Forex trading, also known as foreign exchange trading, is one of the largest and most liquid financial markets worldwide, with trillions of dollars traded daily. This high level of liquidity, combined with rapid price movements, presents traders with abundant opportunities for profit—and, inevitably, for loss. For anyone involved in Forex trading, risk management is a non-negotiable skill set. One of the most indispensable tools for safeguarding against unpredictable price swings is the stop loss. But many traders—especially newcomers—often ask, “What Are Stop Losses and why are they so important?”

In this in-depth guide, we will discuss What Are Stop Losses, examine the various types of stop loss orders, delve into why they are crucial in Forex trading, and break down how to set and manage them effectively. We will also explore common mistakes, psychological challenges, and share practical examples so that both beginners and seasoned traders can enhance their strategies. By the end of this article, you will have a comprehensive understanding of how to use stop losses to protect your trades, optimize risk management, and bolster your overall trading performance.

Table of Contents

Understanding Forex Trading and Risk

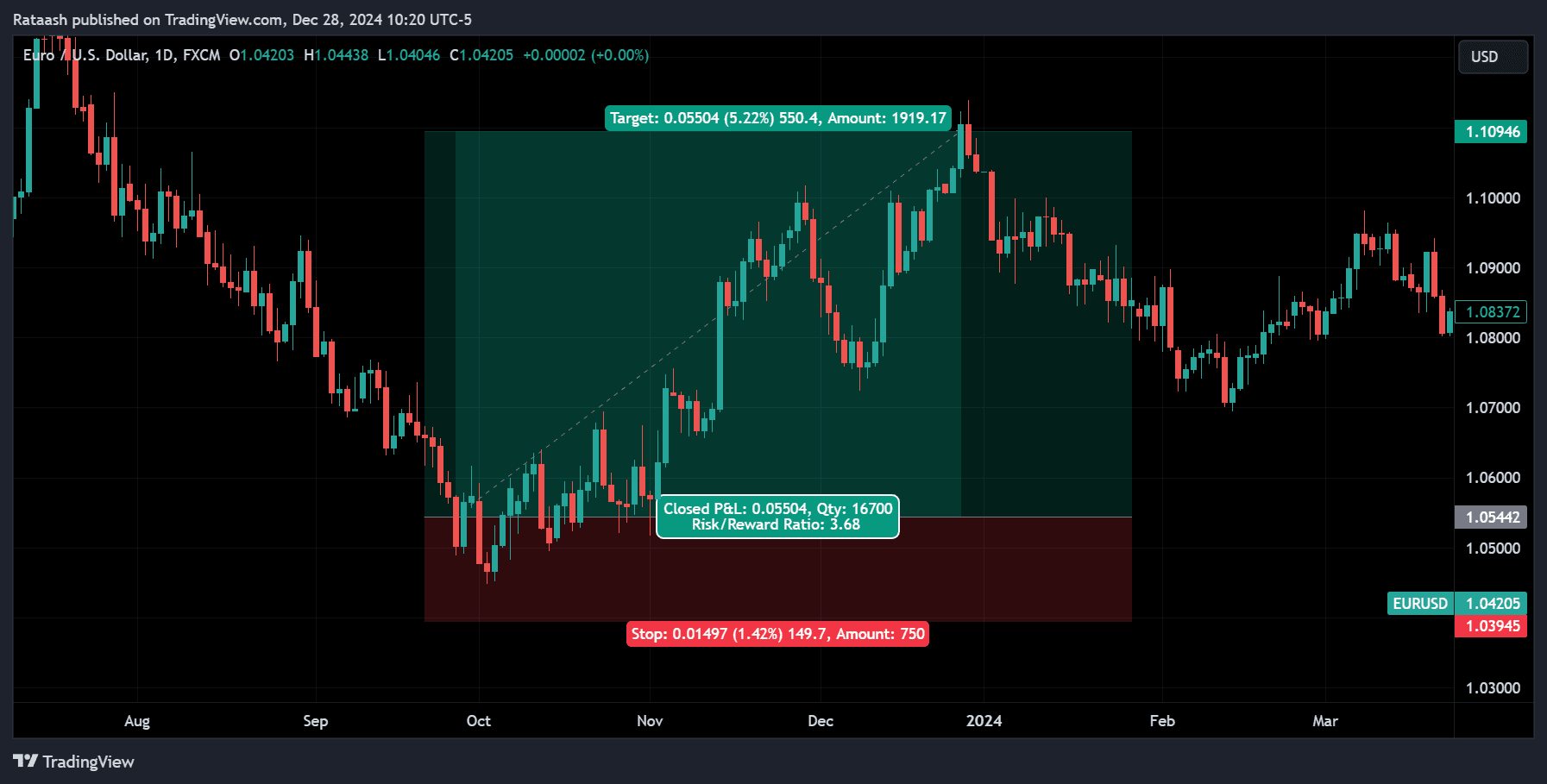

Before delving into the specifics of stop losses, it is essential to understand the broader landscape in which these orders operate. Forex trading involves buying one currency and selling another in the hopes that the currency you buy will increase in value relative to the currency you sell. For example, when trading the EUR/USD pair, you are effectively speculating on whether the Euro will strengthen or weaken against the U.S. Dollar.

Because currencies are traded in pairs, and because the Forex market operates 24 hours a day (5 days a week), price fluctuations can occur rapidly. Political events, economic releases, central bank announcements, and even unexpected global developments can cause dramatic market movements.

Key points about Forex risk:

- High leverage: Forex brokers often offer high leverage, which magnifies both profits and losses. A trader with a small amount of capital can control a large position; however, this can be a double-edged sword.

- Volatility: Currency pairs can become highly volatile, especially during major economic announcements.

- Liquidity: While high liquidity can facilitate easier order execution, sudden price gaps can occur around major news events or during low-liquidity periods (e.g., the Asian trading session for certain pairs).

Given these characteristics, having a robust risk management system in place is paramount. A well-placed stop loss is one of the most important components of such a system.

What Is a Stop Loss?

A stop loss is an order placed with a broker to buy or sell a currency pair once it reaches a certain price level, which is called the “stop price.” The primary purpose of a stop loss is to limit a trader’s loss on a position if the market moves against their expectations.

