Forex trading, the exchange of currencies on a global scale, involves various analytical tools and techniques to predict price movements and make profitable trades. Among these, technical analysis’s channels, support, and resistance levels are crucial components. Understanding and effectively using these concepts can significantly enhance a trader’s ability to anticipate market movements and make informed trading decisions. This also forms the foundation for price action trading.

What are Channels in Forex Trading?

In the previous article, we discussed trends and trendlines, which are drawn by connecting either the low or high points of the price.

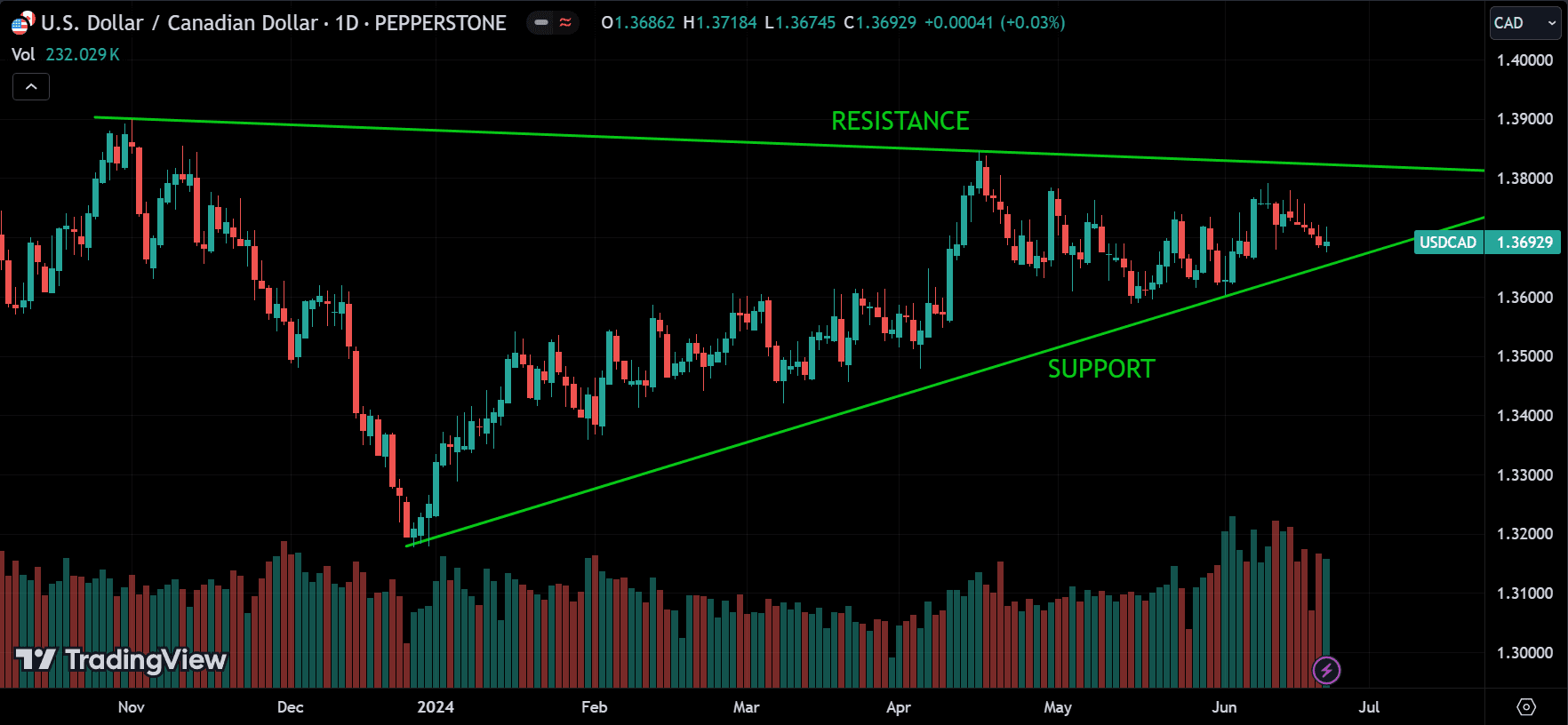

Channels are formed when the price of a currency pair moves within two parallel trendlines. These lines can either be ascending, descending, or horizontal, indicating the direction of the trend. Channels help traders identify the potential highs and lows of the price movement within a trend.

