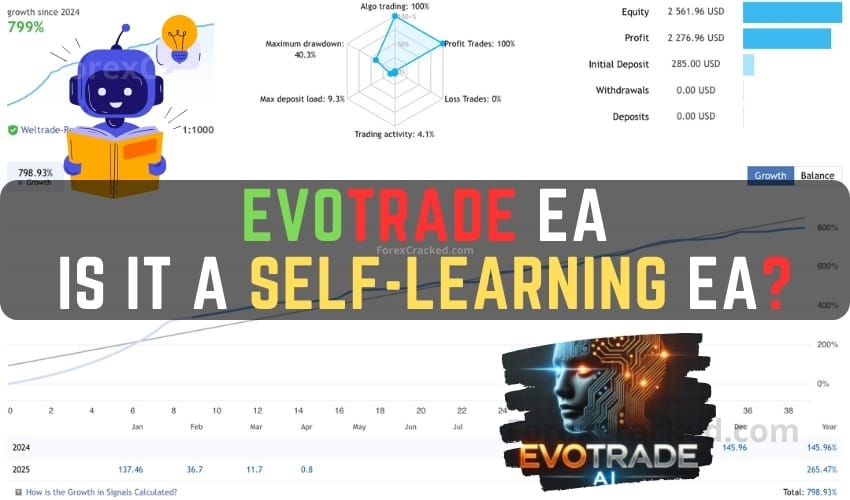

EvoTrade EA has been marketed as a revolutionary self learning EA. With claims of cutting-edge artificial intelligence, deep learning, and real-time market adaptation, it has attracted the attention of both beginner and experienced traders. But does it truly live up to these promises, or is it more of a sophisticated backtesting tool than a Self-Learning trading system? Let’s dig into what EvoTrade EA really offers and examine whether the bold claims hold water.

This touted as the first self-learning trading system in the market, making use of state of the art technologies, including computer vision, data analysis, and neural networks. It is described as a smart EA that learns from each trade, improving its strategies by adjusting take profit and stop loss levels based on constantly changing market conditions.

Here’s a breakdown of the technologies EvoTrade is claimed to include:

- Neural networks such as LSTM and GRU for analyzing historical price data.

- CNN (Convolutional Neural Networks) to detect pattern recognition.

- Proximal Policy Optimization (PPO) and Deep Q-Learning (DQL) for reinforcement learning.

- Natural Language Processing (NLP) to interpret economic news and market sentiment.

- Genetic algorithms to optimize trading parameters across thousands of simulated scenarios.

- Explainable AI (XAI) for transparency in decision making.

With so many advanced technologies mentioned, EvoTrade EA positions itself as more than just a typical rule based EA, it’s implied to be a fully adaptive machine.

Key Features of this Self Learning EA

According to its description, Self Learning EA offers several notable features:

- Self-updating strategy based on trade results

- Deep data analysis for pattern recognition

- Automatically adjusts lot sizes based on risk

- Easy to install with preset configurations

- Support for multiple brokers and account types

- Transparent backtests with real trading condition simulations

On the surface, It promises a lot. For traders, that can be appealing especially to those looking for a more passive, data driven trading solution.

Please test in a demo account for at least a week first. Then, please familiarize yourself with and understand how this EvoTrade Robot works and only use it in a real account.

Recommendations for EvoTrade EA

- Minimum account balance of 100$.

