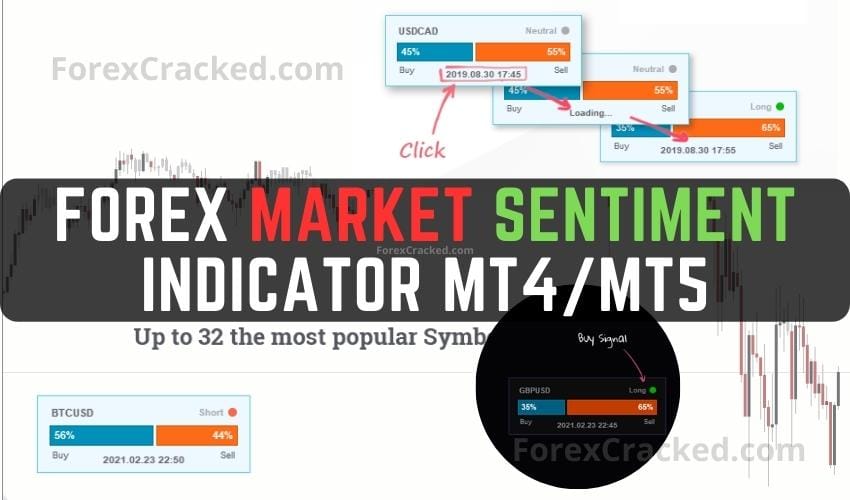

Forex Sentiment Indicator is designed to showcase market sentiment data directly on the chart within the MetaTrader 4/5 terminal, providing traders with valuable insights into the current mood of the market participants.

