The OrderBook Indicator is an MT4/MT5 indicator FREE to Download. An order book is an electronic list of buy and sell orders for a specific currency pair, organized by price level. From identifying Stop Loss clusters to evaluating the chances of a bullish or bearish “attack,” this tool is proving indispensable.

Many traders consider the OrderBook indicator indispensable because it provides an overview of market sentiment and gives them a tactical edge. By observing various patterns of crowd behavior, one can make complete trading decisions that are more nuanced and potentially more profitable.

What is an Order Book

In forex (foreign exchange) trading, an order book is an electronic list of buy and sell orders for a specific currency pair, organized by price level. The order book lists the number of units being bid and offered at each price point, allowing traders and market participants to get a sense of supply and demand at various price levels.

Here’s a simplified example to illustrate the concept:

- Buy Orders (Bids)

- 1.3000: 10 lots

- 1.2990: 15 lots

- 1.2980: 20 lots

- Sell Orders (Asks)

- 1.3010: 12 lots

- 1.3020: 18 lots

- 1.3030: 25 lots

In this example, the bid price is the highest price that a buyer is willing to pay for a currency pair, and the ask price is the lowest price at which a seller is willing to sell. The difference between the highest bid and the lowest ask is called the “spread.”

How is it used in Forex Trading

Here’s how the order book is used in forex trading:

Market Depth

Forex order books provide an aggregated view of the depth of market liquidity, indicating how many buy and sell orders exist at various price levels. Traders can gauge the supply and demand for a particular currency pair at different price levels, allowing them to anticipate price movements and set their trading strategies accordingly.

Price Discovery

The order book helps in the price discovery process by listing bids and asks in real time. Traders can understand the market by analyzing the volume of buy and sell orders at different price levels.

Risk Management

Order books can be a useful tool for managing risk. For instance, traders might use them to identify stop-loss levels by placing orders at points with a noticeable bid or ask volume change.

Trading Strategies

Some traders use order book data for high-frequency trading strategies, such as market making, arbitrage, or scalping. These strategies often exploit small price gaps usually created by order flows or spreads.

This OrderBook Indicator isn’t a standalone trading indicator System. Still, it can be handy for your trading as additional chart analysis, to find trade exit position(TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