Just like the trends, there are three main types of channels:

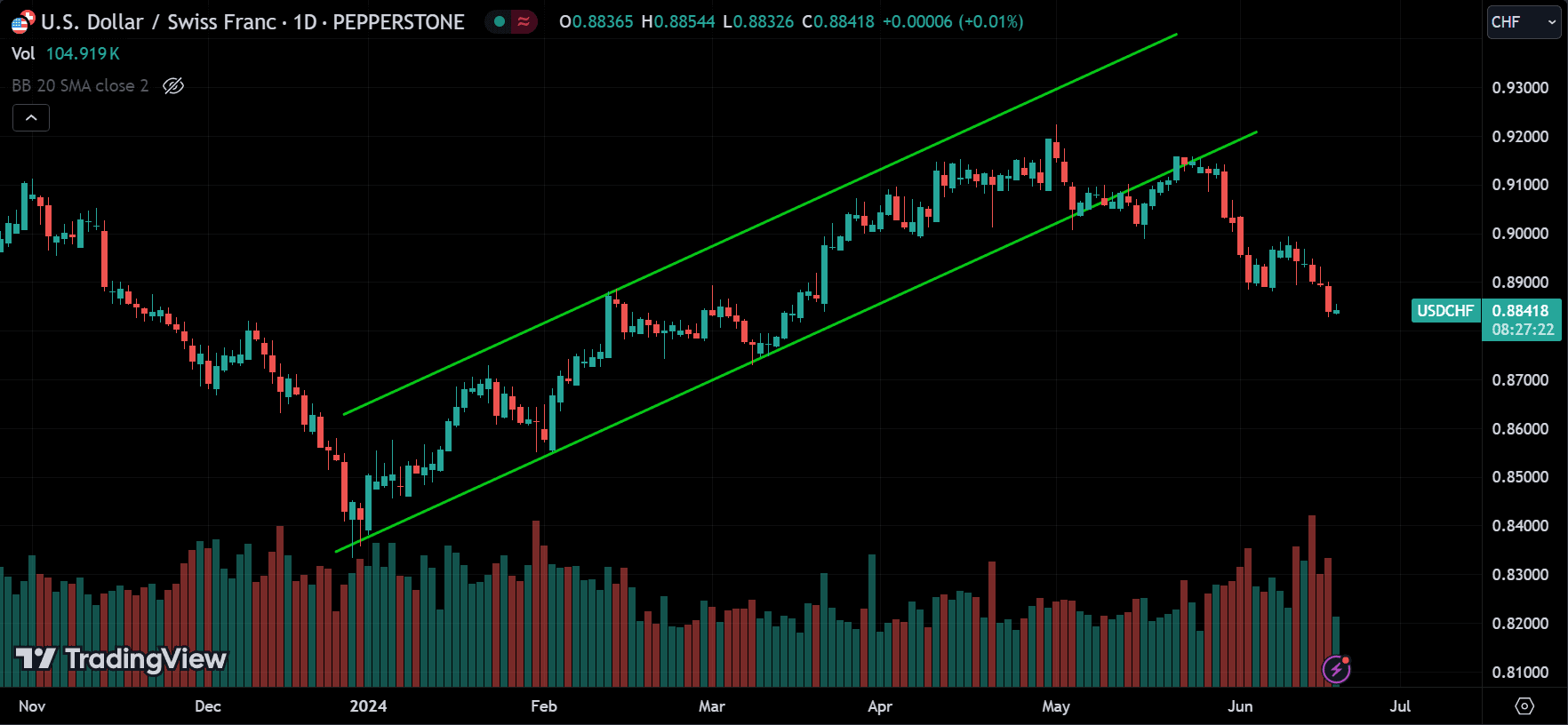

Ascending Channels (Uptrend Channels)

Formed by drawing parallel lines along the support and resistance levels of an upward trending market. The lower line represents the support, and the upper line represents the resistance. This type of channel indicates that the currency pair is experiencing higher highs and higher lows, suggesting a bullish trend.

