Volume is a crucial concept in forex trading, often misunderstood or underutilized by many traders. It provides insights into market activity and the intensity of price movements. Understanding volume can significantly enhance a trader’s ability to make informed decisions. This article delves into what is volume in forex trading, its importance, how it’s measured, and how traders can use volume to their advantage.

Understanding Volume in Forex Trading

Volume, in the context of forex trading, refers to the total number of currency units traded within a specific period. It is a measure of the trading activity and liquidity in the market. Unlike stocks, where volume is straightforward and indicates the number of shares traded, forex volume can be a bit more complex due to the decentralized nature of the market.

In the forex market, true volume data is not as readily available as in stock markets. This is because forex is an over-the-counter (OTC) market, meaning there is no centralized exchange recording all transactions. Instead, volume is often estimated based on the activity in the major trading hubs or using tick volume.

Types of Volume Measurements

- Tick Volume: Tick volume is the most commonly used volume indicator in forex trading. It counts the number of price changes (ticks) within a specific period. Although it does not measure the actual number of currency units traded, it correlates strongly with actual volume. A high tick volume indicates high trading activity and vice versa.

- Real Volume: Some forex brokers offer real volume data, showing the actual number of contracts or lots traded. This data is more accurate but is only available from specific brokers who have access to such information.

- On-Balance Volume (OBV): OBV is a technical analysis tool that uses volume flow to predict changes in stock price. It is calculated by adding the volume on up days and subtracting it on down days. While OBV is more common in stock trading, some forex traders use it to gauge market momentum.

Importance of Volume in Forex Trading

- Confirmation of Trends: Volume is often used to confirm trends. A strong uptrend or downtrend accompanied by high volume indicates that the trend is likely to continue. Conversely, a trend with low volume might suggest a lack of conviction and the potential for a reversal.

- Identifying Reversals: Sudden spikes in volume can indicate potential reversals. For example, if a currency pair has been trending downwards with increasing volume and suddenly experiences a spike in volume with a price increase, it could signal a reversal.

- Market Sentiment: Volume provides insight into market sentiment. High volume during a price increase suggests strong buying interest and bullish sentiment, while high volume during a price decrease indicates strong selling interest and bearish sentiment.

- Liquidity Assessment: Volume helps traders assess market liquidity. Higher volume typically means higher liquidity, which can lead to tighter spreads and less slippage. This is crucial for executing trades efficiently, especially for large orders.

Studying stock volume is the best place to start if you want to learn more about volumes. It includes the basic ideas of supply, demand, and volume. Follow this link to learn more about stock volume.

How to Use Volume in Forex Trading

- Volume Indicators: Traders can use various volume indicators available on trading platforms. The most common ones include the Volume indicator, On-Balance Volume (OBV), and the Chaikin Money Flow (CMF). These indicators help visualize volume data and identify trends and potential reversals.

- Volume and Price Patterns: Combining volume with price patterns can provide powerful trading signals. For example, a breakout from a consolidation pattern accompanied by high volume is more likely to be genuine and sustainable than a low volume breakout.

- Divergence Analysis: Volume divergence occurs when the price is making higher highs (or lower lows), but volume is decreasing. This divergence can signal a potential trend reversal, as the underlying volume does not support the price movement.

- Support and Resistance Levels: Volume can help identify significant support and resistance levels. High volume at a particular price level indicates strong interest, which can act as a barrier for future price movements.

Practical Example

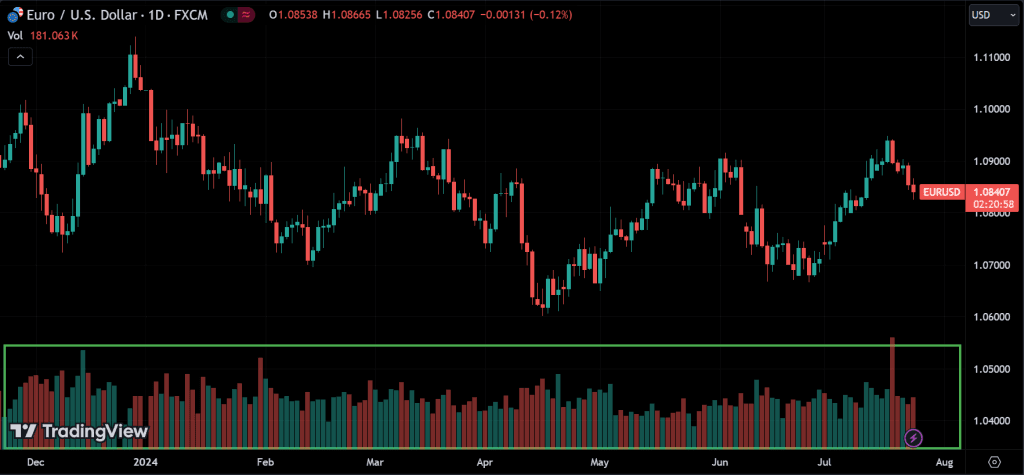

Consider the EUR/USD currency pair, which has been in a downtrend. A trader notices that the volume increases substantially as the price approaches a significant support level. This could indicate that buyers are stepping in, and a reversal might be imminent. To enter a long position, the trader could then look for additional confirmation, such as bullish candlestick patterns or indicators.

Conclusion

Volume is a vital component of forex trading that provides valuable insights into market activity and trader sentiment. By understanding and utilizing volume data, traders can enhance their trading strategies, confirm trends, identify potential reversals, and assess market liquidity. While true volume data in forex may be limited, tools like tick volume and volume indicators can still offer significant advantages. Incorporating volume analysis into your trading approach can lead to more informed and potentially more profitable trading decisions.