![Volatility Factor EA – [Cost $347]- For FREE](https://www.forexcracked.com/wp-content/uploads/2020/04/3-1-1024x437.png)

- Currency pairs: EURUSD, GBPUSD, USDJPY, USDCHF

- Trading Time: Around the clock

- Timeframe: M15

Volatility Factor EA 17 Years of Testing

Volatility Factor EA 2.0 was tested during the worst global financial crisis since the Great Depression.

This period saw wild gyrations within the currency markets and unpredictable “black swan” events that tested the worldwide economic system.

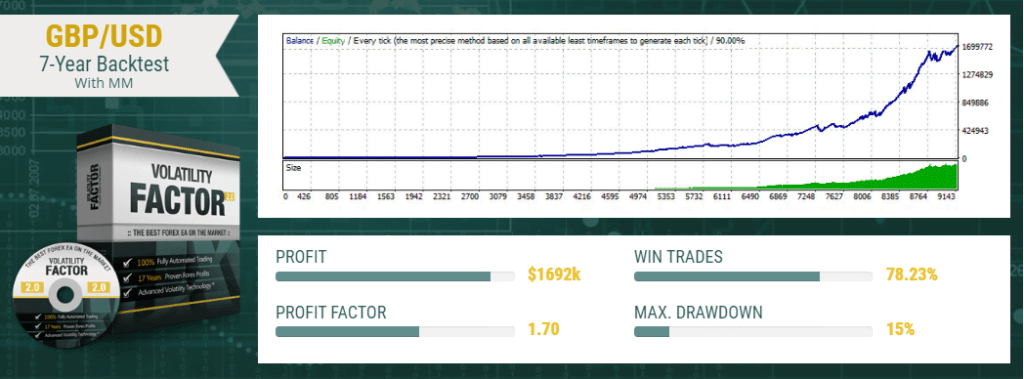

In testing, Volatility Factor 2.0 delivered an over 75% win rate during a 17-year period, with a profit factor on the brink of 1.60!

It’s consistently turned a profit during that point and continues to get incredible returns today.

Below, you can see rigorous data going back 17 years – as well as our latest, live money account, updated in real-time.

A Quick Introduction to Volatility-Based Trading

The best Forex trading strategy is balanced drawing on specific tactics to take advantage of market volatility and market trend. We call this Volatility-Based Trading.

This strategy generally trades within the direction of the market. This helps minimize risk and puts you in the middle of the action. In isolated cases, the strategy involves taking limited positions in anticipation of a correction.

As a whole, Volatility Based Trading takes advantage of the prevailing market direction and maximizes profit opportunities while minimizing risk. The strategy routinely delivers profits since most of the trades are within the direction of the main market impulse. Entry and exit points are calculated in relation to plug volatility borders.

How Volatility Factor Turns Volatility-Based Trading Into A Consistently Profitable Strategy

Volatility Factor is a specialized EA designed to deliver 10-15+ pips per trade. It is supported by a really powerful volatility-based market algorithm that has been put through A battery of real-world tests. It has passed every test and has an impressive win rate.

How it works

![Volatility Factor EA – [Cost $347]- For FREE](https://www.forexcracked.com/wp-content/uploads/2020/04/2-2.png)

Input Parameters

![Volatility Factor EA – [Cost $347]- For FREE](https://www.forexcracked.com/wp-content/uploads/2020/04/4-2.png)

- Magic – advisor ID

- EA_Comment – comment on Volatility Factor deals

- Signal_1 (2, 3, 4) – true/false four signals of the EA`s strategy

- MaxSpread – the maximum allowed spread value for opening deals. Recommended values: for GBPUSD = 3.5, for EURUSD = 2.5

- Slippage – maximum allowable slippage in pips

- NFA – function for traders registered in the USA

- AutoGMT_Offset – GMT offset for the broker, automatically detected

- ManualGMT_Offset – GMT offset for the broker, manually installed

- DST_Usage – enable this parameter (set to true) for the US summertime period

- BetterPricePips – the minimum step in the old pips (4 digits after the decimal point) to open subsequent positions. If it is 0, then the default parameters from the EA code are used (15 pips for GBPUSD and 6 for EURUSD)

- MaxNegAdds – the number of open additional deals when leaving an open transaction in the opposite direction

- ForceProfit – total Take Profit (in pips) to close the basket of deals. If it is 0, the default parameters from the expert code are used and displayed in the info window on the chart

- ForceLoss – total Stop Loss (in pips), upon reaching which all trades will be closed. If it is 0, the default parameters from the expert code are used and are displayed in the info window on the chart

- FixedTakeProfit, FixedStopLoss – the function of manually setting fixed Take Profit and Stop Loss for each transaction

- RecoveryMode – when this option is enabled, after a losing t trade, the adviser will trade with an increased lot size until losses are restored

- FixedLots – a fixed trading lot for each deal. This setting does not work if AutoMM> 0

- AutoMM – Money Management, to automatically determine the lot size based on the exposure

It is activated if the value is greater than 0. If the value is 1, the lot will be used based on the formula 0.01 lots for every $1000 in the account. With a value of 10, a lot will be used based on the formula of 0.01 lot for every $100 in the account, etc. Recommended value for AutoMM = 1.5 and below.

- AutoMM_Max – fuse limiter for AutoMM parameter in combination with recovery mode

Volatility Factor’s algorithm watches the market closely and initiates trades that maximize market volatility. Volatility Factor’s power comes from its lightning-fast reaction and leveraging of the market’s direction.

- You’ll profit with Volatility think about up, down, and stagnating markets.

- You can actively trade in ANY market.

- You won’t have to wait for the “right” trend. You won’t need to worry about selecting the precise correct entry price.

- Volatility Factor does the heavy lifting for you.

When Volatility Factor 2.0 sees a movement in one direction, most of the time it signals trades within the direction of the medium-term market impulse.

It uses powerful and sensitive money management rules to protect risk on the trade until it’s exited. With leverage, returns on this strategy are magnified.

Volatility Factor 2.0 also takes advantage of pricing oscillations around a prevailing price point, continuing to deposit gains in your trading account.

Volatility Factor stands out from the competition because it uses market psychology to take advantage of existing marketing conditions.

Volatility Factor averages approximately 1,000 trades per year: it’s fairly active because it thrives on the volatility of the market place – and across all trades, it’s averaged 10+ pips profit per transaction.

![Volatility Factor EA – [Cost $347]- For FREE](https://www.forexcracked.com/wp-content/uploads/2020/04/5-2-920x500.png)

Dear Sir,

I have seen EAs here which are very good. Can I use this eas on real account? Will it run as run on demo account?

I don’t see the link

Where is the download link?, Email the volatility factor ea to me please

Please enable the download link, this is not a link.

No download Link found here!

[…] this version of Volatility Quality Zero Line is made to oscillate around the zero line (which makes the potential levels, which […]