Here is a super exciting topic for all the readers interested in trading. Have you ever heard about Traders With Edge? If you think you have still not found the perfect firm for your trading business, we urge you to read this Traders With Edge Review article and make sure your world will change for good!

What is Traders With Edge?

Traders With Edge is a project which is on the look for experienced traders. To ensure that a trader has all the qualities the firm looks for, they have developed three types of evaluation courses to match all kinds of traders. These three types of evaluation courses are,

These Systems are specifically designed to discover talent within a trader. As we all know, the path of a trader is challenging. Turtle Challenge only has one phase, and Hare has a two-phase challenge similar to FTMO. What’s unique about Traders With Edge is their new Instant funding challenge. It doesn’t have any challenges to pass to get a funded account.

The Traders With Edge Trader is eligible to keep up to 80% of your profits. The good news is that the firm covers all losses, if any.

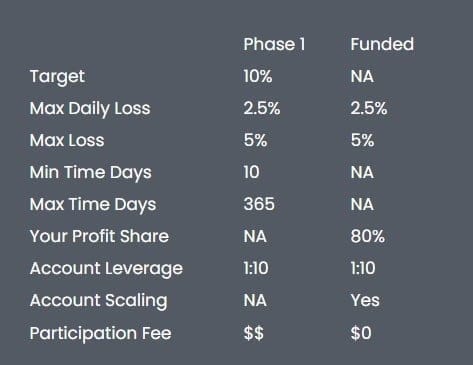

Turtle Challenge Explained

Turtle Challenge only has one phase, so if you complete this without breaking any rules, you will receive a Funded account to trade. Being a one-phase Evaluation procedure, it has tighter rules than Hare two-phase challenge.

The Turtle challenge has tighter rules than the Hare two-phase challenge, where the Profit Target is the same as the other challenges, but it has half the Daily and Max Loss limit. Still, it only has one phase to pass. Being almost half the price of Hare Challange. It’s the cheapest challenge available at Traders With Edge.

This challenge has a duration of 365 calendar days. If the trader has achieved the Profit Target without breaking the rules before 365days. He/she can receive a Funded account to trade without waiting. But keep in mind you need to trade for at least ten days.

| Trading Capital | Participation Fee |

| $5,000 | $55 |

| $10,000 | $100 |

| $25,000 | $250 |

| $50,000 | $450 |

| $100,000 | $750 |

| $200,000 | $1500 |

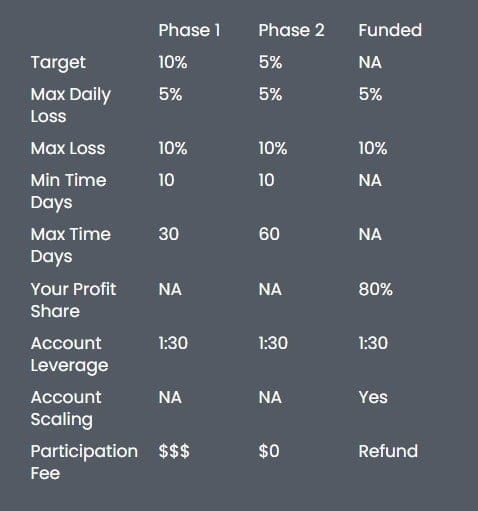

Hare Challenge Explained

Hare Challenge has two phases, so you need to complete both phases without breaking any rules. Being a two-phase Evaluation procedure, it has reasonable rules. By meeting these rules, you prove that you are a disciplined and experienced trader. Your trading style is entirely up to you. This challenge is very similar to the FTMO challenge.

Hare Challenge Phase 1 is the initial step of the Evaluation Process. The traders should get through this for the rest of the procedure.

This challenge has a duration of 30 calendar days. If the trader has achieved the Profit Target without breaking the rules or passing 30 days, he/she can proceed to the next phase without waiting.

The second phase is the next and final step of the Evaluation Process. The main reason for having phase two is to test the trading consistency. This stage has a much easier Profit target when compared to phase 1. The profit target will reduce by half, and the trader gets the full 60 calendar days to show their abilities and shine like a star.

Just as in phase 1, the trader doesn’t need to utilize the entire duration of 60 days. As soon as the trader completes the Profit target, He/she can receive a Funded account to trade without waiting. Remember that you must trade for at least ten trading days in both phases.

On both Phase 1 and Phase 2 accounts, if the profit target is not reached within max time, the account is in profit, and no other violations have been incurred, then you will automatically be issued one free retry.

