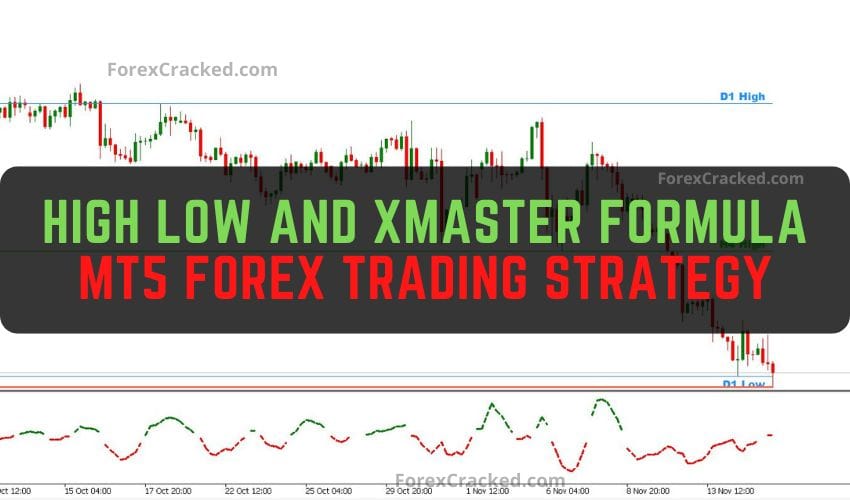

As forex traders, we’re always looking for that edge, which helps us get in at the right time and out before the market turns against us. The Custom High Low and Xmaster Formula Strategy is one of those setups that combines simple logic with powerful tools. It’s all about identifying key price levels and using reliable signals to time your trades. Let me walk you through how it works.

What’s the Deal with the Custom High Low Indicator?

This is your go-to tool for spotting support and resistance levels. Unlike standard indicators, the Custom High Low lets you adjust its timeframe to calculate the highest highs and lowest lows. This is great because you can set it up for short-term trades or zoom out for swing trades.

Here’s how you use it:

- Support Levels: The price tends to bounce back up in these areas.

- Resistance Levels: These are zones where the price often reverses and heads down.

It’s simple but effective. When the price gets close to these levels, that’s your first clue to start looking for a trade.

The Xmaster Formula Indicator: A Signal You Can Trust

The Xmaster Formula does the heavy lifting. It combines technical indicators, moving averages, oscillators, trend lines, and clear buy-and-sell signals. It’s great for confirming momentum, which is key to solid trades.

What I like about the Xmaster Formula is how it simplifies everything. Instead of juggling so many indicators, you get a unified signal. Green for buy, red for sell. Easy.

How It All Comes Together

Now, let’s talk about how to use these tools together. The idea is to spot key levels with the Custom High Low Indicator and then wait for the Xmaster Formula to confirm the move. Here’s how to set it up for both buy and sell trades.

Buy Setup (Going Long)

- Find the Support Level: Watch for the Custom High Low Indicator to mark a significant support level. This is where the price has previously bounced.

- Wait for Confirmation: Check the Xmaster Formula. If it gives you a green signal, you’re looking at bullish momentum, exactly what you want.

- Enter the Trade: Enter your buy trade when the price breaks above the identified support level. This confirms that buyers are stepping in.

- Set Your Stop-Loss: Place your stop-loss just below the recent low. If the trade doesn’t work out, this will protect you from big losses.

- Take Profit: Aim for the next resistance level or a 1:2 risk-reward ratio. For example, if your stop-loss is 20 pips, set your take-profit at 40 pips.

Sell Setup (Going Short)

- Find the Resistance Level: Use the Custom High Low Indicator to spot a strong resistance level—an area where the price has struggled to move higher.

- Look for Bearish Momentum: Wait for the Xmaster Formula to show a red signal. This tells you that sellers are in control.

- Enter the Trade: Jump into a sell trade when the price breaks below the resistance level. This confirms the downtrend.

- Set Your Stop-Loss: Place it just above the recent high. Again, this keeps your risk manageable.

- Take Profit: Target the next support level or use a 1:2 risk-reward ratio, just like with the buy setup.

Download a Collection of Indicators, Courses, and EA for FREE

Why This Strategy Works

This setup works because it combines the strengths of two indicators:

- The Custom High Low Indicator pinpoints where the price will likely reverse or continue.

- The Xmaster Formula gives you the confidence to act with clear buy or sell signals.

By layering these tools, you reduce the guesswork and focus on high-probability trades.

Tips for Using This Strategy

- Adjust Timeframes: If you’re scalping, stick to shorter timeframes, like 5 or 15 minutes. For swing trades, use 1-hour or 4-hour charts.

- Check Market Sessions: This strategy works best during active sessions, such as when London or New York overlaps when there’s more volatility.

- Avoid Trading Before Big News: Major announcements can mess up your setup. Always check the economic calendar before jumping in.

Free Download High Low and Xmaster Formula Strategy

Read More Rainbow Forex Indicator MT4 Free Download

Final Thoughts

The Custom High Low and Xmaster Formula Strategy is one of those setups that’s flexible and easy to adapt. Whether you’re a scalper or prefer holding trades for longer, you can tweak the indicators to fit your trading style. The best part? It gives you a simple way to approach trades without overcomplicating things.

Try this strategy on your MT5 platform and see how it works. Remember, stick to your plan, manage your risk, and don’t let emotions take over.

Happy trading!