SEFC Trading System is a Free trend following Strategy that offers reliable entry and exit points. This article delves into the intricacies of the SEFC Trading System, outlining its rules, indicators, and operational framework designed to navigate the volatile markets with a degree of precision and confidence.

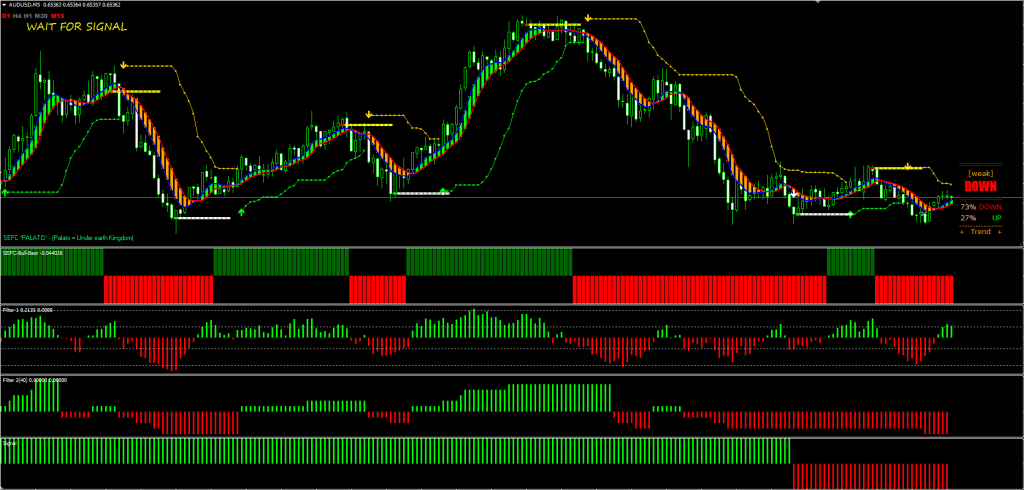

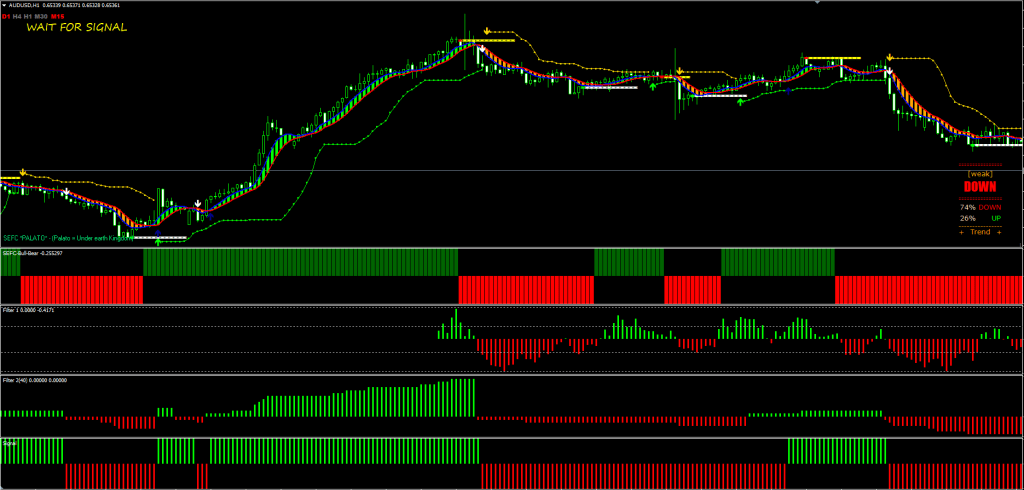

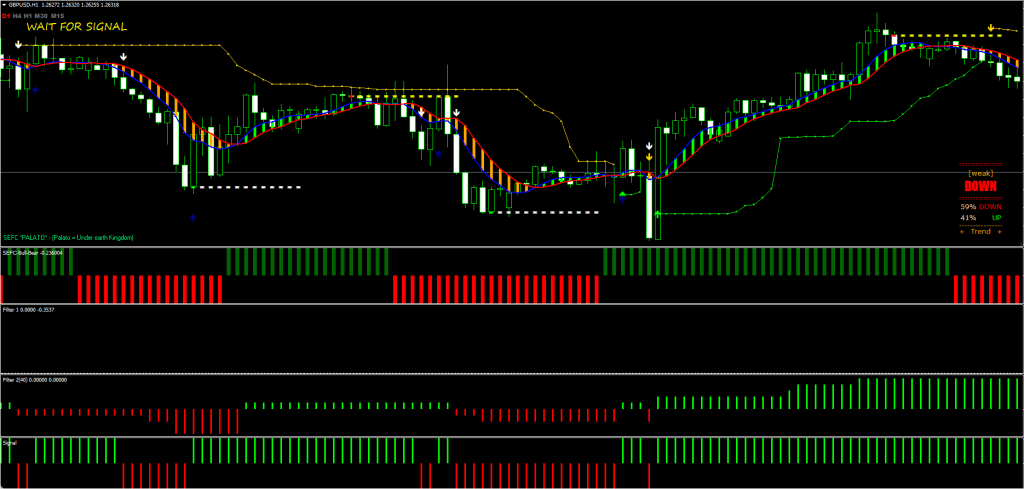

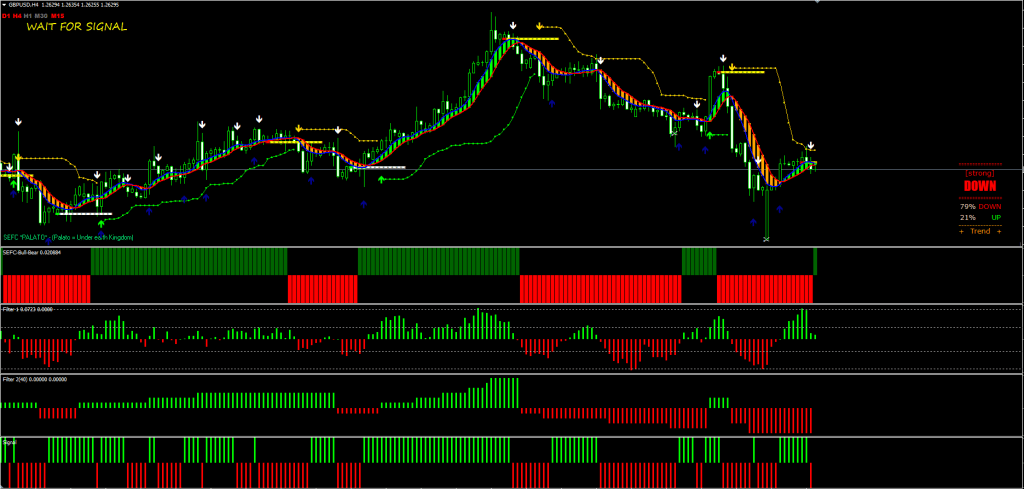

At its core, the SEFC Trading System is built upon a suite of indicators known as the SEFC indicators, coupled with Filter indicators, to sift through the noise and pin down trading signals emanating from the Bollinger Bands Stop. What sets this system apart is its reliance on indicators that, while repaint, are complemented by the non-repainting Bollinger Band Stop alert indicator, ensuring that traders receive timely and reliable signals to act upon.

This Free Forex Strategy is entirely manual. The indicators produce the signals, but any decisions to enter the market and set protection or profitable exit stops will depend on the trader. Therefore, the trader must be familiar with the principles of risk and reward and use initial support and resistance areas to set entries and exits.

SEFC Indicator System can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

This SEFC Trading System can be used on any currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. You can also use it on any time frame that suits you best, from the 1-minute to the 1-month charts.

Download a Collection of Indicators, Courses, and EA for FREE

Trading rules for the SEFC Trading System

Remember to tighten your Stop Losses around High Impact News Releases or avoid trading at least 15 minutes before and after these events when using SEFC Trading System.

As always, to achieve good results, remember about proper money management. To be a profitable trader, you must master discipline, emotions, and psychology. It is crucial to know when and when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility, beyond major sessions, exotic currency pairs, wider spread, etc.