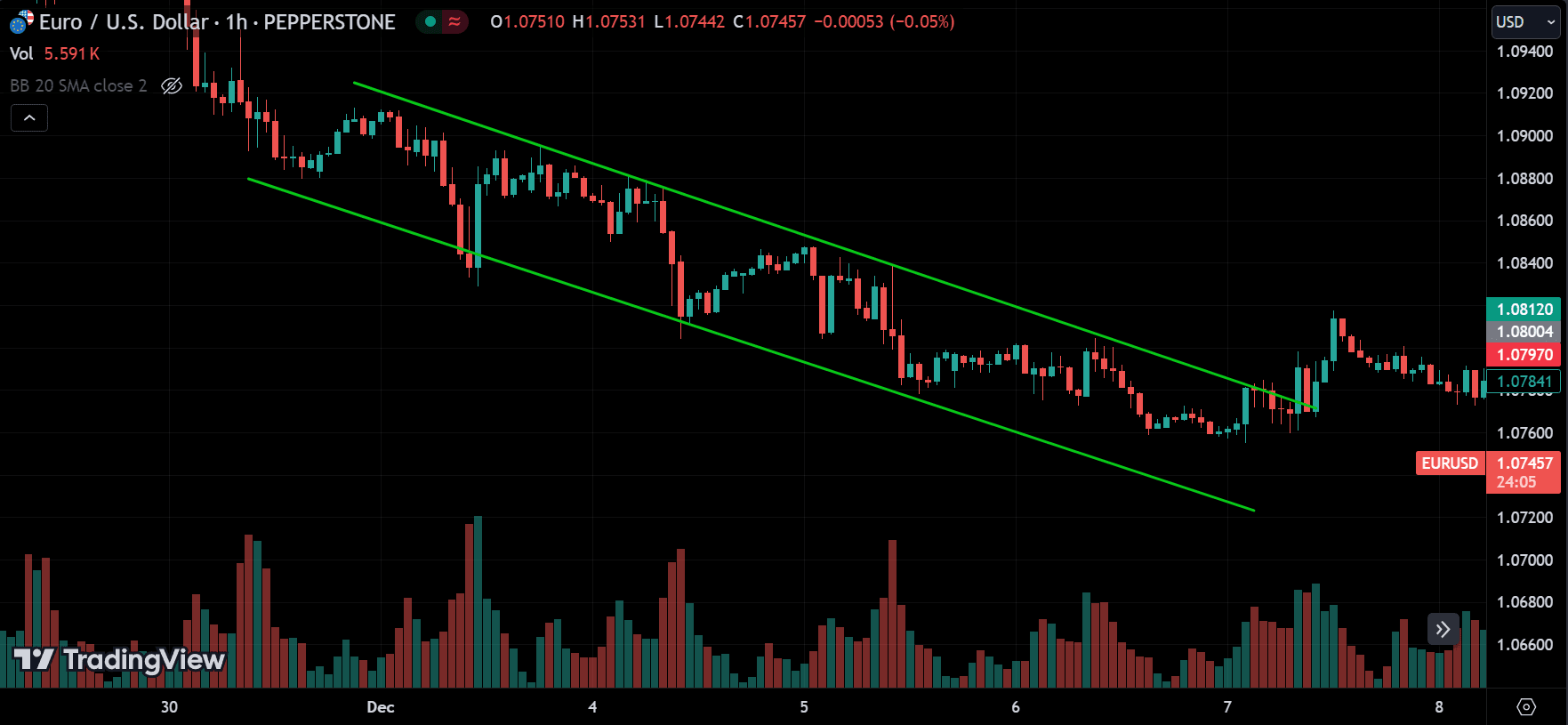

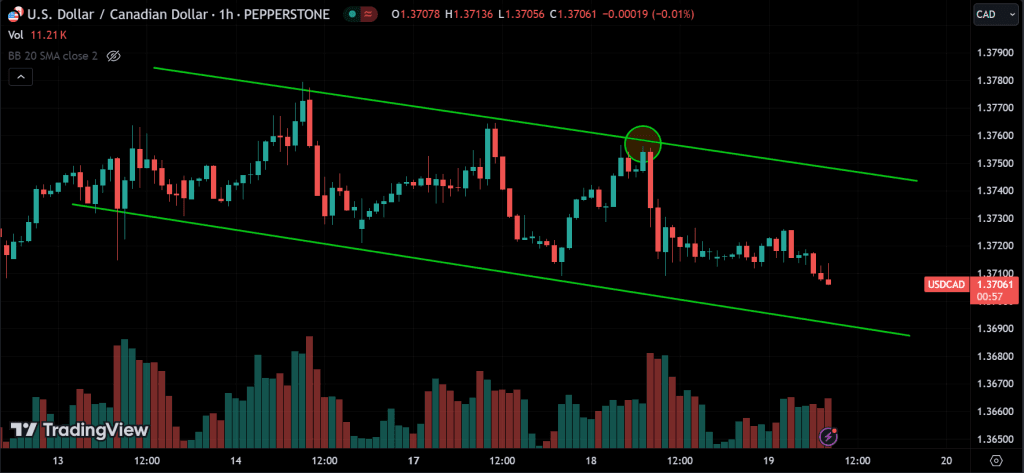

Descending Channels (Downtrend Channels)

Formed by drawing parallel lines along a downward trending market’s support and resistance levels. The upper line represents the resistance, and the lower line represents the support. This channel indicates lower highs and lower lows, suggesting a bearish trend.