| Trading Capital | Participation Fee |

| $5,000 | $95 |

| $10,000 | $180 |

| $25,000 | $280 |

| $50,000 | $390 |

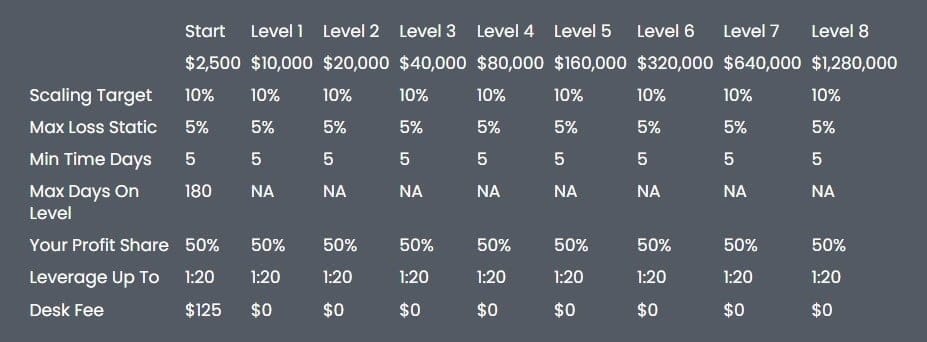

Instant Funding Challenge Explained

What’s unique about this Instant funding challenge is it doesn’t have a challenge or phases to pass to get a funding account. You can start trading on a funded account when you pay a one-time fee.

Compared to the other two challenges, this is the most expensive, starting from 125$. And it has a lower profit share compared to other challenges. But it’s still very reasonable since it doesn’t have an Evaluation Process.

It has two types of accounts called Standard and Aggressive. Different between these two account types is that an aggressive account has a 20% Profit target and 10% Max loss compared to a 10% Profit target and 5% Max loss in a standard account. Also, Aggressive accounts are twice the price of the standard account.

It has an exciting scaling plan. Your trading capital gets upgraded for free if you can profit 10% of your capital without breaching rules. You have 180days to upgrade to the first level; For levels after that, there isn’t any time limit. Remember that you must pass to level 1 before the 180days time limit ends. And same as other challenges, you need to trade for at least five days too.

| Trading Capital | Standard Participation Fee | Aggressive Participation Fee |

| $2,500 | $125 | $250 |

| $5,000 | $250 | $500 |

| $10,000 | $500 | $100 |

| $20,000 | $1000 | N/A |

Customizations

There are also add-ons when purchasing to Customize the rules of these challenges by a bit to make trading easier. Here are the available add-ons

- Increase Max Loss

- Increase Profit Split

- Remove Daily Loss Limit

- Double Leverage

- Hold Over Weekend

- Remove Required Stop Loss

- Change Trailing Max Loss To Static

The technical aspect of Traders With Edge

This System is much more accessible and gives Traders With Edge more freedom and control to actively manage risk. But dear traders, it would help if you were beware of forbidden trading activities. Some trading practices create risk-free, consistent profits or exploit conditions or services. We suggest you refer to the Terms & Conditions of the company for further information on the Forbidden Trading Practices. It is always better to know the ground rules before entering the business.

Who can partner with Traders With Edge?

Traders With Edge invites and accepts traders from all over the world. But the traders from Iran, Syria, and North Korea due to their political backgrounds. All traders should be at least 18 years old to join the firm. If you are an expert and have the know-how to trade profitably and with proper risk management, that is all the firm needs. No other qualifications are required. Sounds pretty interesting.

The Traders With Edge also gives the New traders a chance to use the free demo account to polish their skills before paying the Traders With Edge joining fee and entering a Challenge.

The free trial is an abbreviated version of the Traders With Edge Challenge for you to familiarize yourself with our platforms and trading rules and get a sneak peek of what it’s like trading with Traders With Edge. The trial is also a sandbox where new traders can practice, hone their skills and improve their trading acumen.

Note that the free trial does not provide eligibility to a funded trader account. Traders still need to pass the Traders With Edge Challenges to become funded traders.

What are the rules of the Traders With Edge challenges?

Profit Target

The profit target is the percentage of your capital you need to profit to advance to the next phase or scaling plan.

In an Instant funding account, Traders are free to withdraw from their account, which will not affect their profit target to pass to the next scaling plan level.

For Example, 5000$ Turtle account profit target is 10%, so you need to profit 500$.

Maximum Daily Drawdown

The Maximum Drawdown is the maximum your account can drawdown from the day start blance.

They calculate the daily loss limit based on the previous day’s end of day equity. This is calculated at 5PM EST, so ensure you know what time of day this is in your location.

Example 1:

The day’s starting balance was $100,000. You open a position and it goes into $6,000 profit and you close the trade before the end of the day. At the end of this day your account equity is $106,000 which is carried over to the second day.

The second day your daily drawdown limit is reset with the new High-Water Mark being $106,000. If your daily drawdown limit is 2.5% on the Turtle account then the lowest your equity can reach is $106,000 – $2,650 = $103,350.

Example 2 (Violation): The day’s starting balance was $100,000. You open a position and it goes into $6,000 profit but you did NOT close the trade before the end of the day. Instead you moved your stop-loss to breakeven. At the end of this day your account equity is $106,000 which is carried over to the second day.

On the second day the trade goes back to breakeven and is closed by your stop-loss. Even though the individual trade did not lose from the balance, you have lost more than the allowable amount (2.5% on a Turtle account) on a single day and this will be a hard violation and the account will be closed.

The instant Funding account does not have a max daily drawdown.

Maximum Drawdown

The Maximum Drawdown is the maximum your account can drawdown from the highest balance.

For example, if you have a $100,000 account and make $5,000 in closed profits on your account. Your High-Water Mark is now $105,000.