Buy

- Bollinger Band Stop Alert Indicator: A green arrow alongside a line indicates a buy signal.

- SEFC10 Support Line: A white horizontal line signifies that SEFC10 has formed a support level.

- SEFC05 Indicator: The blue line surpasses the red line, indicating bullish momentum.

- SEFC 084 Indicator: The presence of green bars from the SEFC Bull and Bear indicator signals a strong bullish trend.

- Filter 1 and Filter 2 Indicators: Both displaying green bars further confirm the bullish sentiment in the market.

Sell

- Bollinger Band Stop Alert Indicator: A yellow arrow with a line denotes a sell signal.

- SEFC10 Resistance Line: A yellow horizontal line indicates that SEFC10 has formed a resistance level.

- SEFC05 Indicator: The red line is above the blue line, suggesting bearish momentum.

- SEFC 084 Indicator: The appearance of red bars signals a bearish trend.

- Filter 1 and Filter 2 Indicators: Red bars on both filters corroborate the bearish market sentiment.

Exit Strategy

The SEFC Trading System recommends exiting a position upon the appearance of an opposite trading signal from the Bollinger Band Stop alert indicator or by setting a profit target at a 1:1.5 ratio to the stop loss. Initially, the stop loss is placed at the previous swing high or low, but traders are advised to manage their positions actively, including moving the stop loss to manage risk.

Click here if the download button doesn’t work

Conclusion

The SEFC Trading System presents a structured approach to trend following, equipped with a set of indicators designed to filter out false signals and pinpoint genuine trading opportunities. While no trading system is foolproof, the SEFC Trading System offers a comprehensive framework for traders looking to leverage trend analysis in their trading strategy. As with any trading system, prospective users should practice due diligence, backtest the strategy, and ensure it aligns with their trading style and risk tolerance.