Chaikin Money Flow Indicator is an MT4/MT5 indicator designed as a unique method to gauge money flow into and out of a security. The realm of technical analysis is vast, encompassing many tools and techniques for traders to decipher market movements. Among these tools, CMF Indicator was invented by Marc Chaikin to provide traders with insights into the accumulation and distribution of assets over a set period.

What is Chaikin Money Flow Indicator

Chaikin Money Flow Indicator is a technical analysis indicator used to measure money flow into and out of a security over a specified period. Created by Marc Chaikin, the CMF is often used to confirm trends or anticipate potential market reversals.

The CMF is calculated by combining the concept of accumulation/distribution with the volume to assess the money flow. Essentially, it looks at the close of the stock relative to the range for a given period and then weights it by the volume for that period.

Basics of Chaikin Money Flow

At its core, the CMF operates by synthesizing price and volume data. By default, it examines the money flow over 21 days, although this can be adjusted per a trader’s preference. When correctly interpreted, the CMF Indicator offers traders an eagle-eye view of whether an asset is being actively bought (accumulated) or sold (distributed).

This is particularly valuable because if traders can spot a shift in money flow dynamics, they may be able to preempt potential price reversals or changes. As a result, the Chaikin Money Flow indicator can be an essential weapon in a trader’s arsenal, allowing them to seize opportunities before they become apparent to the broader market.

The Underlying Theory

The CMF’s foundation lies in the belief that market strength is reflected in the price’s position within its daily range. If prices consistently close in the upper echelon of their daily range, it’s a sign of a market flexing its muscles. Conversely, a price that recurrently closes in the lower spectrum of its daily range might hint at a market running out of steam.

In simpler terms, if an asset is closing near the pinnacle of its trading session, the CMF value will likely rise. On the other hand, a close near the session’s low could push the CMF value downward.

Here’s a breakdown of how the CMF is calculated:

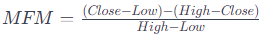

- Calculate the Money Flow Multiplier for each period:

Here, Close is the closing price, Low is the lowest price, and High is the highest price of the period.

- Calculate the Money Flow Volume for each period:

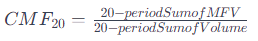

MFV=MFM×Volume - Calculate the CMF for the desired period (e.g., 20 days):

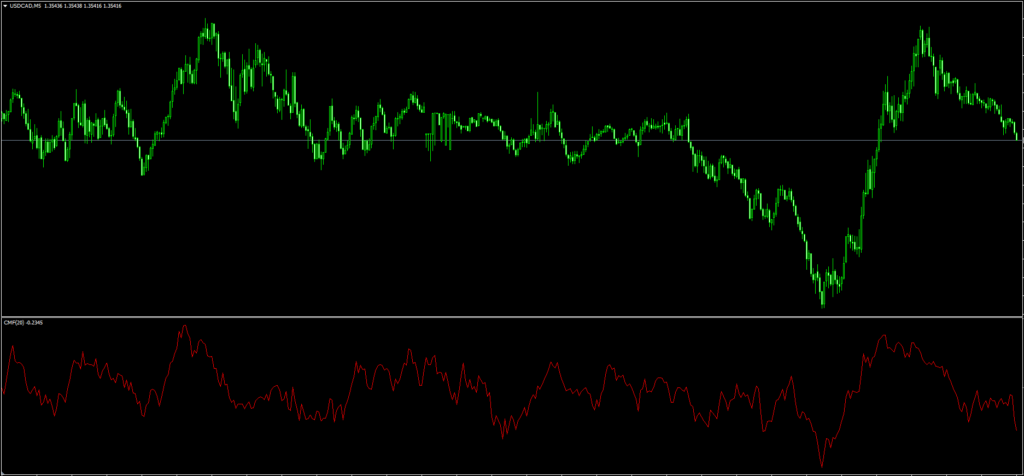

Designed to oscillate between -1 and 1, the CMF Indicator offers clear markers for traders to assess market pressures:

- Positive Territory (Above Zero): The market is characterized by bullish momentum, indicating that buying pressures dominate.

- Negative Territory (Below Zero): This zone indicates bearish momentum, pointing to prevailing selling pressures.

It’s important to understand that, like all technical indicators, the CMF should be used in conjunction with other tools and indicators to make more informed trading decisions. Alone, it may not provide a complete picture of the market conditions.

This Chaikin Money Flow Indicator can be used on any Forex currency pair and other assets such as commodities, Cryptos, Binary Options, Stock markets, Indices, etc. You can also use it on any time frame that suits you best, from the 1-minutes to the Month charts.