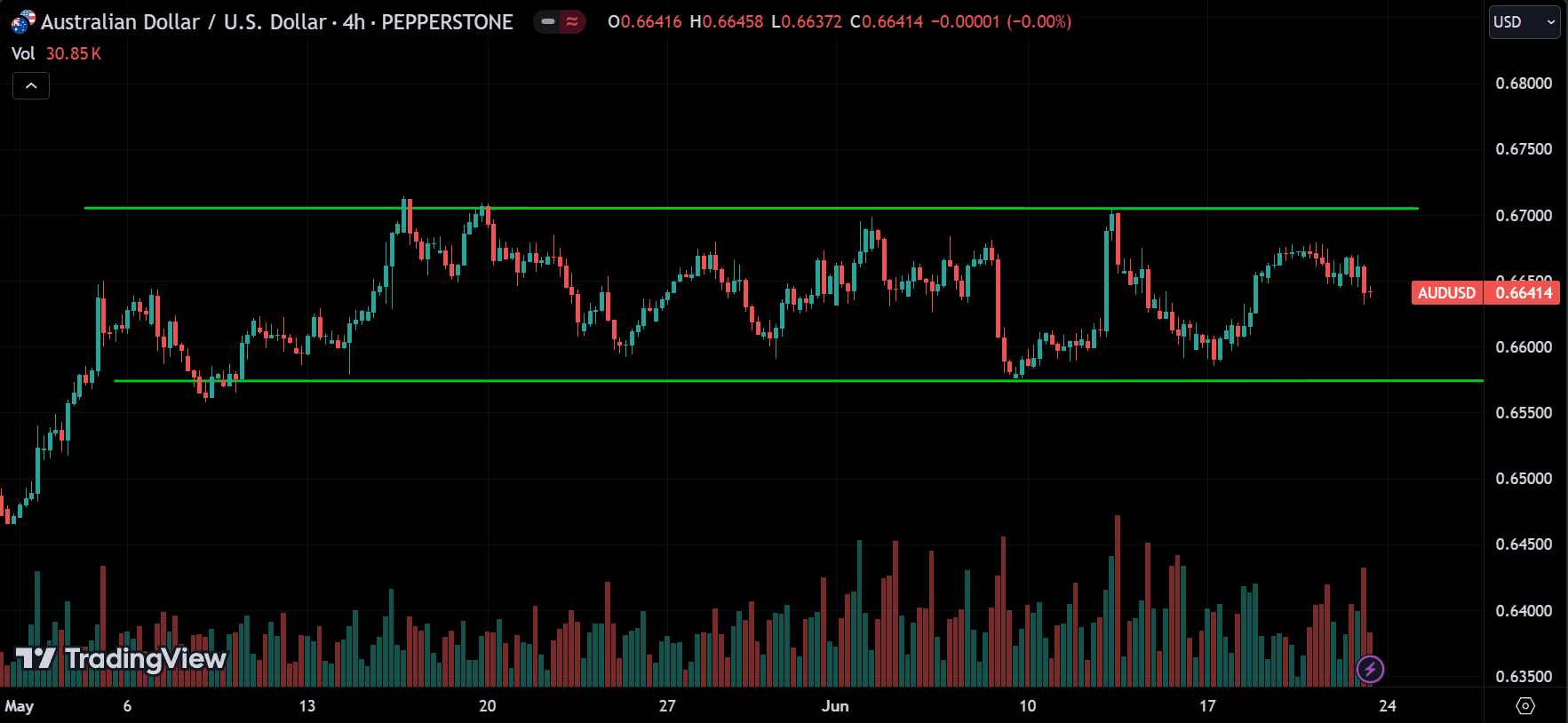

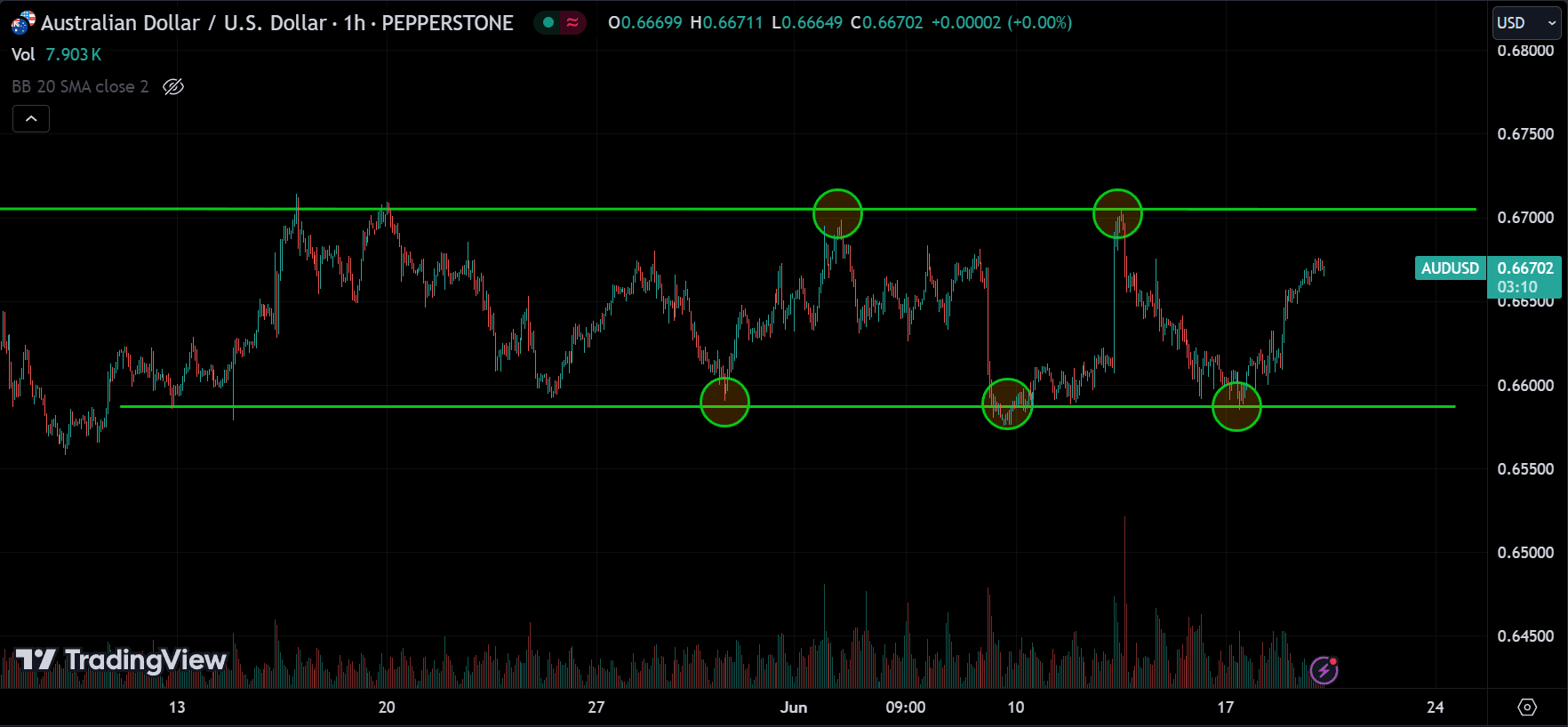

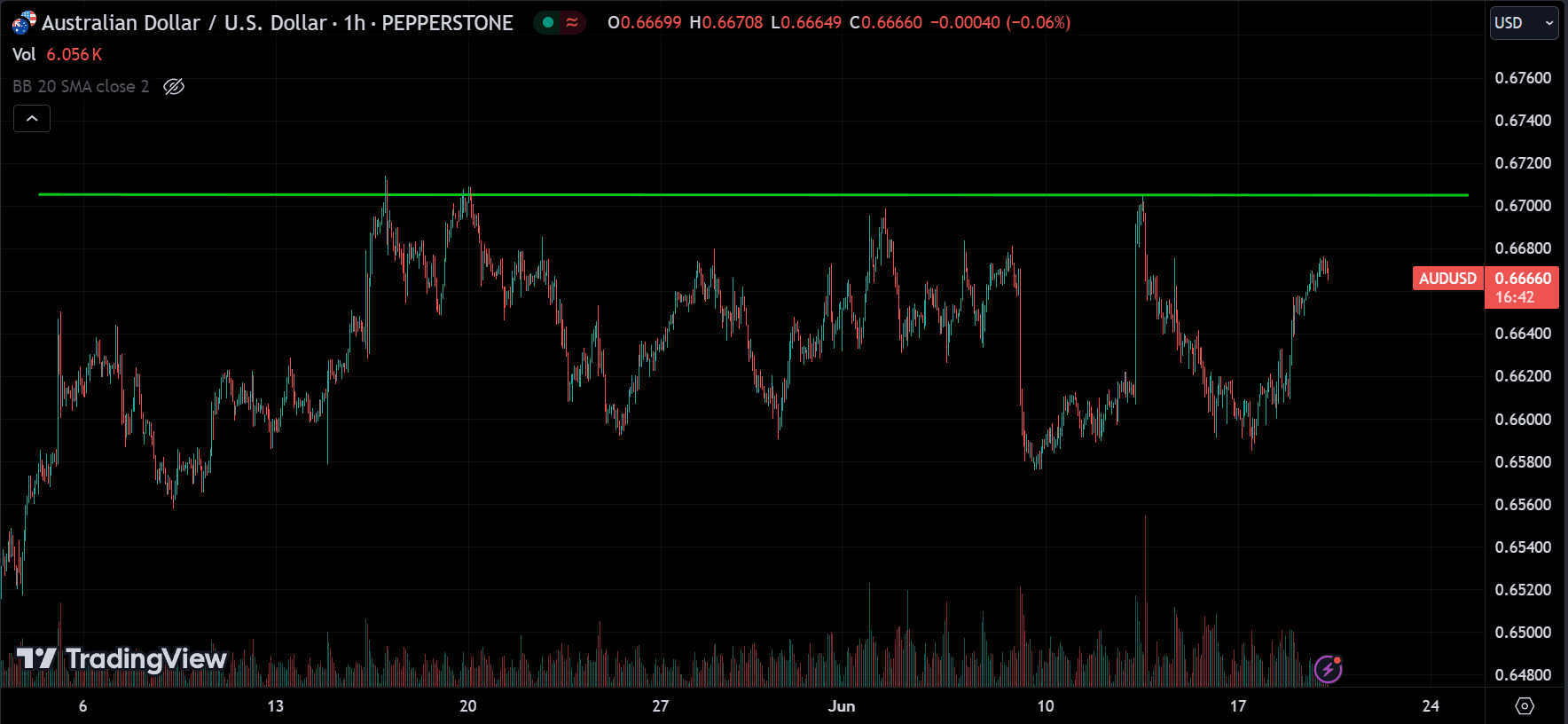

Horizontal Channels (Sideways Channels)

Formed by drawing parallel lines along the support and resistance levels of a market that is moving sideways. This indicates that the price is experiencing a range-bound movement without a clear trend direction.

How to Trade Using Channels?

- Buying in an Ascending Channel: Traders typically look to buy when the price is near the lower support line and sell when it approaches the upper resistance line.

- Selling in a Descending Channel: Traders often sell when the price is near the upper resistance line and buy to cover when it approaches the lower support line.

- Range Trading in a Horizontal Channel: Traders buy near the lower support line and sell near the upper resistance line, anticipating the continuation of the range-bound movement.

