Forex trading, the exchange of currencies on the global financial market, is influenced by various factors. While many traders focus on technical analysis, which looks at historical price movements, fundamental analysis for forex trading dives deeper into the economic and geopolitical forces that drive market movements. This article will cover what fundamental analysis for forex trading is, how it’s applied in the forex market, key indicators to watch, and how to integrate it with other strategies to build a robust trading approach.

What is Fundamental Analysis?

Fundamental analysis involves assessing the intrinsic value of a currency by examining the underlying economic, financial, and geopolitical factors that impact a country’s economy. Unlike technical analysis, which uses charts and historical price data to forecast future movements, fundamental analysis focuses on the big-picture economic landscape.

In the context of forex trading, the goal of fundamental analysis is to identify the key drivers of currency movements, such as interest rates, inflation, unemployment, trade balances, and overall economic growth. Understanding these drivers helps traders anticipate future currency trends, providing insights into when and how to enter or exit trades.

Key Economic Indicators in Forex Fundamental Analysis

1. Interest Rates

Interest rates, set by a country’s central bank, are arguably the most important factor influencing currency value. Higher interest rates attract foreign investors seeking better returns on their investments, causing the currency to appreciate. Conversely, lower interest rates typically lead to a currency’s depreciation as investors look for higher-yielding alternatives elsewhere.

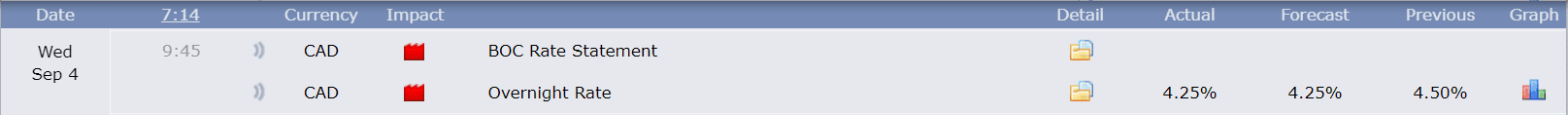

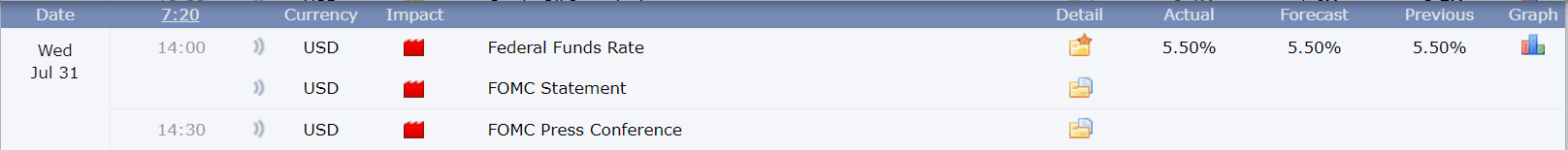

Central banks, like the Federal Reserve (Fed) for the United States or the European Central Bank (ECB), regularly announce interest rate decisions. Traders watch these announcements closely because even small adjustments in interest rates can create significant volatility in the forex market.

2. Inflation

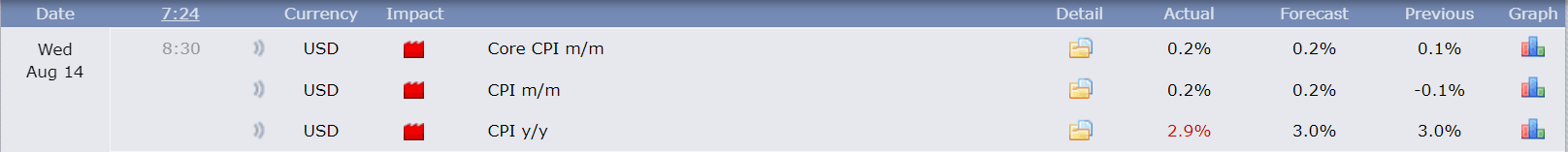

Inflation reflects the rate at which prices for goods and services increase over time. Central banks target specific inflation rates to stabilize the economy. A country experiencing high inflation usually sees its currency weaken because inflation erodes the purchasing power of money. Low inflation, on the other hand, tends to support currency strength.

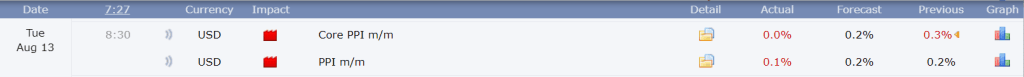

Traders monitor inflation reports such as the Consumer Price Index (CPI) or the Producer Price Index (PPI) to gauge how inflation is trending. Central bank reactions to inflation, such as raising or lowering interest rates, can have a direct impact on currency movements.