OrderBook Indicator Explained

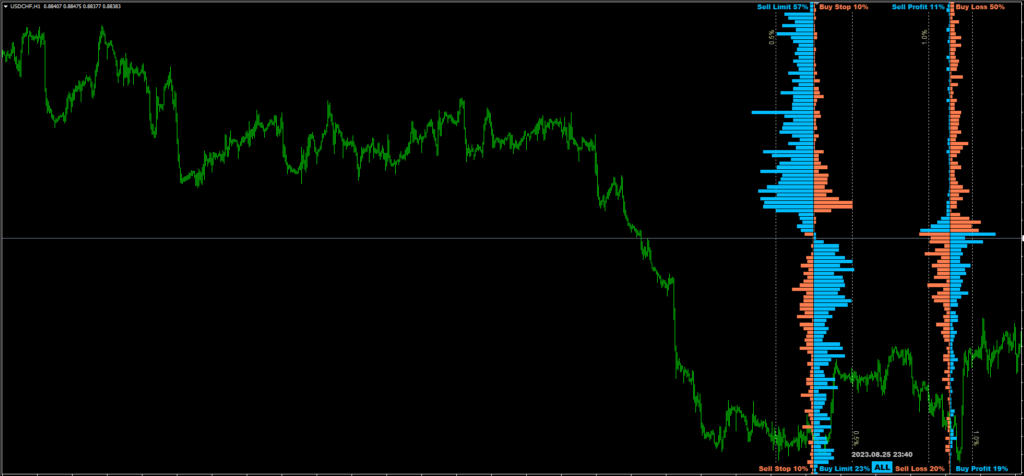

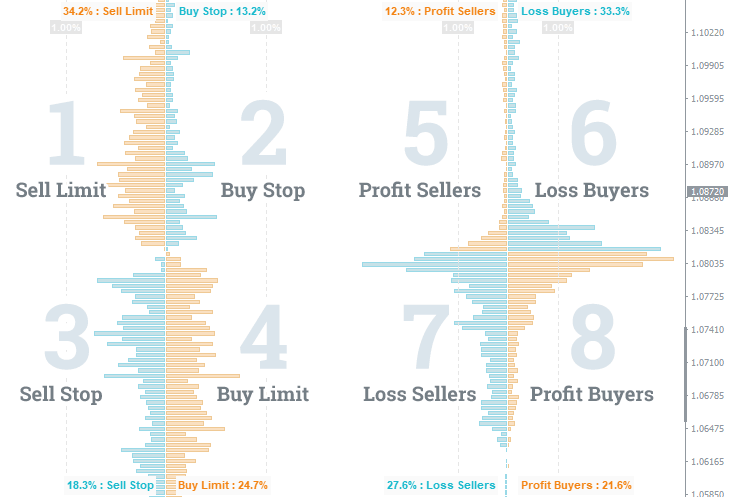

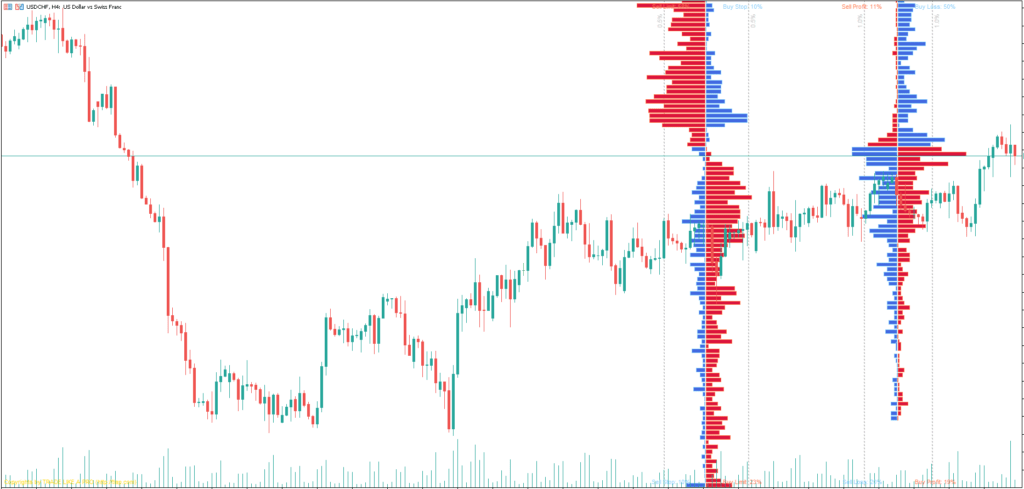

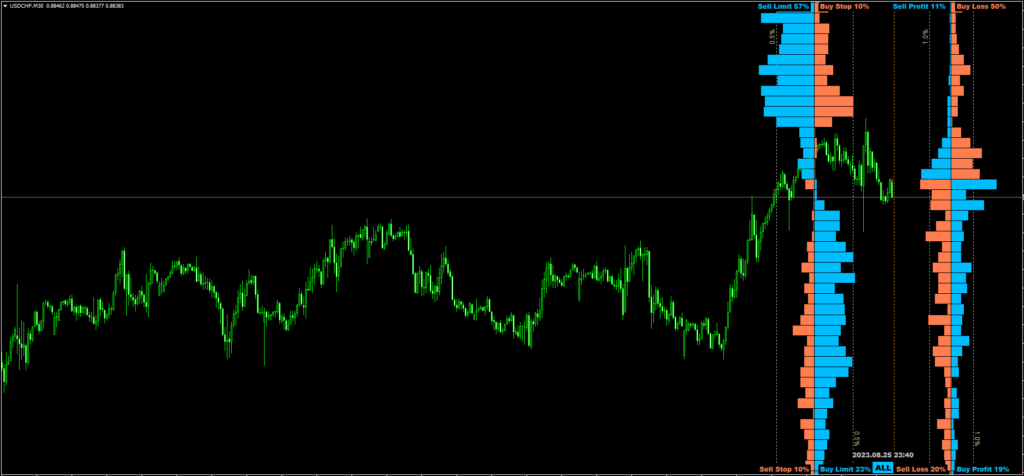

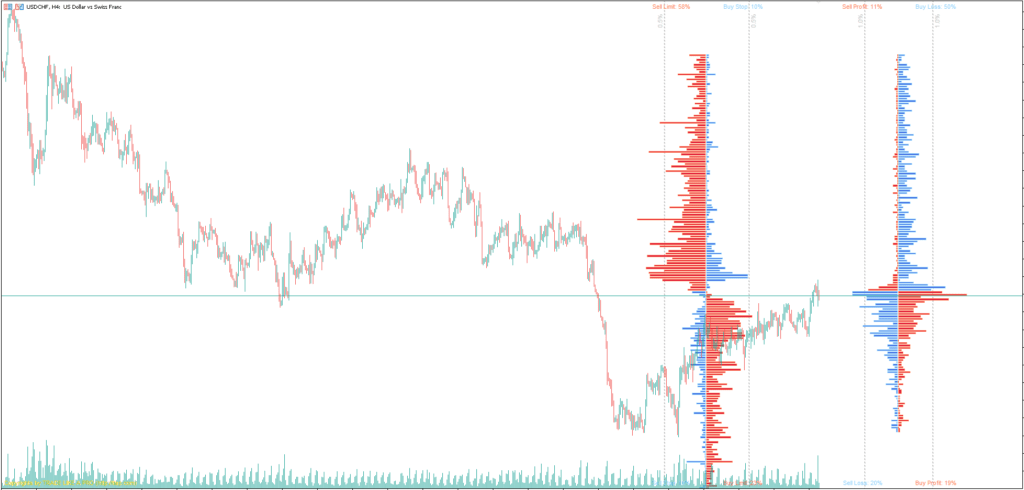

The OrderBook indicator offers a two-sided histogram that visually represents retail traders’ open trades and pending orders for a given financial instrument.

The Order Book MT4 comprises two essential sections:

- Left-side Order Book: Displays all pending orders, including Take Profits and Stop Losses.

- Right-side Order Book: Shows the currently open trades of market participants.

Each section is further divided into quarters, showcasing specific order types like Sell Limit, Buy Stop, Profit Sellers, or Loss Buyers.

The Order Book MT5 provides a comprehensive view of market sentiment at each price level by summing up the trades and representing them as a histogram. It includes all types of pending orders and currently open trades. In a traditional stock exchange setting, you might only get to see the first and fourth squares that represent Limit orders. But thanks to the broader client base of certain brokers, a two-sided order book is possible, even though ordinary stock exchanges cannot offer this type of data.

Download a Collection of Indicators, Courses, and EA for FREE

Practical Uses of the Order Book MT4

Identify Levels with the Largest Stop Loss Clusters

The Order Book MT4 indicator is exceptionally helpful in identifying levels where large stop-loss clusters are present. Knowing where these clusters are can help traders strategize effectively. For instance, these are levels that market makers might target to trigger the Stop Losses, creating potential trading opportunities.