Stop losses in action:

- If you buy (go long) EUR/USD at 1.1000, you might place a stop loss at 1.0950. This means that if EUR/USD falls to 1.0950, your position will be automatically closed, limiting your loss to 50 pips.

- Conversely, if you sell (go short) USD/JPY at 130.00, you might set a stop loss at 131.00. If the price moves up to 131.00, your position closes automatically, preventing further losses should the currency pair continue its upward trend.

A stop loss acts as a safety net that kicks into action when the market moves against you beyond a level you are comfortable with. This ensures that you don’t have to monitor the market every second to manually close your trades, and more importantly, it helps manage risk by protecting your trading capital.

Why Stop Losses Are Important in Forex Trading

1. Capital Preservation

Capital preservation is the cornerstone of long-term trading success. Even the best traders experience losing trades. With a stop loss, your position is automatically exited before your losses become catastrophic. This helps ensure that you preserve enough capital to continue trading and capitalize on future opportunities.

2. Emotion Management

Emotional trading is a common pitfall, especially for beginner traders. When a trade goes into the red, fear and hope can cloud judgment, leading traders to hold onto losing positions in the hope of a reversal. A pre-set stop loss removes emotion from the equation; you establish your maximum risk upfront and let the order do its job if the market moves unfavorably.

3. Risk Management and Consistency

Successful Forex trading isn’t just about scoring big wins; it’s about managing losses effectively. Consistent risk management practices, including the use of stop losses, help traders avoid catastrophic drawdowns. By risking a small, pre-defined percentage of your account per trade, you can maintain a more stable equity curve.

4. Automated Safeguard

Stop losses serve as an automated safeguard that can protect your account even while you are away from your trading screen. Forex markets operate around the clock, so having open positions without any protective stop can be extremely risky. If adverse market moves happen when you’re asleep or unable to monitor your trades, your stop loss is there to protect you.

Types of Stop Loss Orders

Stop loss orders come in various forms, each with distinct features and benefits. Understanding these differences can help you select the most appropriate tool for your particular trading style and market conditions.

1. Traditional (Fixed) Stop Loss

A traditional stop loss is placed at a specific price level. Once that price is reached, the broker will automatically close the trade. This type of stop loss does not move, hence the term “fixed.” You set it and forget it—unless you manually decide to adjust it.

