The Harmonic Pattern Indicator is a tool designed to detect harmonic patterns in real-time. It identifies six specific patterns – Gartley, Butterfly, Crab, Bat, Cypher, and Shark – and automatically marks them on the chart. Harmonic Pattern MT4 indicator also plots all relevant Fibonacci ratios within each pattern and provides alerts when a valid pattern is completed. Additionally, it displays historical patterns, as well as potential and pending ones.

How the Harmonic Pattern Indicator Works

This indicator operates by detecting harmonic patterns based on Fibonacci retracement and extension levels. When a pattern forms, the indicator highlights it on the chart, allowing traders to analyze and act accordingly. The tool also includes pop-up alerts and audio notifications, so users are notified as soon as a new harmonic pattern is identified.

The indicator tracks past patterns, which may help traders study the market’s behavior over time. Traders can use the detected patterns to make entry and exit decisions based on predefined strategies.

This Harmonic Pattern MT4 Indicator isn’t a standalone trading indicator System. Still, it can be very useful for your trading as additional chart analysis, to find trade exit position(TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

What is a Harmonic Pattern?

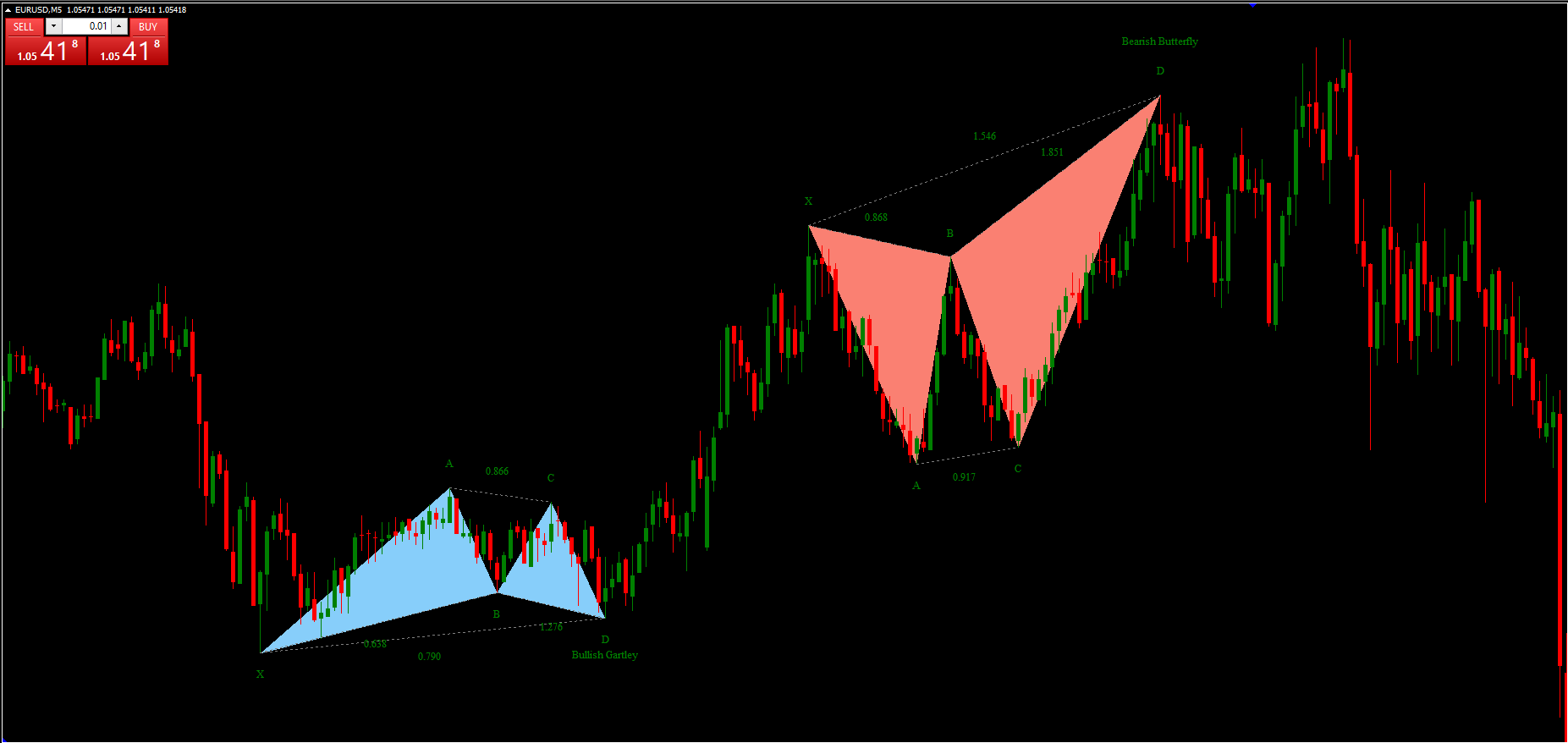

A harmonic pattern is a price movement that follows specific Fibonacci retracement and extension levels. Based on price symmetry and geometric formations, these patterns help traders identify potential reversal points in the market.

Harmonic patterns are widely used in Forex trading to identify high-probability trade setups. Unlike traditional chart patterns, harmonic patterns rely on Fibonacci ratios to confirm their validity. Traders use these patterns to predict points where the price is likely to reverse, helping them make more informed trading decisions.

Some of the most commonly used harmonic patterns include:

- Gartley Pattern

- Butterfly Pattern

- Crab Pattern

- Bat Pattern

- Cypher Pattern

- Shark Pattern

Each pattern consists of multiple legs (price swings) that follow specific Fibonacci levels, forming recognizable shapes on the chart.

How Harmonic Patterns Are Used in Forex

In Forex trading, harmonic patterns help traders spot potential reversal zones, allowing them to enter trades with better timing. Here’s how they are typically used:

- Pattern Identification – Traders wait for the market to form one of the harmonic patterns. This process can be time-consuming, which is why indicators like the Harmonic Pattern Indicator automate the detection process.

- Confirmation with Fibonacci Ratios – Once a pattern is identified, traders check if the key Fibonacci levels align with the expected measurements of that specific pattern.

- Trade Execution – After confirming a valid pattern, traders place buy or sell orders near the predicted reversal point.

- Stop-Loss and Take Profit Rules – Traders set stop-loss levels to manage risk, often using Fibonacci extension and retracement levels for guidance.

By following these steps, harmonic pattern traders attempt to capitalize on market reversals and price corrections, making their trading more structured.