Download a Collection of Indicators, Courses, and EA for FREE

How CMF Indicator Used in Forex Trading

CMF Indicator can also be applied to forex trading like it’s used for stocks. Given that the forex market operates 24 hours and is highly liquid, technical indicators like CMF can be particularly helpful. Here’s how traders might use CMF in forex trading:

- Trend Confirmation:

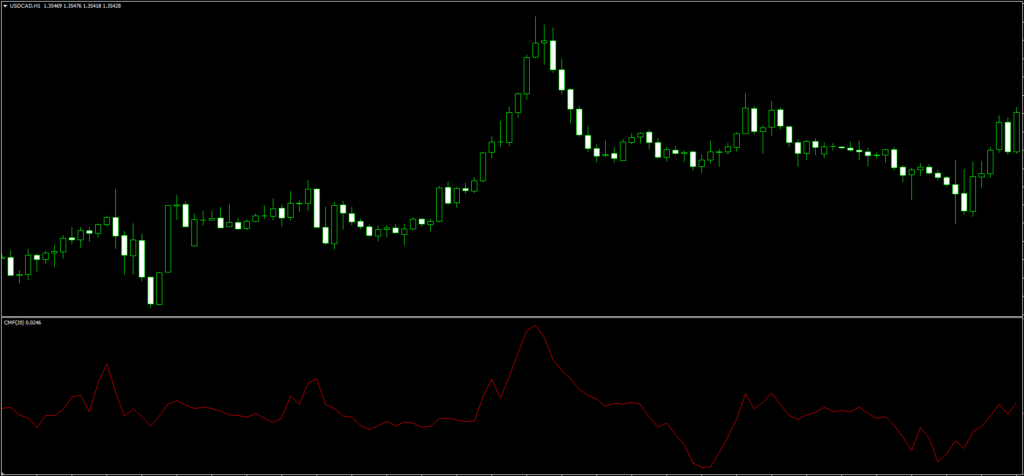

- Positive CMF Values: If the CMF is consistently above zero, this could indicate buying pressure, and the currency pair might be uptrend.

- Negative CMF Values: A CMF consistently below zero might indicate selling pressure, suggesting a potential downtrend.

- Divergences:

- Bullish Divergence: If the currency price is making new lows, but the CMF is moving higher or not making new lows; it may suggest that the selling pressure is waning, and a potential bullish reversal could be imminent.

- Bearish Divergence: Conversely, if the currency price is making new highs, but the CMF is declining or not making new highs, it may indicate decreasing buying pressure and a possible bearish reversal.

- Overbought and Oversold Conditions:

- While Chaikin Money Flow Indicator isn’t traditionally a bounded oscillator like RSI, extreme readings (close to 1 or -1) might suggest temporary overbought or oversold conditions, respectively.

- Breakouts and Breakdowns:

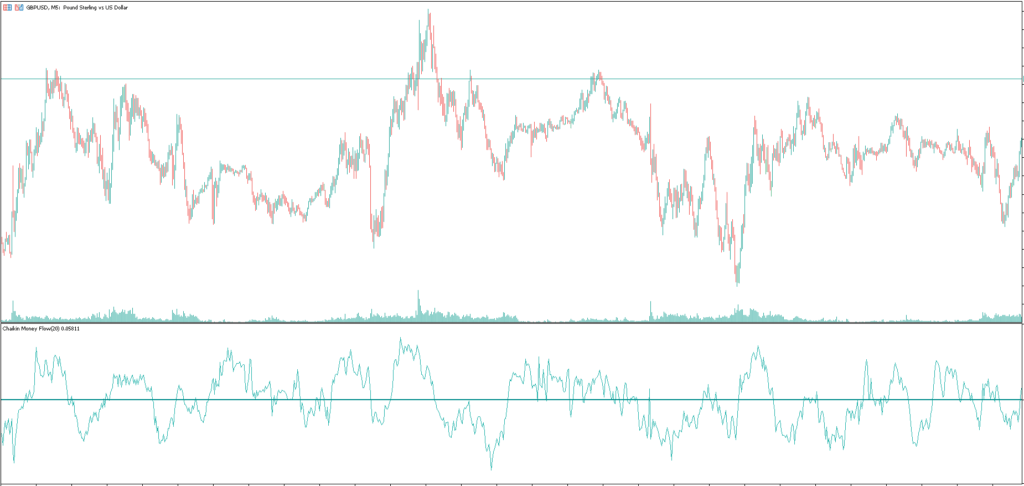

- If a currency pair breaks a key resistance level with a rising CMF, it could validate the breakout as it suggests strong buying pressure.

- Conversely, if a currency pair breaks a key support level with a declining CMF, it could validate the breakdown, signaling strong selling pressure.

- Zero Line Crossovers:

- A crossover above the zero line might be considered a bullish signal, while a crossover below could be bearish. However, frequent crossovers can produce false signals, especially in a ranging market, so they should be used judiciously.

When using CMF Indicator in forex trading, it’s essential to:

- Combined with Other Indicators: CMF should be combined with other technical indicators and tools to provide a more comprehensive analysis. For instance, trend-following tools like moving averages or momentum indicators like RSI can complement CMF.

- Consider Fundamental Analysis: Forex markets can be heavily influenced by macroeconomic data, geopolitical events, and central bank policies. Being aware of such events is crucial as they can overshadow technical signals.

- Use Proper Risk Management: Ensure you have risk management techniques, such as stop-loss orders, to protect your capital against adverse market moves.

- Read More JackPot Elite Strategy MT4 FREE Download

Conclusion

Marc Chaikin’s contribution to technical analysis with the CMF indicator cannot be overstated. Its unique combination of volume and price gives traders a comprehensive view of money flow dynamics. By understanding and harnessing the power of the Chaikin Money Flow Indicator, traders can potentially improve their ability to navigate the ever-changing currents of financial markets.