Pros:

- Simple to understand and implement

- Offers clear risk parameters

- Works well in stable and moderately volatile market conditions

Cons:

- If the stop is placed too close, normal market fluctuations might trigger it prematurely

- No room to capture additional profits on extended price moves, as the stop does not trail (unless you adjust it manually)

2. Trailing Stop Loss

A trailing stop loss is designed to lock in profits as the market moves in your favor. Instead of staying fixed, the stop price moves incrementally with the market if the market is moving in a profitable direction. For instance, if you set a trailing stop of 50 pips on a buy position and the market moves up by 50 pips, your trailing stop will move 50 pips higher, locking in some profit.

Pros:

- Allows for profit maximization during strong trends

- Adapts automatically to favorable price movements

- Reduces the need for manual trade management

Cons:

- Trailing stops can be triggered by market noise if set too tight

- Risk of giving back profit if market reverses quickly and the trailing stop hasn’t yet “locked in” enough gains

3. Guaranteed Stop Loss

A guaranteed stop loss functions similarly to a traditional stop loss but comes with an added guarantee from your broker that your position will be closed at the specified stop price, regardless of market conditions or gaps. This type of order may involve an additional cost or fee. It is particularly useful for highly volatile trading environments or during major news events where price slippage could be substantial.

Pros:

- Ensures execution at the exact stop price, with no slippage

- Highly protective during abnormal or fast-moving market conditions

Cons:

- Often comes with an extra charge or wider spreads

- Not all brokers offer guaranteed stops

4. Stop Limit Orders

Stop limit orders are a combination of a stop order and a limit order. Once the stop price is reached, the order becomes a limit order, which is then executed only at the limit price (or better). This allows traders to control the price at which their trade will be closed, but it also carries the risk that if the market moves too quickly through the limit price, the order might not be filled.

Pros:

- Offers precise control over execution price

- Useful in certain trading strategies where partial fills or execution at a specific price is critical

Cons:

- Might not be executed in fast-moving markets

- Unsuitable for traders who need guaranteed exits

How to Determine the Right Stop Loss Placement

Finding the optimal stop loss level is both art and science. It involves not only technical analysis but also a firm grasp of your risk tolerance, trading strategy, and the market’s inherent volatility.