Download a Collection of Indicators, Courses, and EA for FREE

Example Trading Rules

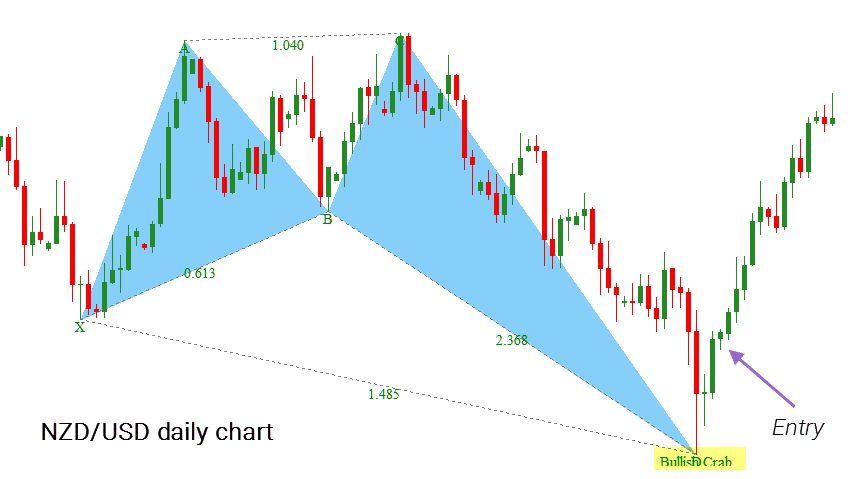

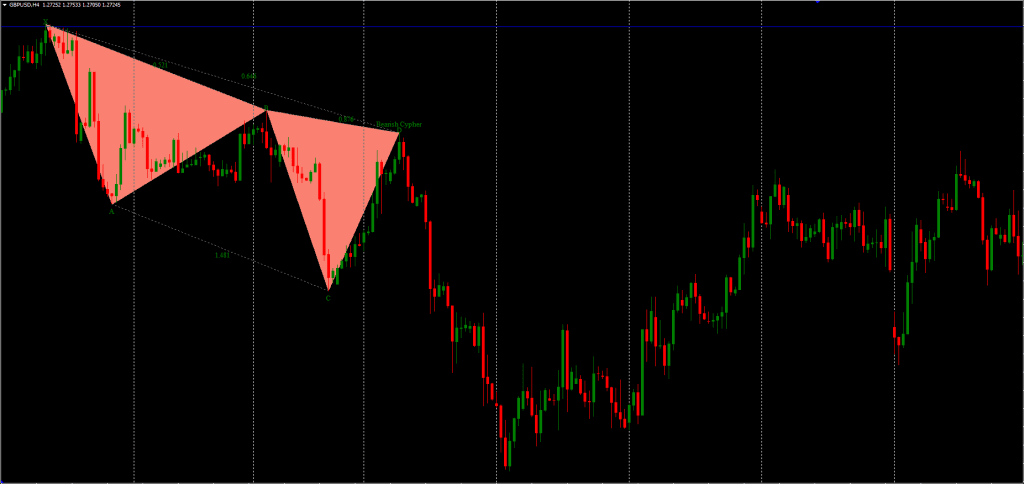

To better understand how this Harmonic Pattern Indicator can be used, let’s look at two examples: a bullish trade using a Crab pattern and a bearish trade using a Cypher pattern.

Example 1: Bullish Crab Pattern

- Entry Rule

- When the indicator detects a complete bullish harmonic pattern, place a pending buy order just above the close of the last bar within the pattern.

- If price rises after the Crab pattern forms, it triggers the pending buy order.

- Exit & Stop-Loss Rule

- A trailing stop is used, calculated as 3 times the ATR (Average True Range).

- For example, if the ATR value is 50 pips, the trailing stop is set at 150 pips (3 × 50 pips).

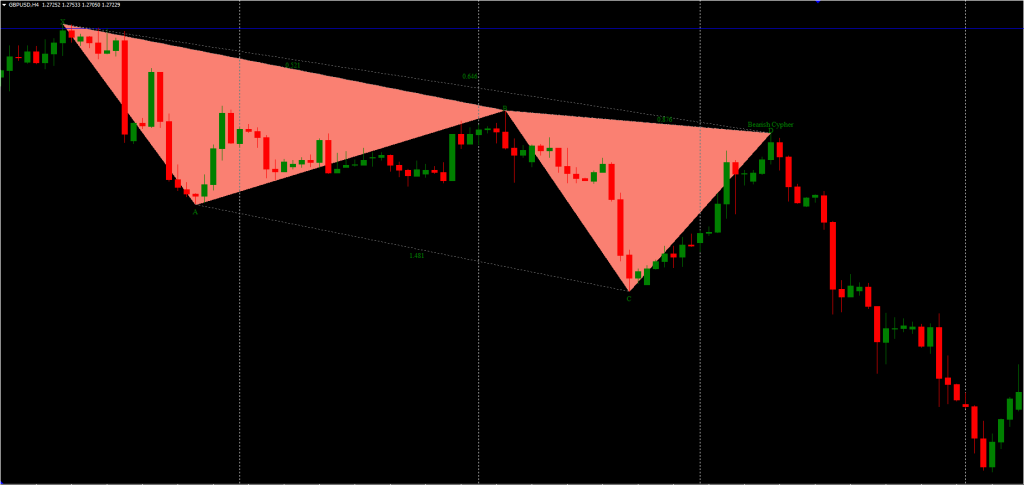

Example 2: Bearish Cypher Pattern

- Entry Rule

- When the indicator detects a complete bearish harmonic pattern, a pending sell order is placed just below the close of the last bar within the pattern.

- If price moves down after the Cypher pattern appears, it activates the pending sell order.

- Exit & Stop-Loss Rule

- The same trailing stop approach is used: 3 × ATR.

Small Trading Tip – How to Calculate ATR Pip Value

If you are unsure how to calculate the ATR pip value, here’s a simple way to do it:

- For currency pairs quoted to four decimal places (like EUR/USD), multiply the ATR by 10,000.

- Example: If ATR = 0.0016, then pip value = 0.0016 × 10,000 = 16 pips.

- For currency pairs quoted to two decimal places (like USD/JPY), multiply the ATR by 100.

- Example: If ATR = 0.25, then pip value = 0.25 × 100 = 25 pips.

This quick calculation helps traders determine an appropriate trailing stop distance when using the Harmonic Pattern Indicator.

Conclusion of Harmonic Pattern MT4

This Harmonic Pattern MT4 indicator provides traders with a structured approach to trading harmonic patterns. While it does not guarantee successful trades, it helps traders spot opportunities by marking patterns on the chart and providing alerts for potential setups.