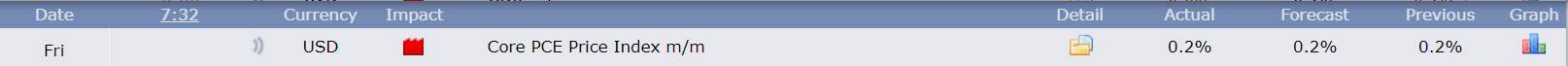

While CPI measures the average change in prices paid by consumers for goods and services, the Federal Reserve typically focuses on the Personal Consumption Expenditures (PCE) Index as their preferred inflation gauge. The key difference is that PCE accounts for a broader range of expenditures and adjusts for changes in consumer behavior, making it a more comprehensive measure in the Fed’s eyes when making monetary policy decisions.

3. Gross Domestic Product (GDP)

GDP measures the total value of all goods and services produced within a country over a specific period. It’s the most comprehensive indicator of economic health. A growing GDP signals a healthy economy, which generally strengthens a country’s currency as foreign investors become more confident in the stability of that nation. Conversely, a shrinking GDP indicates economic trouble, often leading to a depreciation in the currency.

Traders pay close attention to quarterly GDP releases, as unexpected deviations from forecasts can cause sharp market reactions. In forex trading, GDP is crucial for understanding long-term currency trends.

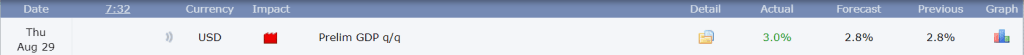

There are three versions of GDP released a month apart – Advance, Preliminary, and Final. The Advance release is the earliest and thus tends to have the most impact

4. Employment Data

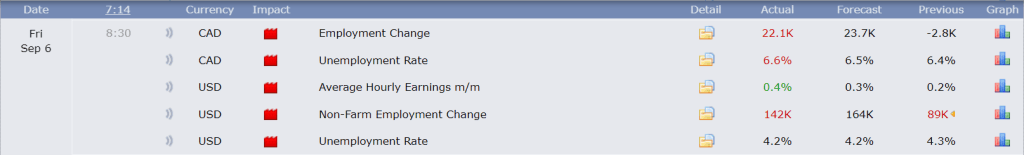

Employment data, including employment claims, the unemployment rate, and Non-Farm Payrolls (NFP), are key indicators of economic health. A country with a low unemployment rate tends to have a strong economy, which supports currency strength. Conversely, high unemployment rates can weaken a currency as they signal economic instability.

In the United States, for example, the Non-Farm Payrolls (NFP) report is released monthly and is one of the most significant employment indicators globally. The report measures the change in the number of employed people, excluding those in the farming industry. Large deviations from the forecasted number can lead to significant volatility in the forex market. Additionally, employment claims (initial jobless claims) provide weekly insights into labor market conditions, though they are typically less volatile than the NFP report. Among these indicators, the NFP is generally the most volatile, followed by the unemployment rate, with employment claims being the least volatile but still important for tracking labor market trends.

5. Trade Balance

The trade balance measures the difference between a country’s exports and imports. A positive trade balance (trade surplus) indicates that a country is exporting more than it is importing, which tends to strengthen its currency as foreign buyers need to purchase the domestic currency to pay for goods. A negative trade balance (trade deficit) can weaken a currency since it signals that more money is leaving the country than entering.

Currencies of nations with trade surpluses, such as China or Germany, generally perform better in the forex market compared to countries with chronic trade deficits.

6. Political Stability and Geopolitical Events

Political events and geopolitical tensions can also impact currency markets. Elections, government policy changes, trade agreements, and conflicts can create uncertainty, leading to increased market volatility. Investors generally prefer stable political environments, so political uncertainty tends to weaken a country’s currency while stability strengthens it.

For instance, during times of political unrest or war, investors often flock to safe-haven currencies like the U.S. dollar (USD), Swiss franc (CHF), or Japanese yen (JPY). Conversely, currencies of countries experiencing political instability may suffer as investors pull their funds out of those nations.