Support and Resistance in Forex Trading

Support and resistance levels are fundamental concepts in technical analysis. These levels represent the price points where the market has historically shown a tendency to reverse its direction.

Remember trend lines? they act as support and resistance levels for the price.

What is Support?

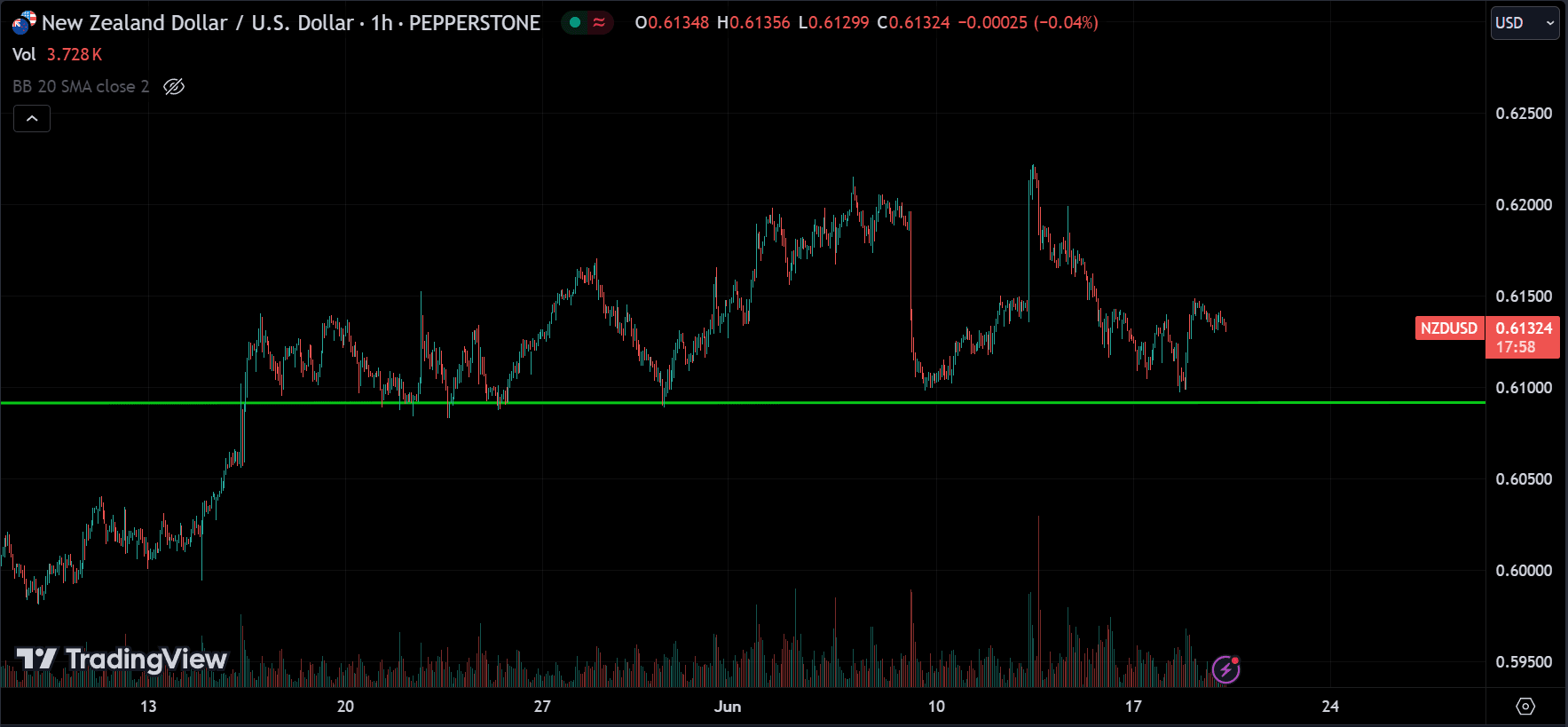

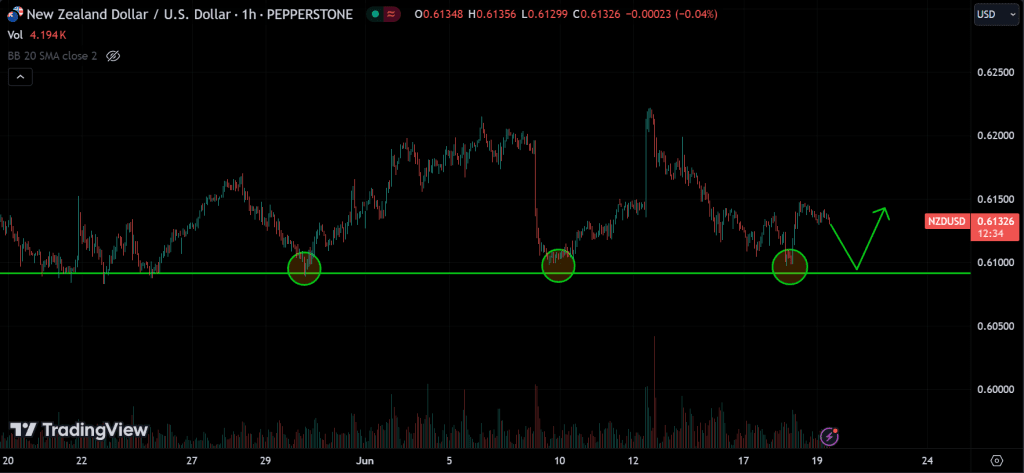

A support level is a price point where a currency pair tends to find buying interest as it falls. At this level, the demand is strong enough to prevent the price from declining further. Support levels are often identified through historical price data and chart patterns. When a support level is breached, it can become a new resistance level.