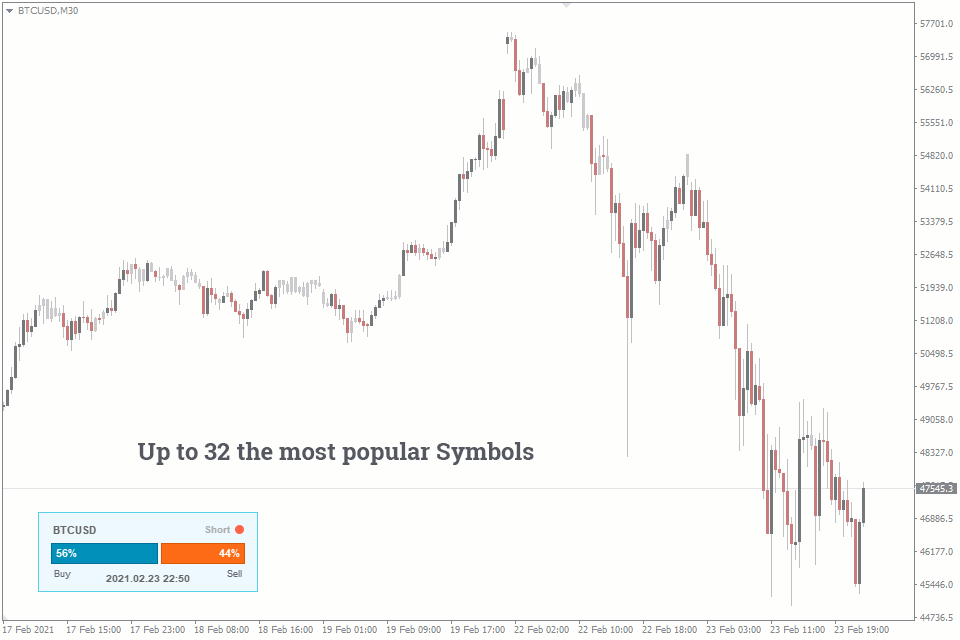

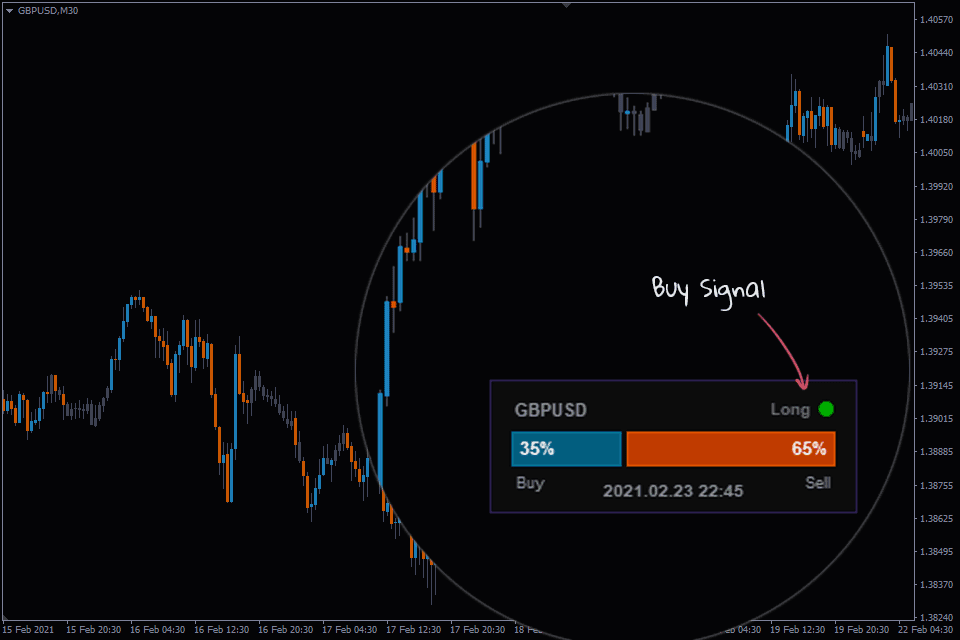

Once you have installed the indicator, a histogram will appear on the chart, illustrating the percentage-based relationship between bullish and bearish traders in the market. This specific ratio is often called the Speculative Sentiment Index (SSI), which is a useful gauge of market sentiment.

It is worth noting that the Sentiment Indicator MT4 is a more simplified version of the Current Ratio indicator. The primary difference between these two indicators lies in the number of data sources they incorporate. As a more comprehensive tool, the Current Ratio indicator utilizes a wider variety of data sources to provide a more in-depth analysis of market sentiment.

Table of Contents

This Sentiment Indicator MT5 can be used on any Forex currency pair and other assets such as commodities, Cryptos, Binary Options, Stock markets, Indices, etc. You can also use it on any time frame that suits you best, from the 1-minutes to the Month charts.

This is an entirely free Indicator without any restrictions made by the fxssi.com website. There are more useful free and paid indicators on this website. So check out their other indicators and show some love for the FXSSI Indicators.

What is Market Sentiment

Market sentiment, also known as investor sentiment or market mood, refers to the overall attitude or feeling of investors towards a particular financial market, asset, or security. It reflects the consensus or prevailing emotions, whether positive (bullish) or negative (bearish) that influence the behavior of market participants.

Various factors, such as economic indicators, corporate earnings reports, geopolitical events, news stories, and social media trends, among others can drive market sentiment. These factors can cause investors to act in a way that impacts the demand for certain assets, ultimately affecting their prices.

Market sentiment can be analyzed using various tools and techniques, including:

- Market Sentiment indicators: These are quantitative measures that track the opinions and emotions of market participants. Examples include the Put/Call Ratio, the Volatility Index (VIX), and the American Association of Individual Investors (AAII) Sentiment Survey.

- Technical analysis: This involves studying historical price and volume patterns to identify trends and predict future market movements. Technical analysts often look for chart patterns, trendlines, and support and resistance levels to gauge market sentiment.

- News and social media analysis: By monitoring the tone and content of news articles, social media posts, and other online sources, investors can gain insights into prevailing market sentiment and anticipate potential shifts in investor behavior.

Understanding market sentiment can help investors make more informed decisions about when to buy or sell assets, as it can provide insights into potential market trends and reversals. However, it is essential to note that market sentiment is not always a reliable indicator, and investors should consider various factors when making investment decisions.