Your account’s minimum equity is calculated by $105,000 minus the maximum drawdown percentage. $105,000 – 5% = $99,750 is the lowest equity your account can reach before violating this rule.

For the Instant Accounts

The Maximum Drawdown for the Instant accounts are static. This means that no matter the profit you are in, your Maximum Drawdown limit is always calculated from the initial account balance after scaling.

For example, if you have a $80,000 account.

$80,000 – 5% = $76,000 is the lowest equity your account can reach before violating this rule.

If you violate these rules, the account will be closed.

Minimum Time

The minimum to complete the Turtle Challenge is 10 trading days. There must have been at least one trade opened on 10 different days to successfully pass the challenge.

A trader may not reach the profit target with one large trade, then use significantly smaller lots to pass the minimum trading days.

When the account is reviewed if there is a large difference in lot size used to pass minimum time rule the challenge will be failed.

Trades must be fully executed trades, they can not just be opened and closed. Pending orders do not count towards the total.

Maximum Time

The maximum to complete the Turtle Challenge is 365 days.

If the profit target is not reached within this time the account will be closed as failed.

The maximum to complete the Hare challenge is 30 days.

If the profit target is not reached within this time and the account is in drawdown it will be closed as failed.

If the profit target is not reached within this time and the account is in profit and no other violations have been incurred, then you will automatically be issued one free retry.

The maximum time to complete the first level of your Instant Funding account is 180 days.

If the profit target is not reached within this time the account will be closed and breached.

After you have reached the profit target of your first account and have scaled to the next level, there is no maximum time limit and you are free to trade at your own pace as long as you do not breach the inactivity period.

All accounts are traded on a demo account so Traders With Edge can manage their risk. Your funded account is connected to a real funded account from which you are paid.

To ensure trades can be copied effectively to the real account, we can not tolerate any form of manipulation on any account.

Manipulation includes but is not limited to:

- Tick scalping – constantly opening and closing trades in less than 30 seconds. We realize that sometimes trades are closed instantly for one reason or another, so if there are occasional trades that are opened and closed in less time we won’t close your account.

- Arbitrage.

- Hedging between accounts.

- Delayed or frozen data feeds.

- Unrealistic fills that don’t take into account slippage, where a huge lot size is used and closed within a small number of pips.

- Allowing others to trade your account.

- Copying other’s trades.

- To use a fully automated EA, you require approval from the Traders With Edge risk management team prior to trading.

- Lot size manipulation – can not use one big trade to pass the profit target and then minimum lot size to pass the min days. The lot size deviation can not be more than a factor of 5. Example 1) If your smallest lot size is 1 and the largest is 5 okay. Example 2) If the smallest lot size is 0.10 and the largest is 5, not okay.

Is Traders With Edge a realistic approach?

Those new to the trading industry get this thought in mind. You must be thinking if this is a legit approach or can this happen. As the profit sharing and the benefits offered sound too interesting, could you ignore it? So let us dig into more details on the matter.

The answer to the above concern is Yes. It is legit and realistic. Most people doubt trading companies, as most are legit and perform fraud. If your consistency in profiting is even and moving, there should not be a doubt that you will fail as a trader. Traders With Edge can make a trader a better forex trader, as they force the traders to be moved by the rules of the account like drawdown etc., which causes them only to take high-quality trades.

After you have successfully passed the stage(s) of your challenge, your account will be sent to our risk management team, who will assess the account to ensure there have not been any violations. Once they have reviewed the account, one of three things will happen; The risk team may ask for more information about your trading if there is any grey area about your trading results. You will receive an email with your new login details for your demo account connected to live funds. You will receive an email explaining the violation that has happened. Keep in mind this is only in the case where you have violated a rule that is defined in the terms and conditions that you signed.

Fund transfer and withdrawals.

Now, this is the essential part of our discussion. Almost everyone is interested in knowing how you would receive the funds. Here are some facts that will degenerately help you.

There are no hidden fees with Traders With Edge. The fee for the Traders With Edge Challenge is the only investment you’ll make. There are no recurring monthly fees or No withdrawal fees.

You can withdraw funds to any of the following; PayPal, Wise, BTC, USDT, and Bank Transfer. After you have traded for ten active trading days with a funded account, you can request a withdrawal of profits at any time, but no more frequently than every 14 days.

Hare accounts – you are eligible for a full refund of the fee you paid for your challenge account and your profit split once you have passed the minimum eligible time, which is ten active trading days after placing the first trade on your funded account. The refund and profit split payment will be void if you violate any rules before this time. Turtle accounts are not refundable regardless of whether you pass the challenge; it’s a different financial model.

Conclusion of Traders With Edge Reviews

Suppose you are looking for a legitimate opportunity to make money; spot on! Here you are with the best firm. It is purely legit, trustworthy, and strictly monitored, so the credibility is high. This is the perfect place if you are a successful and experienced trader. But do not worry. If you are new to the trade, you can still make the best out of it with the trial challenge and polish your skills. I hope the information shared is helpful. Do not worry about wasting your time if you have not yet registered yourself and have the passion for starting up as a trader. It is the best chance for you!

Im very interested in this, and i know i can be a very profitable assett for you