Evaluate the Chances of Bulls or Bears “Attacking”

The OrderBook can show an imbalance between buyers and sellers at certain price levels, helping traders gauge the strength of bulls or bears. This can give you an idea of the direction in which the market is more likely to move.

Distinguish Between False and True Moves

Market anomalies and false breakouts can often trap traders. By observing the pending orders and current trades, the OrderBook indicator can help you differentiate between a true market move and a false one.

Conclusion of Order Book MT5

The Order Book MT5 Indicator is a formidable tool for traders, especially those seeking to trade against the majority of the market. It offers many actionable insights, from identifying stop-loss clusters to understanding the power dynamics between bulls and bears. Traders who have begun to use it often find it so essential that they can’t imagine their trading routines without it. And in a field where information is money, an indispensable tool like the OrderBook can make all the difference.

As the Forex market is “Decentralized” there is no way to have the Real volume of orders in the market. Therefore this indicator is almost useless.

(it may be usefull in stock market, Futures, etc.)

Hi bobby… I’ve downloaded the indicator, but in my MT4 doesn’t work. Do you have better informations for settings or what else it is necessary to run it?

Tnk in advance, have a good day

This is potentially a malware wrapped up as an indicator: it contains references to functions in windows system dll files including network communication and this is very suspcicious…

hi if you can do XAUUSD Order BOOK V1.2?