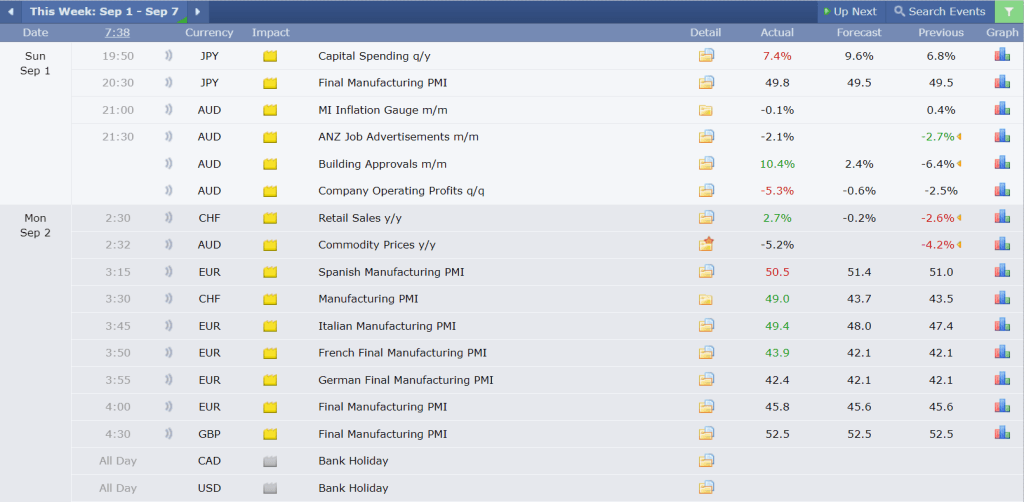

Current vs. Expected Value: The Key to Market Reactions

One of the most critical aspects of fundamental analysis is the comparison between the current value of economic indicators and the expected value (forecasted by analysts). The difference between these values often causes significant market reactions. When actual economic data deviates from what was expected, it can lead to sharp movements in the forex market.

For instance, if the actual inflation rate or employment data is significantly higher or lower than predicted, traders anticipate this shift to impact currency values accordingly. This is what most traders are watchful for; even if they don’t perform detailed fundamental analysis, they monitor how changes between the current and expected values could affect overall market sentiment.

A surprise result—whether better or worse—can spark volatility, so traders keep a close eye on these releases to adjust their positions or enter new trades based on the market’s reaction.

The Role of Central Banks in Fundamental Analysis

Central banks are key players in the forex market, and their actions often have a profound impact on currency values. Central banks, like the Federal Reserve (Fed), European Central Bank (ECB), and Bank of England (BoE), use monetary policy to manage inflation, interest rates, and overall economic growth.

1. Monetary Policy

Monetary policy refers to the actions taken by a central bank to control the money supply and interest rates. Traders closely watch announcements from central banks, especially regarding changes to interest rates or quantitative easing programs.

- Hawkish: A central bank that is concerned about inflation and likely to raise interest rates is considered hawkish, which tends to strengthen the currency.

- Dovish: A central bank that is focused on stimulating economic growth and lowering interest rates is considered dovish, which generally weakens the currency.

2. Quantitative Easing (QE)

QE is an unconventional monetary policy where central banks buy government securities or other financial assets to inject liquidity into the economy. While QE can stimulate growth, it often leads to currency depreciation because it increases the supply of money, reducing its value relative to other currencies.

Combining Fundamental and Technical Analysis

While fundamental analysis provides a broad picture of what drives currency movements, technical analysis can help fine-tune trade entries and exits. Many successful traders combine both approaches:

- Use fundamental analysis to identify the overall trend: For example, if a country is raising interest rates, its currency may be in an uptrend.

- Use technical analysis for timing: Look for chart patterns, support and resistance levels, or other indicators to determine the best time to enter or exit a trade.

For example, a trader might analyze GDP growth and interest rates to determine that the U.S. dollar is likely to strengthen, then use technical analysis to pinpoint the best entry point to buy USD pairs.

Limitations of Fundamental Analysis

While fundamental analysis offers deep insights, it does have limitations:

- Lag in data: Economic indicators are often released weeks or even months after the fact, making it challenging to react in real time.

- Market expectations: Sometimes, the market has already priced in anticipated economic data, meaning that even a strong report may not lead to currency appreciation if the data matches expectations.

- Subjectivity: Interpreting economic indicators can be subjective, and different analysts may come to different conclusions.

Despite these limitations, fundamental analysis remains a powerful tool for long-term forex traders.

Conclusion

Fundamental analysis in forex trading offers a way to understand the bigger economic forces at play. By paying attention to interest rates, inflation, GDP, employment data, and geopolitical events, traders can gain a clearer sense of where currency markets are headed. When combined with technical analysis, fundamental analysis can enhance your trading strategy, helping you make informed decisions based on both market trends and economic realities.

Integrating fundamental analysis is essential for traders serious about mastering forex. You can develop a more comprehensive and effective trading strategy by continuously monitoring key economic indicators and understanding how they influence currency movements.

thank you for awesome work, this document is essential for traders