The forex trendline trading with 34 ema trading strategy is a trading strategy that combines the forex breakout of a trendline with 34 EMA to look for good trade setups.

MT4 Currency Pairs: Any

MT4 Timeframes: 5 minutes and over

Other Forex Indicators: only 34 forex ema or you can any of the following and substitute for 34 ema: 14 ema, 7 ema, 21 ema or 50 ema, or even ten ema.

Strategy Background

The forex 34 EMA is used for trend confirmation.

- If the chart price is above the 34 ema, you are only looking for buy-trade setups.

- If the price is traveling below the 34 ema, you are only looking for good sell trade setups.

So, where does the forex trendline come into play?

- Well, first, you have to know to learn to draw a trendline.

- But with this chart trendline, you want to pick the two nearest chart swing high points or peaks for drawing downward trendlines and the two nearest chart swing lows to draw the upward chart trendline.

- When price breaks a chart trendline, it also indicates a market trend is changing.

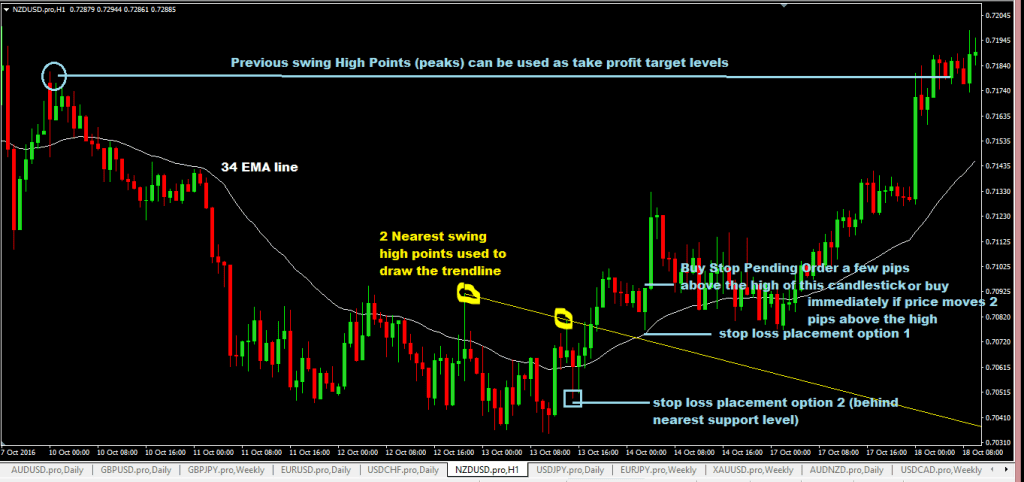

Strategy Buy Trading Rules

1) draw the forex downward trendline based on the two nearest swing high peaks and wait for a breakout of the trendline.

(2) if there is a breakout, check to see if the price is above the 34 ema line.

(3)next thing you do is to sit and wait and watch the highs of the chart candlesticks that form, as this is where you need to identify your entry signal candlestick

(4) This is important: The entry signal candlestick is the candlestick with a high that is lower than the previous candlestick’s high. If that single candlestick’s high is broken, buy immediately at the market, or you can place a sell-stop order just a few pips (2-3 pips) above the high of that signal candlestick, so if the price breaks its high, it will execute your order.

(5) if your buy stop pending order is not activated and the chart candlesticks continue to make chart lower highs, move your buy stop pending order to each lower high candlestick that forms until the price increases and triggers the buy stop order. Ensure that the candlestick’s lower highs do not close below the 34 ema line.

(6) I’ve given two stop loss placement options on the mt4 chart below. Place your stop loss(SL) just below the low of the chart candlestick that activates your order, or if there is the nearest support level, you can use that as well.

(7) For taking profit, use risk: reward of 1:3 or use previous swing high points /peaks and use that as a profit target

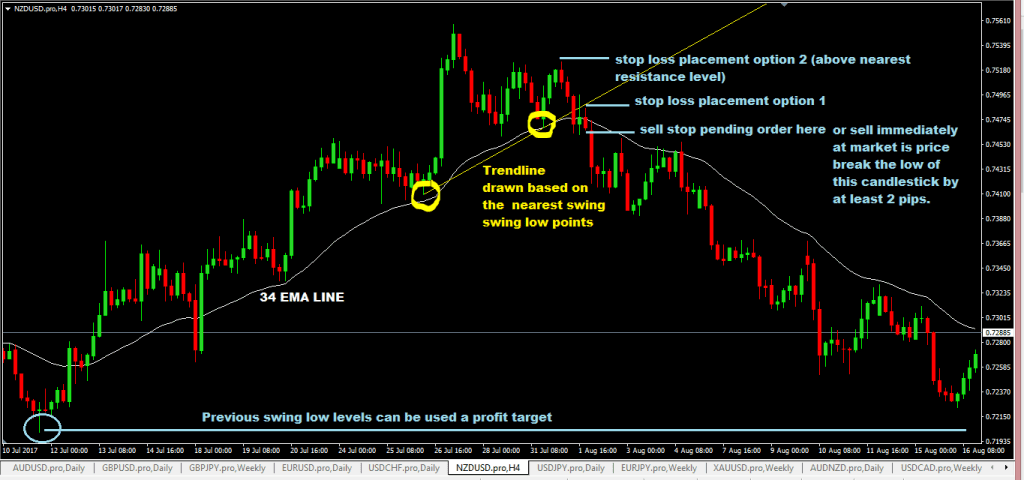

Sell Trading Rules

Just the exact opposite of Buy Rules:

(1) draw your upward trendline based on the two nearest chart swing low points and wait for a chart trendline breakout to happen

(2) chart price must then fall below the 34ema

(3) Watch the lows of the candlesticks that form after the downward trendline breakout.

(4) This is important: The entry signal candlestick is the candlestick with a low that is higher than the previous chart candlestick’s low; if that single candlestick’s low is broken, then sell immediately at the market, or you can place a buy-stop order just a few pips (2-4 pips) below the low of that signal chart candlestick so if the price breaks its low, your pending order will be activated.

(5) if your sell stop pending order is not activated when chart candlesticks continue to make chart higher lows, continue to move your sell stop pending order to each higher low candlestick that forms until the price moves down and starts your sell stop pending order. Make sure that when chart candlesticks are making chart higher lows, they do not close above the forex 34 ema.

(6) Place your stop loss(SL) just above the high of the candlestick that activates your order.

(7) For taking profit target, use risk: reward of 1:3 or use previous swing lows for a take profit(TP) target.

Disadvantages of the Forex Trendline Trading With 34 EMA Strategy

- There is always that good potential of getting too many false entry signals in a non-trending or sideways market.

- sometimes the market will make a huge move, and you will find that there won’ be any nearest chart swing high or chart low points to draw your trendlines

Advantages of the Forex Trendline Trading With 34 EMA Strategy

- When price breaks a chart trendline, it tends to be a pretty good signal that a new market trend is starting. Added onto that, you have the forex 34 ema also indicating that market trend change.

- In good strong forex trending markets, this forex trading system has the potential to perform exceptionally well.

- The use of forex reversal chart candlestick patterns can also be applied to enhance your trade entry on this system.

[…] Related Trendline Trading With 34 EMA Forex Strategy […]