How it used in Forex Trading

In forex trading, market sentiment is the collective attitude of traders and investors toward a particular currency or currency pair. It plays a crucial role in the foreign exchange market, as sentiment can drive price fluctuations and trends. Market participants use sentiment analysis to gauge the strength or weakness of a currency, helping them make more informed trading decisions. Here are some ways market sentiment is used in forex trading:

- Identifying market trends: Traders can assess market sentiment to determine whether most market participants are bullish (optimistic) or bearish (pessimistic) about a currency. A prevailing bullish sentiment often indicates an uptrend, while a bearish sentiment suggests a downtrend.

- Contrarian trading: Some forex traders adopt a contrarian approach, betting against the prevailing market sentiment. They believe extreme sentiment levels can signal potential market reversals, as overly bullish or bearish positions may become unsustainable and lead to a correction.

- Sentiment MT5 indicators: Traders use sentiment indicators to gauge the market mood. In the forex market, some popular sentiment indicators include the Commitment of Traders (COT) report, which shows the positions of large speculators, commercial hedgers, and small speculators, and the Daily Sentiment Index (DSI), which measures the percentage of bullish traders for various currency pairs.

- Risk sentiment: Risk sentiment measures investors’ appetite for risk. When risk sentiment is positive, traders may be more likely to buy higher-yielding, riskier currencies and sell safe-haven currencies. Conversely, during periods of negative risk sentiment, traders may favor safe-haven currencies over riskier assets.

- News and economic releases: Forex traders closely monitor news and economic data releases to assess their potential impact on market sentiment. Positive news or strong economic data can boost sentiment for a particular currency, while negative news or weak data can dampen sentiment.

- Technical analysis: Forex traders also use technical analysis tools like trendlines, moving averages, and support and resistance levels to identify sentiment-driven price patterns and potential entry and exit points for trades.

Forex traders need to consider market sentiment alongside other factors like technical and fundamental analysis. By incorporating market sentiment into their trading strategies, traders can make more informed decisions and better anticipate potential market movements.

What Kind of Data is Used to Predict Market Sentiment

The data source for aggregated client positions consists of several prominent brokers’ information. For instance, the market sentiment index data published on the DailyFX website, provided by the IG Group (previously FXCM) broker, is used.

We meticulously verify all acquired data, ensuring the accuracy and relevance of the information provided.

Supported Currency Pairs of this Sentiment Indicator MT4

Upon the launch of the Market Sentiment Indicator, it displayed data for the following currency pairs:

EURUSD, GBPUSD, XAUUSD (Gold), USDCAD, USDJPY, USDCHF, AUDUSD, NZDUSD, GBPJPY, EURGBP, EURJPY, GBPCHF, GBPCAD, EURCHF, EURAUD, CADJPY, AUDJPY, CADCHF, GBPNZD, EURNZD, AUDCAD, GBPAUD, AUDCHF, NZDJPY, AUDNZD, EURCAD, NZDCAD, CHFJPY, CHFSGD, NZDCHF.

A “No data” message indicates that the currency pair is not currently supported and no data is available.

Over time, the list of supported pairs may expand to include various indices, crude oil, and bitcoin. You won’t need to update the indicator manually to access new data.

