The simple trendline retest forex trading strategy is used when:

- price breaks a chart trendline and goes away from it

- and after a while, it starts heading back to the chart trendline it just broke previously.

Now, even though the chart trendline was broken when the price comes back, that mt4 trendline can support or resist the price.

That’s when you can wait for an excellent opportunity to use the trendline retest forex trading strategy.

What Currency Pairs Can You Use The Simple Trendline Retest Forex Trading Strategy On?

Any of the mt4 currency pairs can be used with this forex trading strategy.

What Are MT4 Timeframes Suitable For Trading With The Trendline Retest Forex Trading Strategy?

You can use any mt4 timeframe, but the 1hr timeframe and above are much more suitable because they reduce the “noise” prevalent in the smaller timeframes.

Any Forex Other Indicators Required To Use With The Trendline Retest Forex Trading Strategy?

No additional FX indicators are required. What you need is just a good eye for drawing valid trendlines.

It simply identifies a minimum of two swing high points for drawing downward mt4 trendlines and a minimum of two chart swing low points for drawing an upward mt4 trendline.

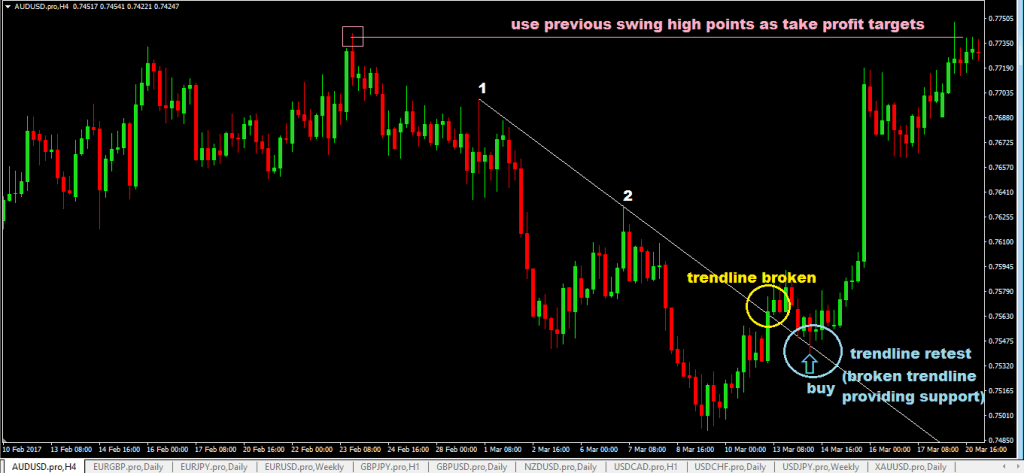

Here’s An Simple Example of A Buy Setup Based On The Trendline Retest Trading Strategy

The chart below shows 4hr chart of AUDUSD. Notice that price was:

- In a downtrend for a while, a trendline was drawn connecting two swing high points or peaks marked as 1 & 2 on the mt4 chart below.

- Price eventually went up to it and broke the trendline, and it went away and up from it for some time before it came back down to retest that trendline it broke prior.

- When the price hit the chart trendline, it started moving upward again for a long while.

So here are the simple trading rules for the buy setup:

- draw a downward trendline

- If the price breaks the trendline, wait for the retest.

- If a retest happens, it is better to use a bullish reversal chart candlestick as a trigger to place your pending buy top order just 2-3 pips above that bullish candlestick. If the price decides to go up, your buy stop order will be activated.

- Place your stop loss(SL) a few pips (5-10 pips) under the low that bullish candlestick.

- Use the previous chart swing high as your take profit(TP) targets for profit targets.

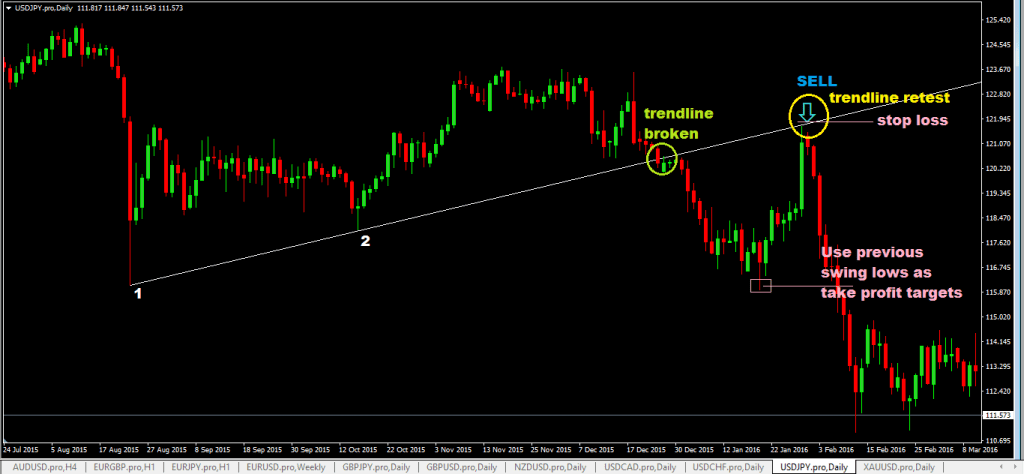

Here’s An Example of A Sell Setup Based On The Trendline Retest Trading Strategy

The mt4 chart below is a daily chart of USDJPY, and notice that:

- A chart trendline was drawn, and it was intersected.

- Price dropped away from that chart trendline for a while and later went back up to retest it.

- The broken trendline acted as a chart resistance, and the price moved down again from it.

The strategy trading rules are the exact opposite of the buying rules:

- draw the upward trendline

- Wait for the retest of the trendline.

- Use a bearish reversal chart candlestick as a trigger for you to place your sell stop order 2-4 pips under the low of that bearish chart candlestick pattern. If the price continues to go down, your sell stop pending order will be activated.

- Place your stop loss(SL) 5-10 pips above the high of the bearish candlestick pattern, but if it’s too close, you may need to increase your stop loss(SL) distance a bit more to avoid getting stopped out early.

- use previous chart swing lows as your take profit targets

Advantages of the Simple Trendline Retest Forex Trading Strategy

- There will be some times when you will miss the simple trendline trading strategy setup or the trendline breakout trading strategy setup. Then’s when you can use the chart trendline retest forex trading strategy if the price ever comes back to the mt4 trendline that was broken previously.

- Has a reasonable risk: reward ratio when the price starts trending.

- It’s not complicated at all. The trading rules are easy and simple to understand and implement.

Disadvantages of The Trendline Retest Forex Trading Strategy

- Sometimes, the price will break a trendline and never return to retest it.

- Sometimes, the price will break come to retest the trendline, cause a spike, take out your stop loss, and move in the direction your trade is based on. That happens, and it’s just the nature of forex trading, so you have to expect that to happen.

Read More: Advance Swing Trading Strategy

[…] trendline retest forex trading strategy […]

No download link my brother

Hey, how to download this system?