Asian Breakout System is an Asian Session High Low Breakout Trading System. AHAL (Asian High Asian Low) strategy has emerged as a popular choice for its simplicity and potential profitability. This daily scalping trading method discards traditional trading tools such as Fibonacci retracements, trend lines, chart patterns, and oscillators, favoring a more straightforward approach. This system can be adapted and modified to include personalized trading rules.

Understanding the AHAL Breakout Strategy

The bedrock of the AHAL strategy is identifying the highest (Asian High) and the lowest (Asian Low) price points during the Asian trading session. To do this, traders chart lines marking the extreme price points between 21:00 GMT and 06:00 GMT, the standard time frame for the Asian trading session. By 06:00 GMT, traders can conclusively establish the Asian High and Low of the day.

The breakout trading system is built around the anticipation that the price of an asset will move significantly in either direction, especially after being confined within a relatively narrow price range. The AHAL method sits squarely within this system, utilizing the High and Low of the Asian session to predict potential breakouts during subsequent trading sessions.

Once the Asian High and Low are identified, traders can use these points to mark potential breakouts during the European or American trading sessions. The underlying presumption here is that significant price movements are likely to occur once the price of an asset moves beyond the High or falls below the Low established during the Asian session.

Leveraging AHAL for Profitable Trades

Traders utilizing the AHAL method usually place buy orders just above the Asian High and sell orders just below the Asian Low. The logic behind this strategy is that if the price breaks out of the established range, a strong trend (upward or downward) is likely to follow.

A buy order above the Asian High anticipates a bullish trend, while a sell order below the Asian Low predicts a bearish trend. This provides an opportunity for traders to capitalize on substantial price movements that could potentially result in profitable trades.

This Asian Breakout System is entirely manual. The indicators produce the signals, but any decisions to enter the market and set protection or profitable exit stops will depend on the trader. Therefore, the trader must be familiar with the principles of risk and reward and use initial support and resistance areas to set entries and exits.

AHAL System can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

Breakout Trading System can be used on any Forex currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. You can also use it on any time frame that suits you best, from the 1-minute through to the 1-month charts.

Risk Management in this Breakout Trading System

While the AHAL method has proven profitable for many traders, it is not without risk, like any trading strategy. A critical aspect of managing this risk is properly setting stop-loss orders. In this case, stop-loss orders are typically set just below the Asian High for buy orders and just above the Asian Low for sell orders. This strategy helps limit potential losses if the price unexpectedly reverses after the breakout.

Download a Collection of Indicators, Courses, and EA for FREE

Trading Rules for Asian Breakout System

Remember to tighten your Stop Losses around High Impact News Releases or avoid trading at least 15 minutes before and after these events when using this Asian Breakout System.

As always, to achieve good results, remember about proper money management. To be a profitable trader, you must master discipline, emotions, and psychology. It is crucial to know when and when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility, beyond major sessions, exotic currency pairs, wider spread, etc.

Setup for Entry and Exit

- Work best on GBPUSD. It also works on all other pairs, but try it out with different SL and TP.

- Use 55 EMA to spot high-probability trades, thus avoiding entering any positions against the trend. Identify the trend using the EMA on the hourly chart, then switch to M5 TimeFrame to enter either buy at the Asian High or sell order at Asian Low.

- You must adjust trading session times to match your broker server time in the input parameters. Default settings are for GMT 2+. (which is the default on most brokers)

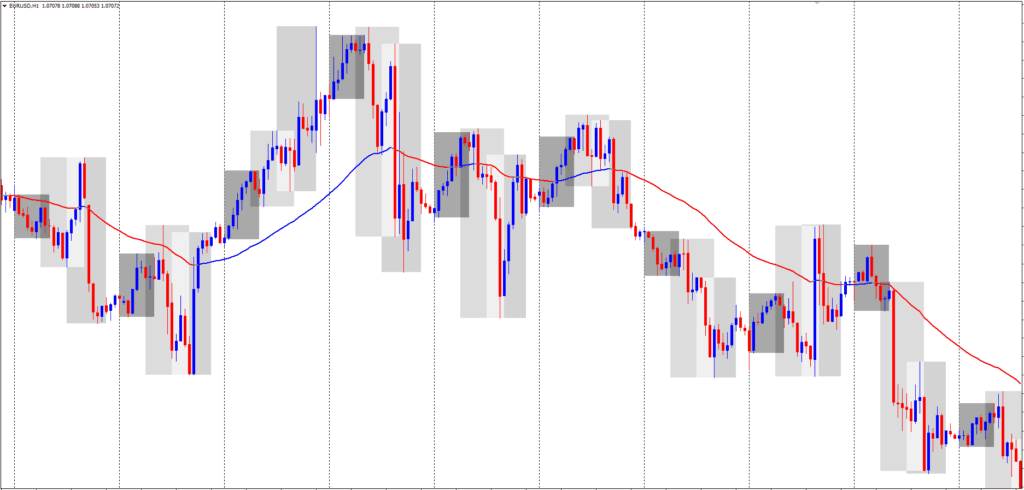

- Dark Gray Box – the Asian session

- Medium Gray Box – the European Session

- Light Gray Box – the America session

Buy Entry

- 55 EMA on the hourly chart is in uptrend mode. (EMA is blue with price above the EMA)

- Place a pending buy order at the Asian High.

- Set the stop-loss 30 pips below the Asian High.

- Set the first targeted profit at 15 pips.

- Set the second target profit at the next mid-pivot price level or the next pivot point.

- Auto Pivot Points Indicator MT4/MT5 FREE Download

- Move the stop-loss to break even after the first target profit is hit.

- Exit the second trade if an M5 candle close lower than the nearest pivot point.

Sell Entry

- 55 EMA on the hourly chart is in downtrend mode. (H1 EMA is red with price below the EMA)

- Place a pending sell order at the Asian low.

- Set the stop-loss 30 pips above the Asian low.

- Set the first targeted profit at 15 pips.

- Set the second target profit at the next mid-pivot price level or the next pivot point.

- Move the stop-loss to break even after the first target profit is hit.

- Exit the second trade if an M5 candle close higher than the nearest pivot point.

Conclusion of AHAL System

The AHAL System is a relatively simple yet effective trading strategy, allowing traders to leverage price movements outside the established Asian High and Low. While it discards many conventional trading tools, its simplicity and potential for profitability make it an appealing option for both new and experienced traders. However, as with any investment strategy, thorough understanding, careful implementation, and thoughtful risk management are vital to success.