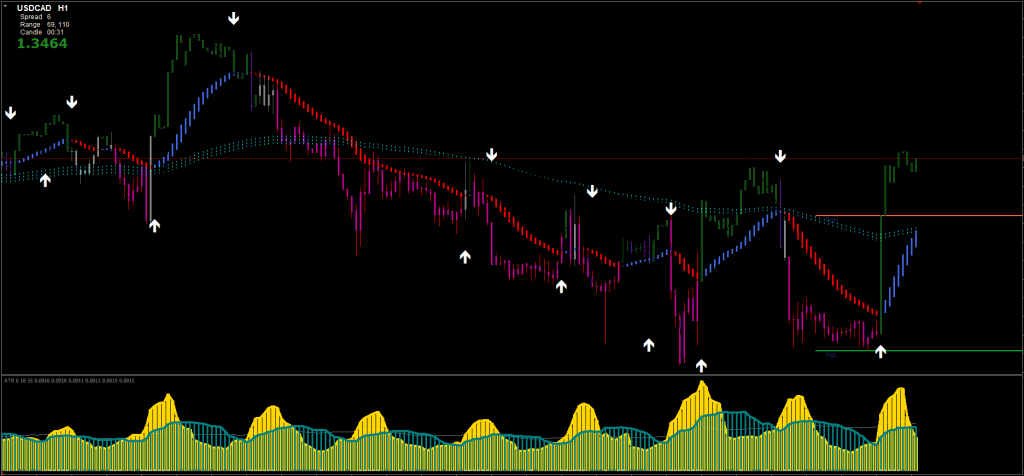

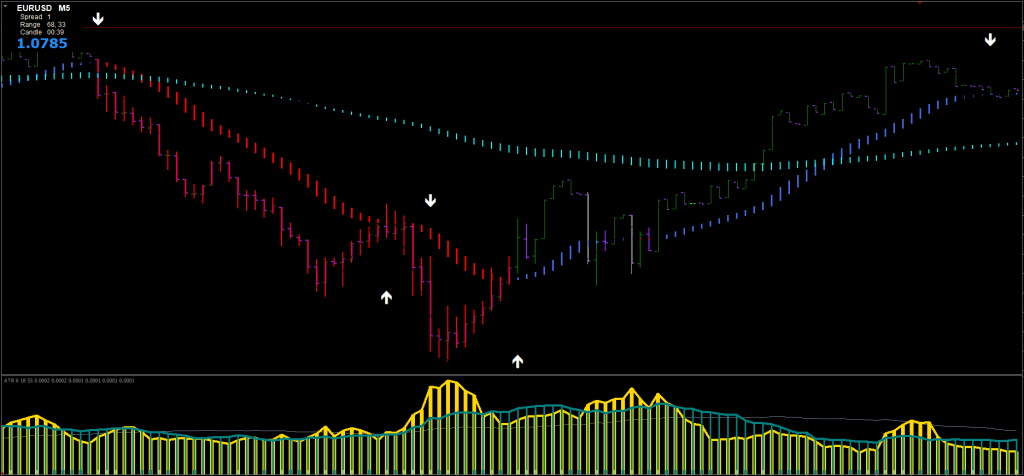

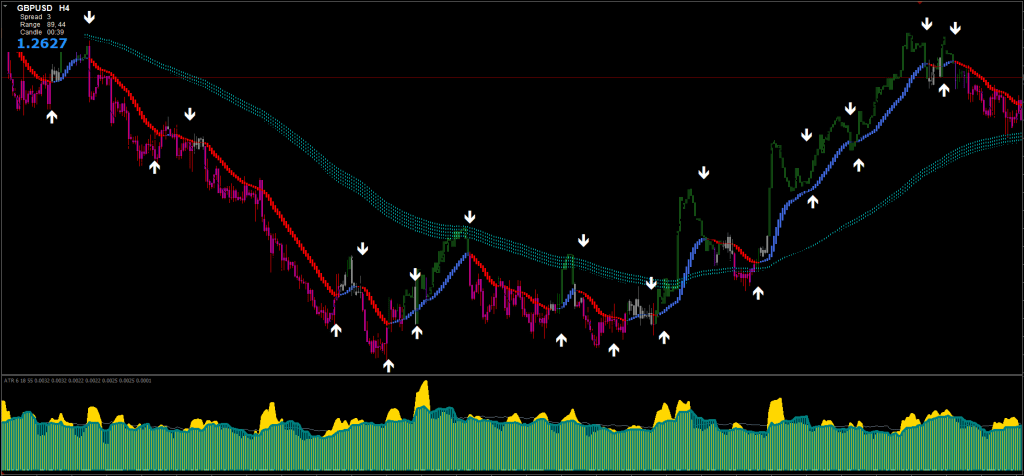

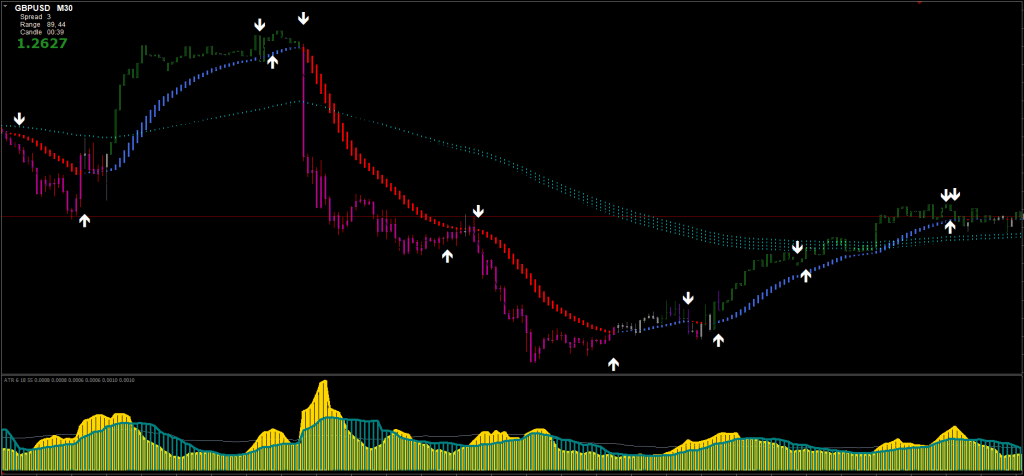

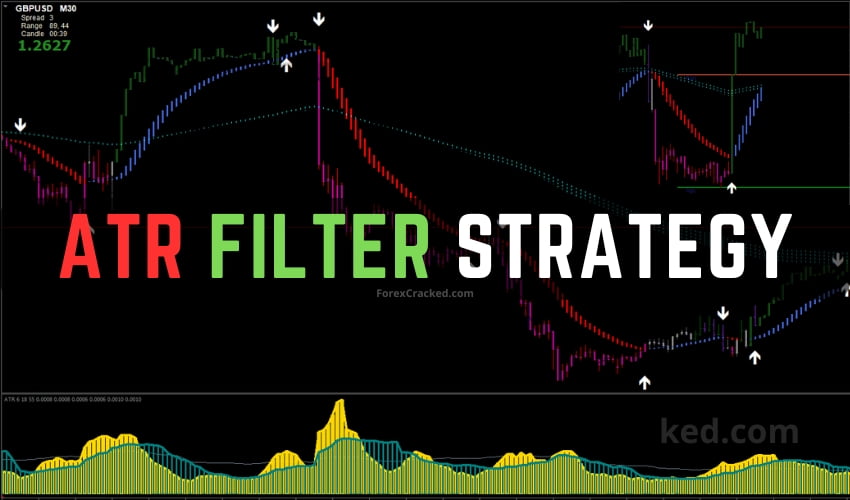

This ATR Filter Strategy leverages a customized Average True Range (ATR) indicator designed to measure market volatility. It integrates it with trend-following indicators to filter and enhance trading signals.

The ATR Mastic is the customized indicator mentioned above. It is a specialized indicator that enhances the traditional ATR by incorporating two distinct histograms: the ATR fast and the ATR slow. This dual-histogram approach allows traders to gauge market volatility with greater accuracy. When the ATR fast histogram surpasses the slow histogram, it signals favorable market volatility conditions, making it an opportune time to consider market entry. The versatility of the ATR Mastic extends beyond the ATR Filter Strategy, as it can be effectively integrated into other trend-following strategies or used as a filter alongside various trend indicators.

This ATR Filter Strategy is entirely manual. The indicators produce the signals, but any decisions to enter the market and set protection or profitable exit stops will depend on the trader. Therefore, the trader must be familiar with the principles of risk and reward and use initial support and resistance areas to set entries and exits.

This ATR Indicator can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

You can set ATR Filter System to send you a signal alert. This is helpful as it means you do not need to stare at the charts all day, waiting for signals to appear, and you can monitor multiple charts simultaneously.

This ATR Filter Strategy can be used on any currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. You can also use it on any time frame that suits you best, from the 1-minute to the 1-month charts.

Download a Collection of Indicators, Courses, and EA for FREE

Trading rules for ATR Filter Strategy

Remember to tighten your Stop Losses around High Impact News Releases or avoid trading at least 15 minutes before and after these events when using this ATR Filter Strategy.

