge in volume or a quickening pace in bearish candlesticks.

- Execution: Execute a put option with an expiry of 1 to 5 minutes.

Risk Management

- Limit the investment per trade to 5% of the total capital to manage risk effectively.

- Avoid the common pitfall of doubling down on investments after an unsuccessful trade.

- Choose only reputable and regulated brokers to ensure security and fair trading conditions.

Download a Collection of Indicators, Courses, and EA for FREE

Practical Trading Examples

Call Option (Buy Signal):

- When the RSI crosses above the 55 levels, and there is a noticeable bullish activity in the candlesticks, it signals to buy. Implement the trade with a short expiry to capitalize on the quick market move.

Put Option (Sell Signal):

- If the RSI falls below 45 and there’s a corresponding bearish candlestick pattern, it indicates a strong sell signal. Setting a put option with a brief expiry can maximize returns from this movement.

Important Considerations

- The RSI’s responsiveness to price momentum shifts makes it an invaluable tool. Still, validating these signals with additional indicators or thorough price analysis is crucial to minimize the risk of false signals.

- Practice this strategy on a demo account to fully understand its nuances before implementing it in live trading scenarios.

Features of the RSI Strength Binary Options Strategy

- Platform: MetaTrader 4

- Ability to Change Settings: Yes

- Timeframe: Suitable for any, from 1 Minute to Daily

- Currency Pairs: Works with any currency pair

This strategic approach, built around the robust RSI framework and supplemented by smart risk management, positions traders well for success in the fast-paced world of binary options trading.

Read More 300 Pips Weekly: A Simple Forex Strategy with Price Action

Conclusion

The RSI Strength Binary Options Strategy provides a systematic approach to exploit market movements effectively through precise entry signals generated by the RSI. Adhering to the outlined rules and maintaining disciplined risk management can significantly enhance their trading accuracy and profitability in binary options. This strategy, although potent, requires understanding and experience in market analysis to be fully effective. Traders should consult financial experts and thoroughly test any strategy in a simulated environment before live application.