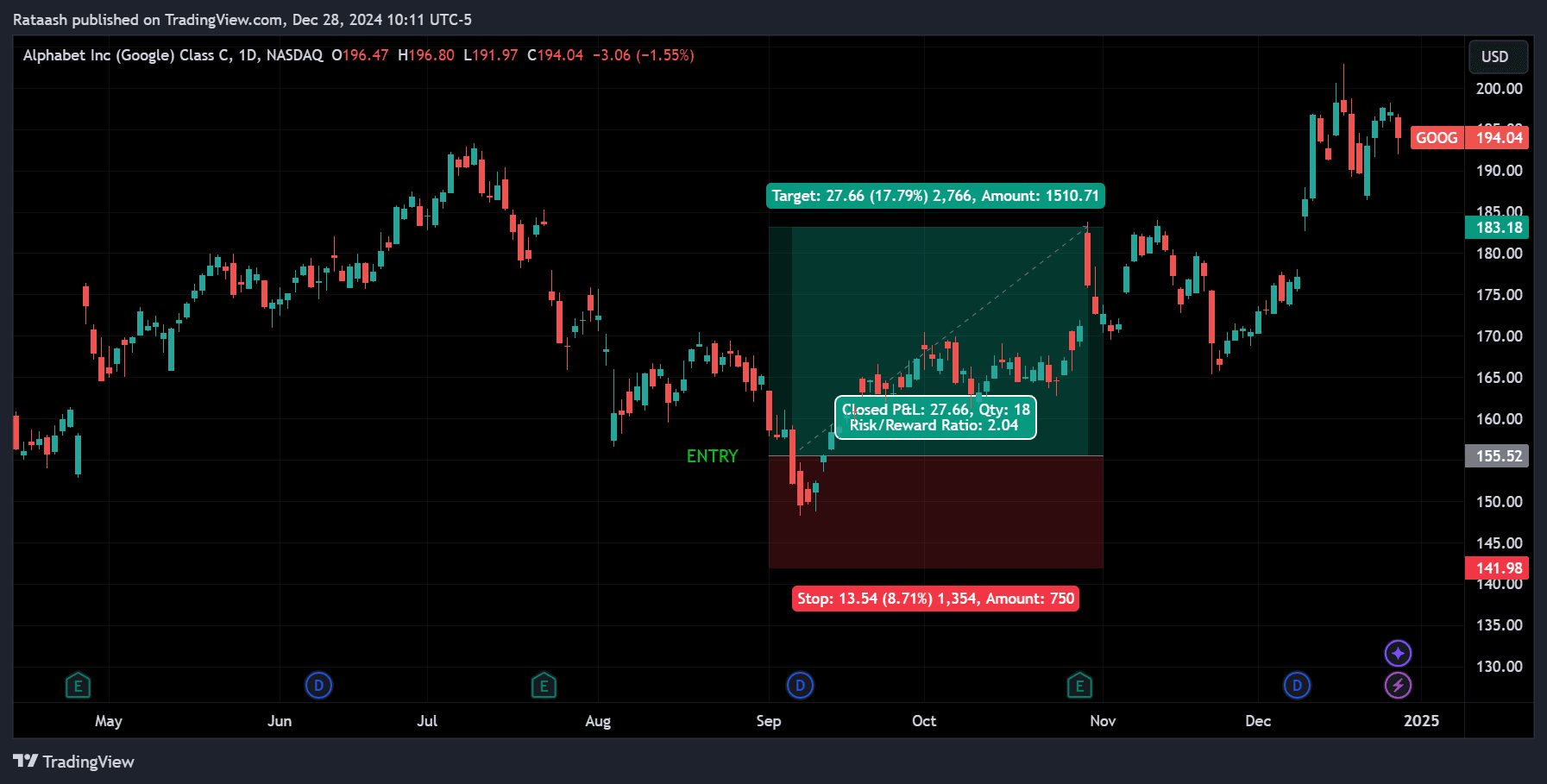

1. Using Risk-Reward Ratio

Many successful traders use a risk-reward ratio to determine stop loss and take profit levels. For example, if you risk 50 pips, you may aim for a reward of 100 pips, giving you a 1:2 risk-reward ratio. This ensures that even if you only win half of your trades, you can still come out profitable over the long run.

- Example: You risk 1% of your account on every trade. If your stop loss is triggered, you lose 1%. However, if you hit your take profit, you gain 2%. Over multiple trades, this strategic ratio can help maintain a positive expectancy.

2. Identifying Key Support and Resistance Levels

Support and resistance levels are critical in Forex trading. Placing a stop loss just below a significant support or just above a strong resistance can be an effective strategy. This way, your stop loss is less likely to be triggered by normal price movements, and only gets activated if the market truly breaks through a key level, signaling a potential trend reversal.

- Visual Example: On a EUR/USD daily chart, if 1.2000 is a major support zone, you might set your stop slightly below 1.2000 (e.g., 1.1980) to give the trade a bit of breathing room.

3. Applying Volatility Indicators

Trading currencies that exhibit high volatility requires a different approach to stop loss placement compared to trading more stable pairs. One popular tool is the Average True Range (ATR) indicator, which measures the average range of price movement over a specific period.

- ATR-based stops: If the daily ATR of USD/JPY is 80 pips, you might set your stop loss at 1 or 1.5 times the ATR below your entry for a long position. This adjusts your stop loss based on recent volatility, reducing the chance of being stopped out prematurely.

4. Considering Fundamental Factors

While technical analysis is often used to determine stop loss placement, you should not ignore fundamental factors like economic news releases, central bank announcements, and geopolitical events. If a major news event is scheduled, market volatility can spike unpredictably, and a more conservative (wider) stop may be warranted—or you might decide to stay out of the market altogether until the event passes.

Common Mistakes When Setting Stop Losses

Even the most experienced traders can fall prey to common mistakes related to stop loss placement. Recognizing these pitfalls and avoiding them can significantly improve your trading results.