As always, to achieve good results, remember about proper money management. To be a profitable trader, you must master discipline, emotions, and psychology. It is crucial to know when and when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility, beyond major sessions, exotic currency pairs, wider spread, etc.

Buy

- Ensure the price is above the Trender H indicator, confirming a bullish trend.

- Optionally, the price should be above the Begashole trend indicator for added confirmation.

- Look for the Barbarian buy arrow, indicating a potential upward movement.

- The ATR Mastic Sc should display a green paint bar, signaling bullish market conditions.

- The gold histogram of the ATR Mastic A should be greater than the blue histogram, reinforcing the buy signal.

Sell

- Ensure the price is below the Trender H indicator, confirming a bearish trend.

- Optionally, the price should be below the Begashole trend indicator for additional verification.

- Look for Barbarian sell arrow, indicating a potential downward movement.

- The ATR Mastic Sc should display a red paint bar, signaling bearish market conditions.

- The gold histogram of the ATR Mastic A should surpass the blue histogram, validating the sell signal.

Exit Strategy

Exiting at the right moment is crucial, and this Free Forex Strategy provides clear guidelines for this:

- Place the initial stop loss above or below the previous swing high or low, providing a safety net against market reversals.

- Aim for a profit target with a stop loss ratio of 1:1.18, balancing risk and reward efficiently.

- Consider securing profits by setting a modest profit target, thereby enhancing the strategy’s profitability through strategic stop loss placement.

- Read More Ind Scalper Forex EA FREE Download

Conclusion

By leveraging the ATR Mastic indicator, traders can identify high-probability entry points supported by a clear framework for managing exits and mitigating risk. As with any trading strategy, success requires practice, discipline, and a thorough understanding of market dynamics. The ATR Filter Strategy, with its focus on volatility and trends, presents a compelling option for traders seeking to optimize their trading outcomes in the ever-changing landscape of the financial markets.

Thanks will test it