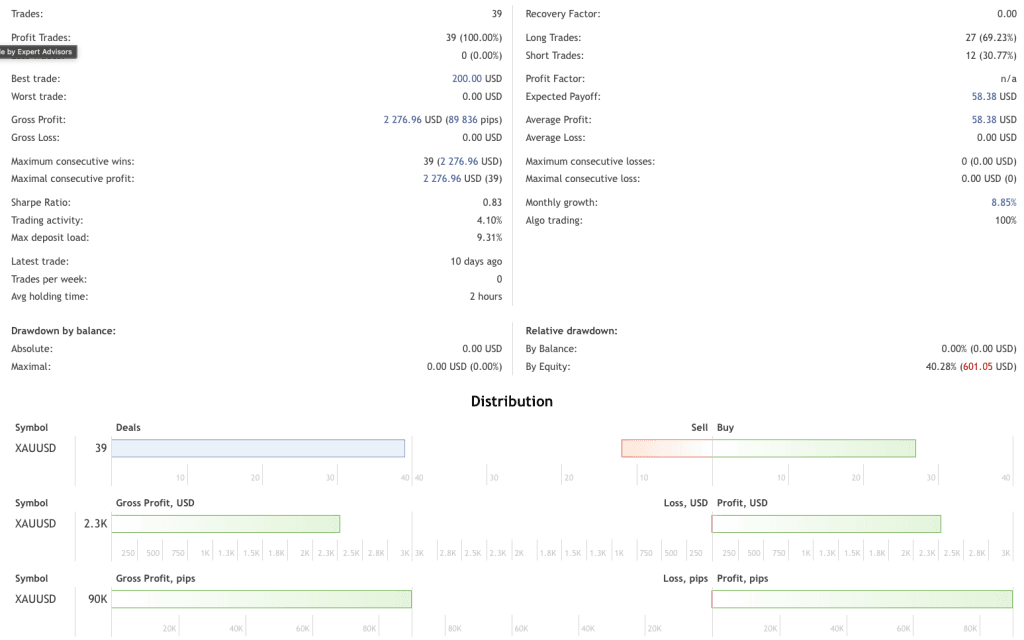

- Works best on XAUUSD. (Work on any Pair)

- Work best on H1 TimeFrame. (Work on any TimeFrame)

- EvoTrade EA should work on VPS without interruption and low latency to reach stable results. So we recommend running this Self Learning EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- Low Spread account is also Recommended (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Is It a Self-Learning Trading System?

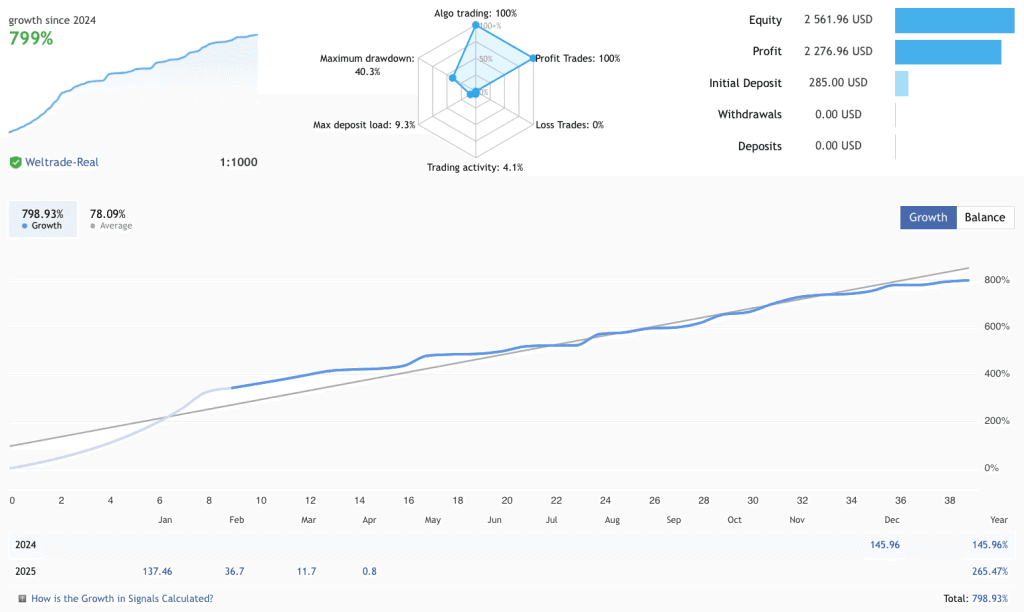

Despite the technical jargon and bold advertising, EvoTrade may not be the self-learning trading system it’s marketed as.

Let’s break this down:

- While it refers to technology like LSTM, PPO, CNN, and GPT, there’s no concrete evidence that the EA actively trains or evolves using real-time data autonomously. Without real-time retraining mechanisms or user-accessible logs showing continuous learning, it’s debatable whether this is genuinely adaptive in practice.

- The EA’s file size is over 1MB, suggests it could contain a vast amount of embedded historical data. This may account for strong backtesting performance but also can raises concerns about overfitting. In other words, it might “memorize” past market conditions instead of learning to handle new, unseen scenarios.