1. Setting the Stop Loss Too Tight

It’s tempting to place a very tight stop loss to minimize losses, but an excessively tight stop can lead to being frequently stopped out on normal market fluctuations. For instance, if you set a stop loss just 5 pips away from entry on a currency pair with a typical daily range of 100 pips, you might be exposing yourself to frequent small losses.

Solution: Align your stop loss with market structure, key levels, or volatility measures like ATR. This offers a buffer against routine price swings.

2. Placing the Stop Loss Too Wide

Setting a stop loss extremely far from entry might keep you in a trade longer, but it also risks large losses. If your stop is hundreds of pips away without a compelling reason (e.g., extremely high volatility), you might be jeopardizing more capital than necessary.

Solution: Stick to a predefined risk percentage of your trading account (e.g., 1-2% per trade). Ensure that your position size aligns with your intended stop loss distance, so you don’t exceed your risk tolerance.

3. Not Using a Stop Loss at All

Some traders opt to trade without a stop loss in an attempt to avoid “random” stop-outs or with the misguided notion that the market “must” eventually reverse in their favor. This is one of the most dangerous practices in Forex trading. Without a stop loss, your entire account is at risk if a major move goes against you.

Solution: Always use a stop loss. Treat it like an insurance policy on every trade. If your broker doesn’t allow stop losses, consider switching to one that does.

4. Moving the Stop Loss Arbitrarily

A stop loss is meant to protect you when the market proves your trade thesis wrong. Moving it arbitrarily (like shifting it farther away when the price is about to hit it) defeats the purpose. This often leads to bigger losses and can severely damage your trading psychology.

Solution: Only adjust your stop loss based on solid market logic, such as breaking a significant trendline or forming a new support/resistance area. Avoid shifting it out of fear or hope.

Strategies for Effective Stop Loss Placement

Different trading styles and timeframes require different stop loss strategies. Below are some tailored approaches for swing trading, day trading, and scalping.

1. Swing Trading

Definition: Swing trading involves holding positions for multiple days to weeks, aiming to capture larger market moves.

- Stop Loss Placement: Swing traders often rely on daily or 4-hour charts. A common strategy is to place stops below a recent swing low for long positions or above a recent swing high for short positions.

- Considerations: Because swing trades aim for larger gains, stops are usually wider. Traders may use ATR-based stops to account for multi-day volatility.

- Example: If you buy AUD/USD expecting a multi-week uptrend, you might place your stop below the previous week’s low.

2. Day Trading

Definition: Day trading involves opening and closing positions within the same trading day, aiming to capitalize on intraday price movements.

- Stop Loss Placement: Day traders typically use shorter timeframes (5-minute, 15-minute, or 1-hour charts). Stops are tighter, often placed around intraday support/resistance levels or pivot points.

- Considerations: Quick market moves require rapid decision-making. Day traders often rely on real-time price action, volume analysis, and smaller risk-reward targets.

- Example: A day trader might short GBP/USD at the break of a minor support level, placing a stop just above that level, aiming for a quick 20–30 pips.

3. Scalping

Definition: Scalping is the shortest-term trading style, with positions opened and closed within minutes or even seconds, seeking very small profits repeatedly.

- Stop Loss Placement: Because scalp trades aim for very small gains, stop losses are correspondingly tight.

- Considerations: High spreads and transaction costs can hurt scalpers if their stop is triggered frequently. Precision is critical, and scalping is generally not recommended for beginners.

- Example: A scalper might set a stop loss only 5–10 pips away, targeting a similar or slightly higher profit range.

Psychological Challenges and Stop Losses

The psychological aspect of Forex trading is enormous, and stop losses are intricately tied to this dimension. Here are some common mindset hurdles:

- Fear of Losses: Seeing a position move against you can trigger anxiety, causing traders to move or remove stop losses. This is counterproductive; your fear might lead you to expose yourself to bigger losses.

- Hope for Reversal: Traders often hang onto losing positions too long, hoping the market will turn around. A stop loss removes that temptation.

- Regret: It’s common to feel regret if your stop loss is hit and the market subsequently reverses in your original favor. However, in the long run, a stop loss is meant to protect your capital from catastrophic moves, which pays off over time.

A robust trading plan that incorporates stop losses can alleviate much of this emotional turmoil. By defining risk parameters beforehand, you set clear boundaries for how much you are willing to lose on any single trade.

