The Best Currency Strength Meter stands out due to its unique features and advanced capabilities. This article provides an in-depth review of this indicator, highlighting its key functionalities and the advantages it offers to traders.

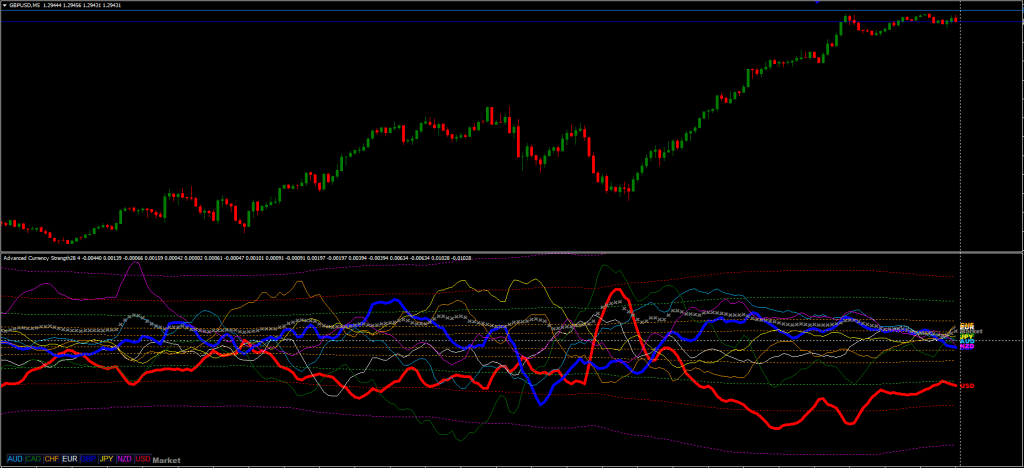

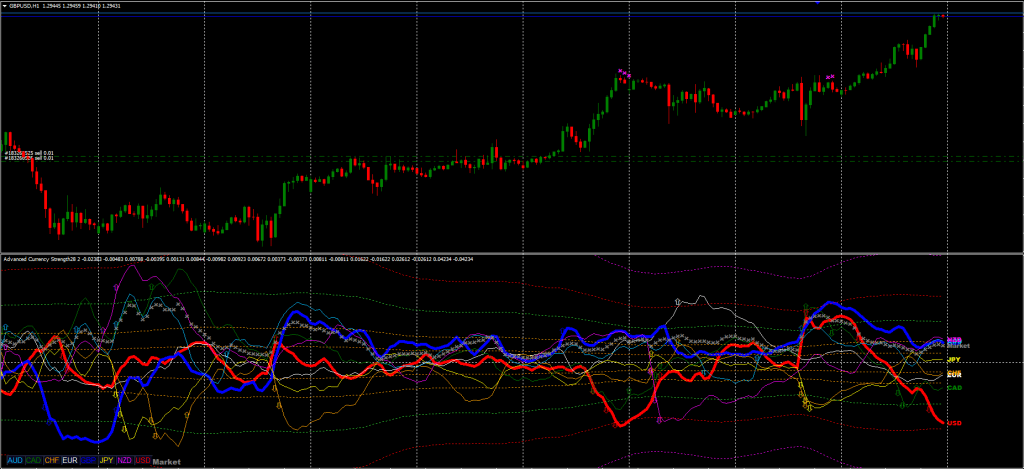

Currency Strength Indicator is a sophisticated trading tool that allows traders to monitor the strength of various currencies within the Forex market. This indicator is particularly notable for its ability to display currency strength for 28 Forex pairs on a single chart, streamlining the analysis process for traders who manage multiple pairs simultaneously.

One of the distinguishing features of this indicator is its multi-timeframe functionality. This allows traders to quickly assess the trend across different timeframes, making it easier to identify both short-term and long-term trading opportunities. The currency strength lines are designed to be smooth and consistent across all timeframes, enhancing the accuracy of trend identification and enabling precise entry points.