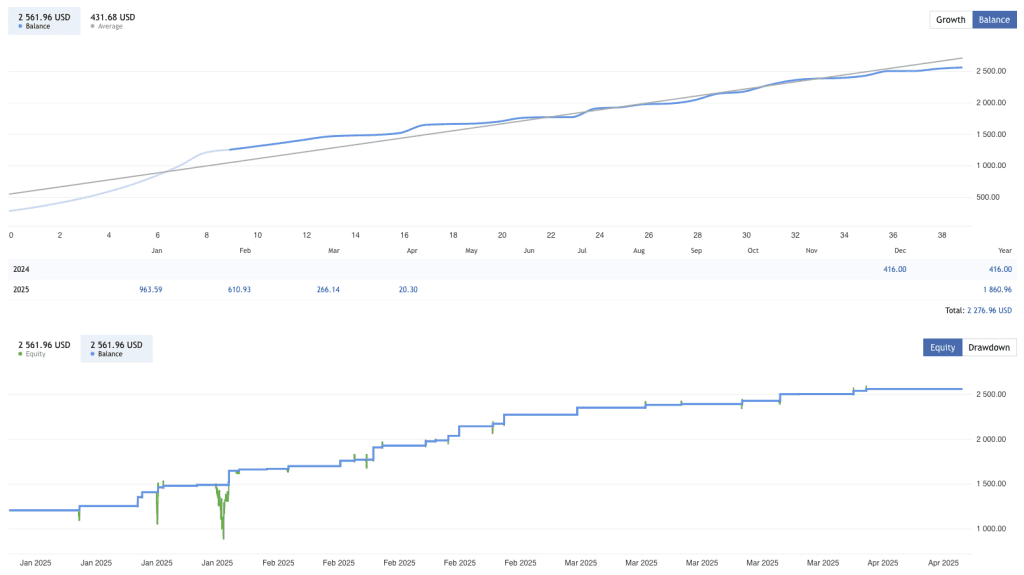

- Performance reviews show that while EA performed impressively up to its release date, more recent backtests beyond that timeframe indicate declining performance metrics.

This implies that, while possibly well optimized for past data, may struggle in adapting to new market realities. Rather than learning in real time, it could be relying on pre coded logic that works within limited market environments but fails in evolving ones.

Thus, while EvoTrade incorporates a lot of AI-related buzzwords, there’s little proof that the so called self learning happens after the EA is deployed on live markets. This EA is most likely a scam. If you’re interested in testing it for yourself, you can do so from below.

Conclusion

EvoTrade EA certainly looks like an advanced and well constructed trading robot. It may employ sophisticated methods to parse large datasets and produce favorable backtest results. However, the claim of it being a true self-learning trading system is questionable.

As always with expert advisors, it’s recommended to test the EA in demo environments and stay updated with third party reviews before committing to live funds.

Qual a versão?

is possible that every Ea works better on gold h1 timeframe ?

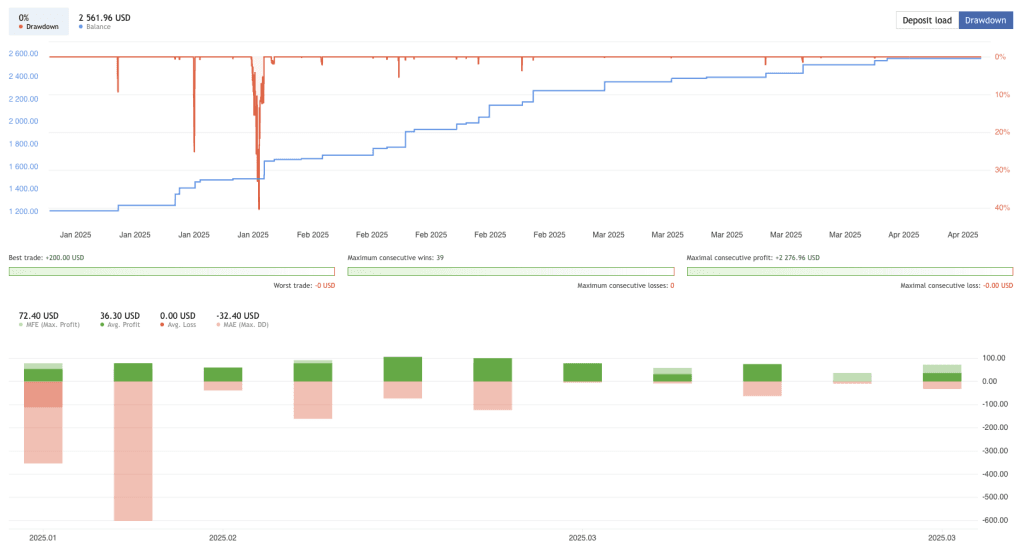

Watch out from its backtesting results! This EA operates similarly to CyNera and Alpha—where consistent profits can quickly be wiped out by just one or two stop-losses. From observation, it appears the strategy relies on overbought and oversold signals, along with day breakout patterns, to trigger position entries. Use with caution, especially in volatile conditions.

Too many EA in the name of AI but after I used some of those i can say they are all follow some pattern to excute the trade. They took TP like 10pips but SL 1000pips that why they rarely hit sl but when they do it will or almost wipeout your capital

what are the best Ea’s in yuor opinion ?

I agree with you—many EAs today claim to use AI or machine learning, but in reality, most still rely on traditional entry signals. Indicators like RSI, CCI, and ATR are commonly used to confirm overbought and oversold conditions. What’s noticeably lacking is transparency—none of these systems clearly explain how AI, such as ChatGPT is actually integrated into their trading logic. Additionally, many of them target small TP, which are relatively easy to capture with XAUUSD. However, when the market moves against the position, the large SL can quickly blow an account.