Real-World Examples of Stop Loss Usage

Nothing beats real-life scenarios for illustrating the importance and mechanics of stop losses. Below are a few hypothetical yet realistic examples:

1. Example 1: Using a Tight Stop on a Volatile Pair

- Scenario: You are trading GBP/JPY, a notoriously volatile pair. You identify a bullish pattern on the 15-minute chart and decide to go long at 160.50, expecting a quick move to 161.50.

- Stop Loss Placement: A tight stop loss is set at 160.00, 50 pips away, based on the pair’s intraday volatility.

- Outcome: GBP/JPY spikes to 161.30, at which point you decide to close half the position and trail your stop to 160.80. Even if the market reverses, you’ve locked in profit.

In this example, a moderately tight stop loss was appropriate due to the pair’s daily volatility. The partial profit-taking and trailing stop further reduced risk.

2. Example 2: Trailing Stop on a Trending Market

- Scenario: You are a swing trader who has identified a strong uptrend in EUR/USD from a weekly chart. You enter a long trade at 1.1000.

- Stop Loss Placement: Initially, you set your stop at 1.0900. However, to maximize gains, you also implement a trailing stop that moves behind the price by 100 pips.

- Outcome: The pair climbs to 1.1200. Your trailing stop moves up to 1.1100, locking in at least 100 pips of profit. If the trend continues, the trailing stop will move even higher.

Here, the trailing stop allows you to ride the wave of a trending market while securing a certain level of accumulated profits.

3. Example 3: Fundamental News Event Protection

- Scenario: The Federal Reserve is scheduled to announce an interest rate decision, and you anticipate volatility in USD-based pairs. You enter a short position on USD/CAD at 1.3500 ahead of the announcement, expecting a dovish stance.

- Stop Loss Placement: You place a guaranteed stop loss at 1.3550 to protect against potential slippage.

- Outcome: The Fed surprises markets with a neutral stance, causing USD/CAD to briefly spike to 1.3570. Your guaranteed stop loss closes your trade at 1.3550, limiting your loss to 50 pips.

In a high-volatility scenario with significant news risk, the extra cost of a guaranteed stop loss might be justified to avoid unexpected slippage.

Conclusion

Stop losses are more than just an order type in Forex trading; they are a fundamental aspect of disciplined risk management. By predefining the maximum amount you’re willing to lose on a trade, you safeguard your trading account against catastrophic losses and emotional decision-making.

Key Takeaways:

- Definition: A stop loss is an order that automatically closes your position if the market reaches a predetermined price, thereby limiting your losses.

- Importance: They help preserve capital, manage risk, reduce emotional trading, and provide round-the-clock protection in a market that never sleeps.

- Types: From traditional fixed stops to trailing stops and guaranteed stop losses, each type offers unique advantages depending on your trading style and market conditions.

- Placement Strategies: Effective stop loss placement involves analyzing risk-reward ratios, support/resistance levels, volatility indicators like ATR, and fundamental events.

- Common Mistakes: Setting stops too tight, too wide, or moving them arbitrarily can undermine your trading. Always rely on a logical, market-based approach.

- Adapt to Your Style: Whether you’re a swing trader, day trader, or scalper, your stop loss strategy should align with your timeframe and risk tolerance.

- Psychology: Fear and hope can sabotage even the best trade setups. A well-thought-out stop loss strategy helps mitigate these emotional traps and preserves mental capital.

- Examples: Real-life scenarios illustrate how stops function in volatile markets, trending conditions, and news-driven spikes.

When used correctly, stop losses provide a significant edge in the Forex market. They embody the trader’s commitment to discipline, reduce the likelihood of substantial drawdowns, and offer peace of mind by automating the risk management process. By integrating stop losses into a broader trading plan—which includes analysis, position sizing, and a keen awareness of market conditions—you can greatly enhance your odds of success in one of the world’s most dynamic trading arenas.

Final Thoughts

Always remember that no single stop loss level or type is foolproof. Your choice should be a deliberate decision that fits your trading strategy, market conditions, and personal risk tolerance. Continuous learning, backtesting, and forward testing can help you refine your approach over time. By leveraging the power of stop losses effectively, you safeguard your hard-earned trading capital and set a strong foundation for consistent profitability in the Forex market.