What is Resistance?

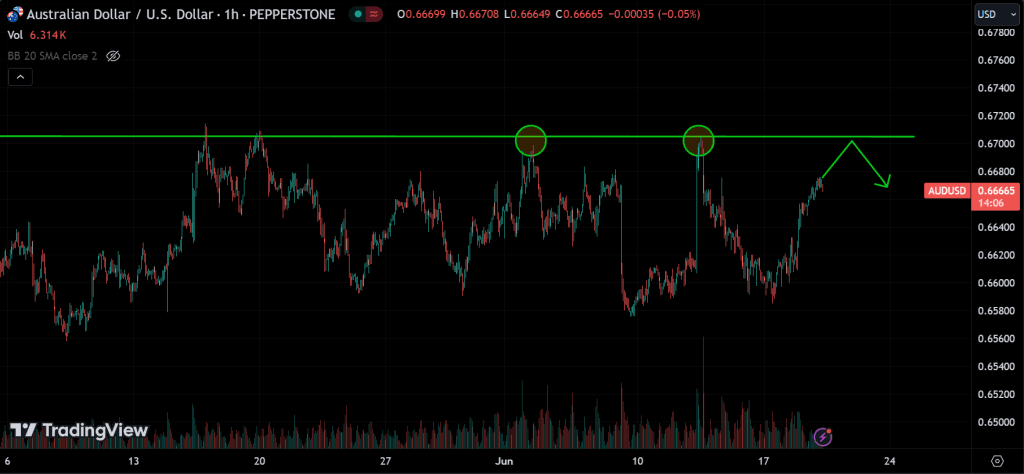

A resistance level is a price point where a currency pair tends to find selling interest as it rises. At this level, the supply is strong enough to prevent the price from rising further. Resistance levels are also identified through historical price data and chart patterns. When a resistance level is breached, it can become a new support level.

How to Trade Using Support and Resistance?

- Buying at Support: Traders look to enter long positions when the price approaches a known support level, anticipating a bounce back up.

- Selling at Resistance: Traders look to enter short positions when the price approaches a known resistance level, anticipating a pullback.

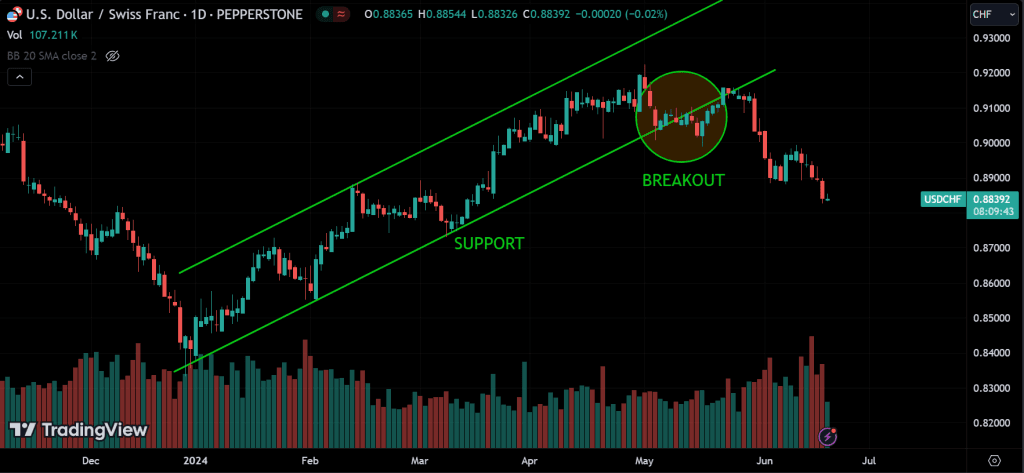

- Breakout Trading: Traders also watch for breakouts, where the price moves decisively above a resistance level or below a support level. A breakout indicates a potential start of a new trend.

Combining Channels, Support, and Resistance

Effective forex trading often involves combining channels with support and resistance levels to confirm trade setups and enhance the accuracy of predictions.