Update Frequency of the Market Sentiment Indicator

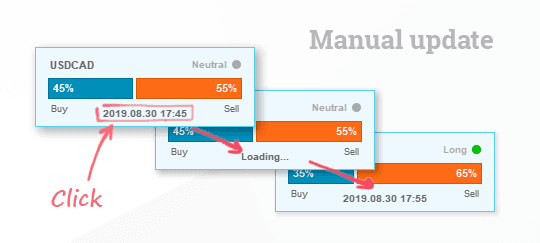

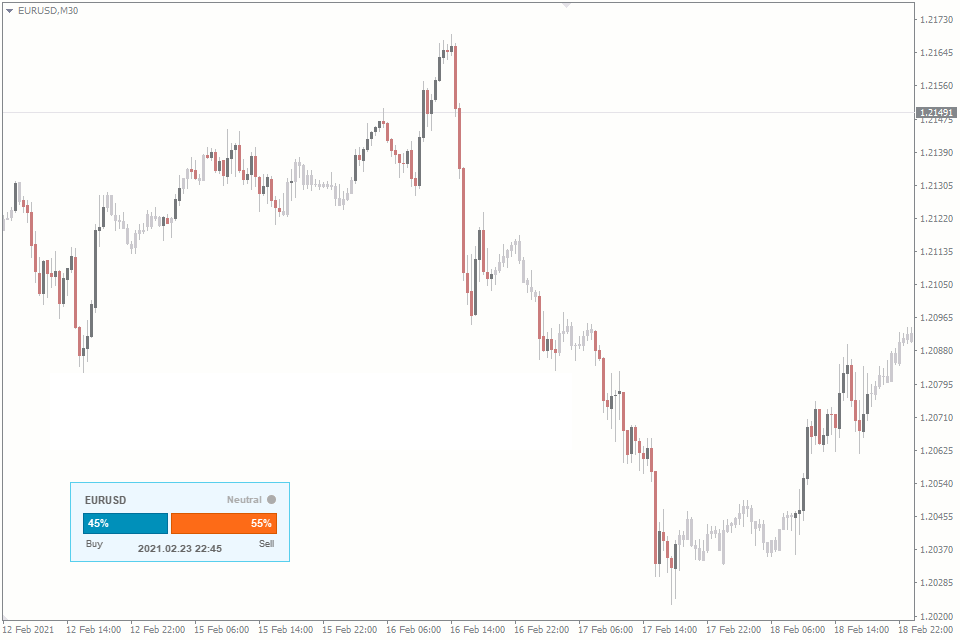

By default, the Sentiment MT4 Indicator updates once per hour. However, if necessary, you can decrease this interval to 5 minutes.

Additionally, you can manually update the data by clicking the “time” on the indicator panel.

Download a Collection of Indicators, Courses, and EA for FREE

Forex Sentiment Indicator Input Parameters

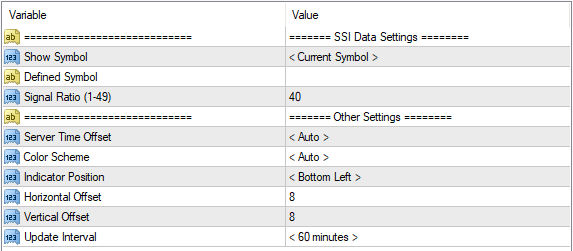

- Show Symbol. Choose one of the following options:

- Current Symbol – the currency pair is determined automatically.

- Defined Symbol – provide the required currency pair in the field “Defined Symbol.”

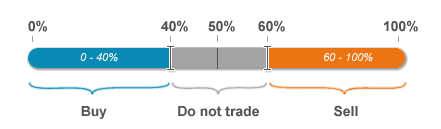

- Signal Ratio (1-49). Determines the boundaries beyond which the signal forms for the ratio of traders’ positions indicator. If 40 is set, the Buy signal will be triggered at 40 or less; and the Sell signal will be triggered at 60 or higher.

- Server Time Offset. Selects the time zone. By default, it’s determined automatically. This parameter affects only the block showing the last update time but does not affect the frequency of updates.

- Color Scheme. Two color schemes are available: white and dark backgrounds. By default, it’s determined automatically.

- Indicator Position & Offset. With these settings, you can change the corner where the indicator is placed on the chart and set spaces from this corner.

- Update Interval – the frequency at which the Market Sentiment Indicator will request data from the server. It varies from 5 to 60 minutes.

How to Use the Forex Sentiment Indicator

Before executing a trade, assessing the prevailing market sentiment is crucial. For instance, determine the proportion of traders currently favoring long (buy) positions versus short (sell) positions.

Armed with this data, you can avoid entering a trade that’s likely to result in a loss or, on the contrary, reinforce your decision to initiate a new trade.

Consider buying when over 60% of traders hold short positions or, conversely, sell when the majority have long positions. This fundamental principle underlies the typical market sentiment analysis approach.

Subsequently, you can modify this percentage threshold according to your personal experience and trading preferences.

For more insights on this topic, refer to our report examining the profitability of market sentiment data.

- More Free Indicators by this Developer FXSSI

Admin Thx for share !