Key Features and Functionality of Currency Strength Indicator

The Best Currency Strength Indicator is built on advanced algorithms that provide a robust trade identification and confirmation framework. Here are some of the key features that make this indicator a valuable tool for Forex traders:

- Multi-Timeframe Analysis: The indicator supports multi-timeframe analysis, allowing traders to customize their charts according to their preferred timeframes. Each timeframe is optimized independently, ensuring the indicator’s readings are accurate and relevant for different trading strategies.

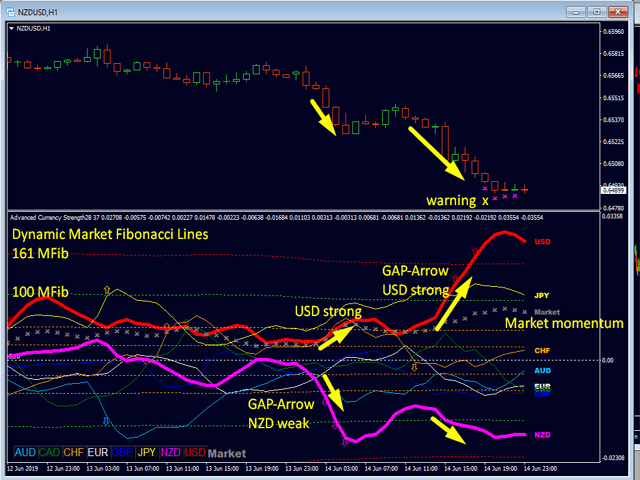

- Dynamic Market Fibonacci Levels: One of the standout features of this indicator is the application of Dynamic Market Fibonacci Levels. These levels adapt to current market activity, providing traders with a more responsive and accurate measure of market conditions. This dynamic adjustment helps in identifying critical points in the market where potential reversals or continuations might occur.

- Market Momentum Line: The indicator introduces a Market Momentum line, which serves as an additional tool to gauge the strength or weakness of a currency. This feature is particularly useful for traders looking to confirm the direction of a trend or spot potential trade opportunities based on momentum shifts.

- Visual Alerts and Indicators: The Currency Strength Meter Indicator includes several visual alerts, such as arrows indicating strong currency momentum gaps, warnings for overbought or oversold conditions, and alerts for potential pullbacks or reversals. These visual cues help traders make more informed decisions by highlighting key market conditions.

- User-Friendly Interface: The indicator is designed for ease of use. It features buttons for quick chart changes, automated support charts to enhance broker feed speed, and reduced data calls from external pairs, which helps maintain the trading platform’s efficiency.

This currency strength indicator isn’t a standalone trading indicator System. Still, it can be very useful for your trading as an additional chart analysis, for finding trade exit positions (TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

Download a Collection of Indicators, Courses, and EA for FREE

Practical Applications of Currency Strength Meter

The Currency Strength Meter Indicator is highly versatile and can be used in various trading strategies. Its ability to adapt to different timeframes and market conditions makes it suitable for both trend-following strategies and counter-trend trading. The indicator’s dynamic features, such as the Market Fibonacci Levels and Market Momentum, allow traders to choose whether to trade with the trend, look for trend continuations, or anticipate pullbacks.

This indicator helps identify the strongest and weakest currencies by graphically displaying their strengths and weaknesses over time and provides insights into the best times to enter and exit trades. This can be particularly beneficial in avoiding trades during periods of low volatility or when a currency is nearing a reversal.

Conclusion

The Best Currency Strength Meter Indicator offers a comprehensive and advanced toolset for Forex traders. Its unique combination of multi-timeframe analysis, dynamic market adaptations, and visual alerts makes it a powerful addition to any trader’s toolkit. Whether you are a beginner looking to enhance your trading strategy or an experienced trader seeking more precise entry and exit points, this currency strength indicator provides the tools necessary to make more informed and strategic decisions in the Forex market.

Can you do the one that has GOLD? Currency Strength Exotics to be exact

Currency Strength Exotics please dear…