Here’s how traders can use these tools together:

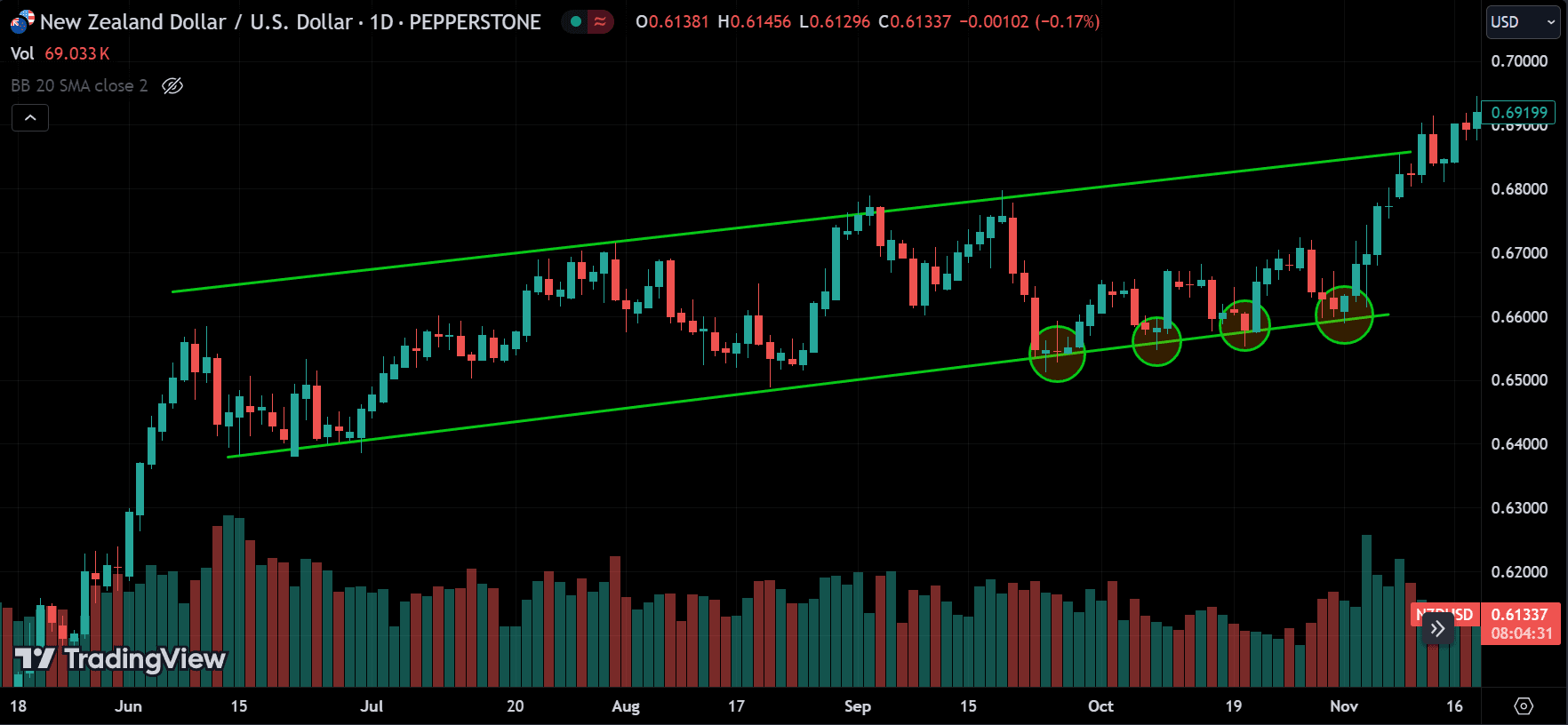

- Confirming Trends: When the support or resistance levels align with a channel’s boundaries, it reinforces these levels’ strength. For instance, if the lower boundary of an ascending channel coincides with a historical support level, it provides a stronger signal for potential buying opportunities.

- Identifying Breakouts: A breakout from a channel, especially when it coincides with a support or resistance level, can signal a significant market movement. Traders watch for increased volume and momentum to confirm the breakout and enter trades accordingly.

- Setting Price Targets: Channels and support/resistance levels help traders set realistic price targets. In an ascending channel, traders might set their target near the upper resistance line, while in a descending channel, they might target the lower support line. Similarly, support and resistance levels provide clear points for setting stop-loss and take-profit orders.

Practical Examples

- Ascending Channel with Support: Suppose a currency pair is in an ascending channel with a historical support level at the channel’s lower boundary. A trader might place a buy order near this support level, expecting the price to rise towards the channel’s upper boundary.

- Descending Channel with Resistance: In a descending channel, if the upper boundary coincides with a resistance level, a trader might place a sell order near this level, anticipating the price to fall towards the lower boundary.

- Breakout Confirmation: If the price breaks above the upper boundary of an ascending channel and a historical resistance level at the same time, a trader might interpret this as a strong bullish signal and enter a long position, expecting further upward movement.

Conclusion

TradingView provides free tools to draw channels and support and resistance levels on live prices. Also, our website has indicators to draw channels and support and resistance.

Channels, support, and resistance are essential tools in the arsenal of a forex trader. Understanding how to identify and utilize these elements can significantly improve trading performance. By combining the directional guidance of channels with the reversal indicators provided by support and resistance levels, traders can enhance their ability to predict market movements, manage risk, and execute successful trades. As with all trading strategies, it is crucial to practice diligent risk management and continuously refine one’s approach based on market conditions and personal trading experience.