Foreign Exchange, commonly known as Forex or FX, is the decentralized global market for trading currencies. It’s the largest financial market in the world, with an average daily trading volume exceeding $6 trillion.

Understanding the Basics of Forex Trading

At its core, Forex trading involves the buying and selling of currency pairs. Unlike stocks or commodities, currencies are traded in pairs, exchanging one currency for another. The most commonly traded currency pairs include EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), and USD/JPY (US Dollar/Japanese Yen).

Various participants, including central banks, commercial banks, hedge funds, corporations, and individual retail traders drive Forex markets. Central banks play a significant role in influencing currency values through monetary policy decisions, while commercial banks facilitate most of the trading activity in the market.

The Forex market operates 24/5, spanning across different time zones. It typically opens Sunday evening in Asia (around 5:00 PM Eastern Standard Time) and closes Friday afternoon in New York (also around 5:00 PM EST).

However, liquidity and trading volumes vary throughout the trading sessions, with peak activity occurring during the overlapping periods of major financial centers like London, New York, and Tokyo.

Now, to navigate the Forex market effectively, traders need to become familiar with important terms used in Forex trading. So, let’s take a closer look at some of these terms one by one to understand them better.

Terms Used in Trading

Spot Price:

The spot price refers to the current market price of a currency pair at any given moment. It represents the most recent price at which a currency pair was traded in the Forex market.

Order Book in Trading:

The order book in Forex is a record of all pending buy and sell orders for a particular currency pair at various price levels. It displays the depth of market liquidity by showing the volume of orders waiting to be executed at different price points.

You need to understand order books to comprehend how prices change in the market, so let’s have an example.

So, the order book is basically a book with all the buyers and sellers listed. Let’s consider an order book for USD/MXN.

Imagine someone wants to buy 20 MXN for 1 USD, while another person wants to buy at 19, and perhaps someone else wants to buy at 18.50. On the selling side, someone might want to sell at 21, another at 21.50, another at 21.99, and another at 25.

So, you’ll find all the buyers on the left side of the order book, and on the right side, all the sellers at different price levels. It also includes the quantity of orders, but for this example, let’s just focus solely on prices.

This collection of orders is known as the order book because it contains all the limit orders from people who want to buy and sell.

Now, let’s say someone comes in and says, “I want to buy MXN at 21,” and someone in the order book is willing to sell at 21. So, they both will get their orders executed together if they have enough quantity. After that, the order will be removed from the order book and shown as a completed transaction and the price it did is the spot price we discussed earlier.

However, if someone still waits for their order to be filled, it will remain part of the order book. So, until your limit order gets filled, it will be included in the order book.

And this is the main reason why prices change in the market. Prices don’t change because of news or events; it’s because of the orders that people send to the market that drive prices.

It’s the supply and demand between buyers and sellers. If there’s too much demand for a pair and not enough people to sell it to them, the price will go up. On the other hand, if more people want to sell and there aren’t enough buyers to buy from them, the price will fall. Your job is to understand the supply and demand at a given time to make a profit from the market.

If you’re still unsure about how the order book works, take a look at this article. It’s about stock prices, but the example goes into much more depth about order books and how orders drive prices.

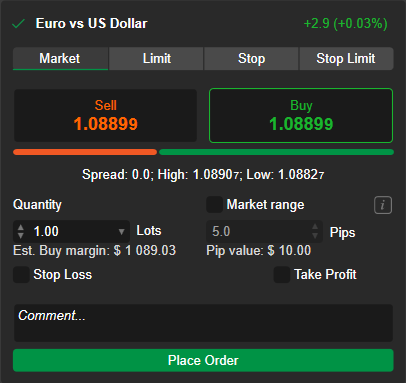

Bid & Ask:

Now, in the order book, the highest price someone is willing to pay for a pair is called the bid. And the seller who is willing to sell at the lowest price is called the ask.

So, the bid price is what the buyer is willing to pay the most. Now, if you want to sell right now, at this moment, what price can you sell at? You can sell it to the person who is willing to pay the most, and that’s the bid price. So, when you’re looking at the bid price, you can think of it as if you want to sell right now. This is the price you can sell at.

Now, on the other hand, if you want to buy it right now, where can you buy it? You won’t place your order on the buyers’ side and wait for someone to sell it to you right? So, If you want to buy right now, you’ll have to buy at the ask price.

Spread:

We call the difference between the bid and ask prices the spread.

The spread is kind of like your commission or cost. Let’s go back to the example. So, Our Bid and Ask prices are 20 & 21. let’s say right now you want to buy MXN, and you buy it at 21. Then, right away, you turn around and sell it at 20, so you just lost an MXN, just by buying at the ask and selling at the bid.

When you’re trading, you want something that has a low spread. For example, if the ask was 20.50 and the bid was 20.40, if you had bought at 20.50 and then sold right away at 20.40, you would have only lost 0.10 MXN. So, you want to ensure that you have a small spread when you’re trading something.

When you’re trading, you usually won’t even see the order book. Instead, you’ll only be provided with the bid and ask prices. Many brokers won’t allow you to place your order in the order book and transact with other clients.

Some may permit it, but others will simply give you those prices and trade against you. If you want to buy, they’ll sell it to you at that price and handle the transactions in the background by hedging or other means. They might have different spreads depending on the time and volatility of the market.

For instance, if they can get the MXN at 20.48 and sell it to you for a higher price of 20.50, they will do so. However, the problem arises if they give it to you at 20.50, and by the time they acquire it, the price can move significantly, posing a risk for them. Therefore, they might widen their spread when the market is experiencing high volatility. This is something you need to keep in mind.

Conclusion

So, what we’ve learned here is the price terminology of Forex: spot price, order book, bid price, ask price, and the spread. In the next article, we’ll delve into pips and lots, and we’ll learn how to calculate pip value. Cya.