The TDI Bounce Forex Scalping Strategy leverages the Trader’s Dynamic Index (TDI), an all-in-one indicator that combines multiple technical tools, including the Bollinger Bands, RSI, and moving averages. The TDI Bounce strategy focuses on trading market reversals by observing how the RSI interacts with the moving average in the TDI window. This strategy helps traders capitalize on short-term price bounces, making it ideal for scalping.

Understanding the TDI Indicator Components

The TDI Indicator has several components:

- Bollinger Bands (Blue and Yellow lines): Indicate market volatility and overbought/oversold conditions.

- RSI (Green Line): Mimics price movement and helps identify potential market reversals.

- Moving Average (Red Line): Represents the overall trend direction.

In the TDI Bounce Forex Scalping strategy, instead of waiting for all signals to align as in the traditional TDI strategy, we focus on the RSI line bouncing off the moving average, which indicates a continuation of the current trend after a minor pullback.

Trading Concept: RSI Bounce off the Moving Average

The RSI line often reflects price action movements and the moving average acts as a dynamic support or resistance level. Instead of waiting for a crossover between the RSI and the moving average, this strategy capitalizes on RSI bouncing off the moving average. The idea is to enter a trade after the RSI bounces back, confirming the direction of the trend.

Buy Setup: Entry, Stop Loss, Exit

Entry:

- The RSI line (Green) must be above the moving average line (Red).

- After the RSI curls down, please wait for it to bounce back up without crossing the red line.

- Enter a buy trade as soon as the RSI points upwards again at the close of the candle.

Stop Loss:

- Set the stop loss a few pips below the most recent minor swing low.

Exit:

- Close the trade as soon as the RSI curls down again at the close of the candle.

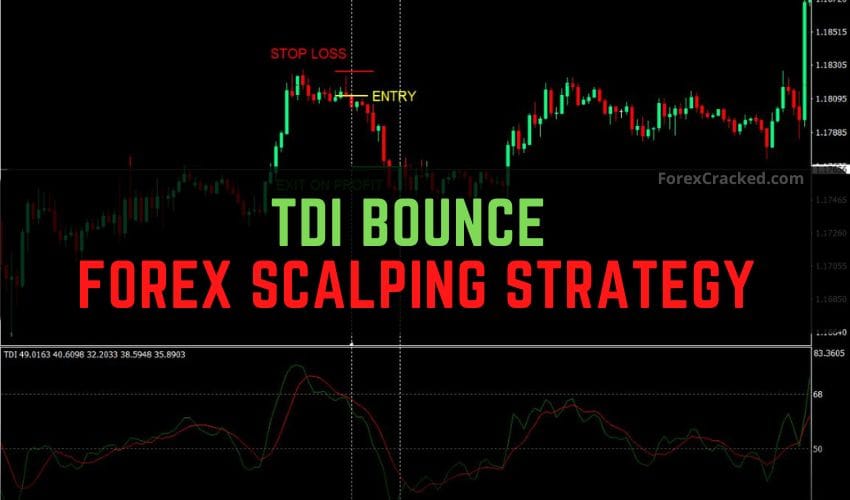

Example Buy Trade

In the example shown, the RSI line crossed above the moving average, signaling a potential uptrend. After a brief downward curl, the RSI bounced back up, confirming the upward movement. The stop loss was set below the minor swing low, risking ten pips. The price rallied, and the trade was closed for a 61-pip profit, resulting in a 1:6 risk-reward ratio.

Sell Setup: Entry, Stop Loss, Exit

Entry:

- The RSI line (Green) must be below the moving average line (Red).

- After curling up, wait for the RSI to bounce back down without crossing above the red line.

- Enter a sell trade when the RSI starts pointing downwards again at the close of the candle.

Stop Loss:

- Place the stop loss a few pips above the most recent minor swing high.

Exit:

- Close the trade when the RSI curls back up at the close of the candle.

Example Sell Trade

In this scenario, the RSI line stayed below the moving average, confirming a bearish trend. After briefly curling upward, it resumed its downward movement, confirming the sell signal. The stop loss was placed just above the previous swing high, risking 15 pips. The trade was exited at a 45-pip profit, achieving a 1:3 risk-reward ratio.

Download a Collection of Indicators, Courses, and EA for FREE

Advantages of the TDI Bounce Forex Scalping Strategy

- Early Trade Entries: The bounce setup allows for early trade entries without waiting for full crossovers, enabling traders to catch minor pullbacks within a trend.

- Low Risk: This strategy minimizes risk by placing stop-loss orders near recent swing highs or lows, often with a high reward-to-risk ratio.

- Responsive to Price Movements: The TDI’s RSI closely mirrors price action, helping traders respond quickly to shifts in market momentum.

- Scalping Potential: This strategy is perfect for short-term scalping, allowing traders to profit from slight fluctuations in trending markets.

Limitations of the Strategy

- Ineffective in Ranging Markets: This strategy works best in trending markets where price bounces off the moving average. The price might fluctuate too much in a ranging or sideways market, causing false signals.

- Requires Discipline: Scalping strategies demand strict adherence to entry and exit points. Traders must monitor the market closely and be ready to act quickly.

Free Download TDI Bounce Scalping Forex Trading Strategy

Read More Best Scalping Forex Indicator MT4 Free Download

Conclusion

The TDI Bounce Forex Scalping Strategy is a powerful tool for traders looking to capitalize on minor retracements in trending markets. By focusing on the RSI’s bounce off the moving average, this strategy offers early entries into trades with minimal risk. It is best suited for scalping in high-volatility conditions. However, traders should be cautious when applying this strategy in sideways or ranging markets, as it may lead to false signals. This strategy is an excellent addition to any scalper’s toolkit, especially when combined with proper risk management.