Total Trend System is a Trend Trading System that stands out as an integrated approach that combines trend following, momentum, and volatility analysis to create a holistic market view. The Total Trend Trading System is a time-tested methodology that has been a part of the forex market for a very long time. It has garnered a mixed response, with many applauding its effectiveness while others remain less enthusiastic.

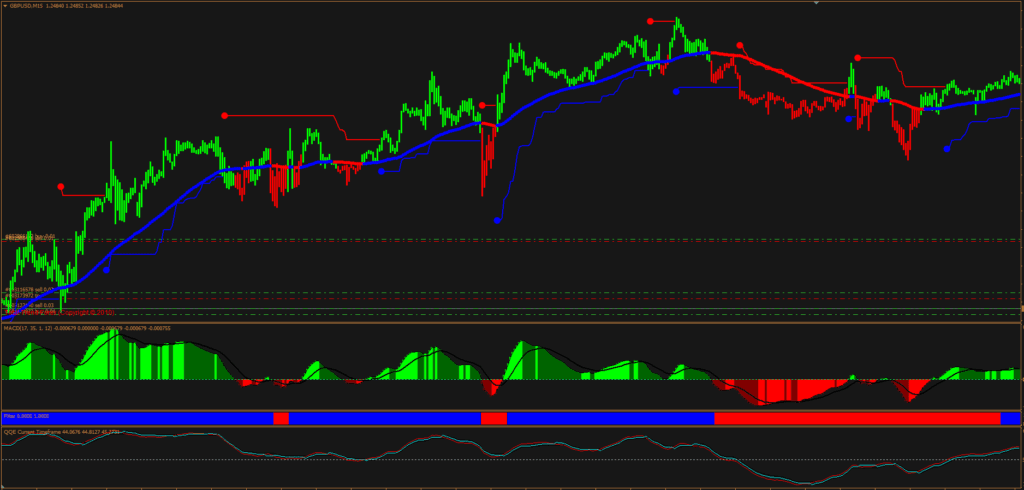

At its core, the Total Trend System is a technical analysis methodology that aims to identify potential buy and sell signals in the financial markets. It achieves this by employing a combination of moving averages, momentum indicators, and volatility measures, each of which provides a unique perspective on market activity. This diversified approach allows traders to capture a comprehensive picture of market trends and potential shifts in market direction.

Understanding this Trend Trading System

Using Moving Averages

A vital component of the Total Trend Trading System is moving averages, statistical measures that smooth out price data by creating a constantly updated average price. This tool is instrumental in identifying the overall trend of the market.

In the Total Trend System, multiple moving averages are used concurrently to gauge short-term, intermediate, and long-term trends. For instance, a short-term moving average, like a 10-day moving average, can determine short-term trends. On the other hand, a longer-term moving average, such as a 50-day moving average, can be used to identify intermediate-term trends. This multi-timeframe analysis provides a more nuanced view of market trends and helps avoid the pitfalls of over-reliance on a single time frame.

Incorporating Momentum Indicators

The Total Trend Trading System employs momentum indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages. These tools offer insights into the strength of the ongoing market trend and can help confirm signals generated by moving averages.

The RSI, for example, compares the magnitude of recent gains to recent losses in an attempt to determine the overbought or oversold conditions of an asset. The MACD, the other hand, tracks the relationship between two moving averages of an asset’s price. The MACD triggers technical signals when it crosses its signal line above (to buy) or below (to sell).

Embracing Volatility Measures

Lastly, the Total Trend Trading System acknowledges the role of volatility in shaping market trends. By incorporating volatility measures, the system enhances its ability to identify periods of uncertainty and potential trend reversals. Moreover, understanding volatility can also help manage risk and determine appropriate position sizing in the context of a trader’s risk tolerance.

Quantitative Qualitative Estimator

The QQE is short for the Quantitative Qualitative Estimator. This powerful indicator has the ability to eliminate, or filter out, a lot of bad trades.

This indicator is pretty simple to use but does need some explanation. The QQE is essentially a smoothed RSI indicator with a signal line. The signal line is a smoothing average known as Wilder’s Period. Together the two lines work like a Stochastic Oscillator or a 2-line MACD. The lines must be in order for a trade signal to be valid. A line is drawn through the middle of the indicator window, called the 50 lines.

This Trend Trading MT4 is entirely manual. The indicators produce the signals, but any decisions to enter the market and set protection or profitable exit stops will depend on the trader. Therefore, the trader must be familiar with the principles of risk and reward and use initial support and resistance areas to set entries and exits.

Trend Trading System can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

You can set Total Trend Indicator to send you signal alerts. This is helpful as it means you do not need to stare at the charts all day, waiting for signals to appear, and you can monitor multiple charts simultaneously.

Trend Trading System System can be used on any Forex currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. You can also use it on any time frame that suits you best, from the 1-minute through to the 1-month charts.

Download a Collection of Indicators, Courses, and EA for FREE

Trading rules for Total Trend System

Remember to tighten your Stop Losses around High Impact News Releases or avoid trading at least 15 minutes before and after these events when using this Total Trend System.

As always, to achieve good results, remember about proper money management. To be a profitable trader, you must master discipline, emotions, and psychology. It is crucial to know when and when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility, beyond major sessions, exotic currency pairs, wider spread, etc.

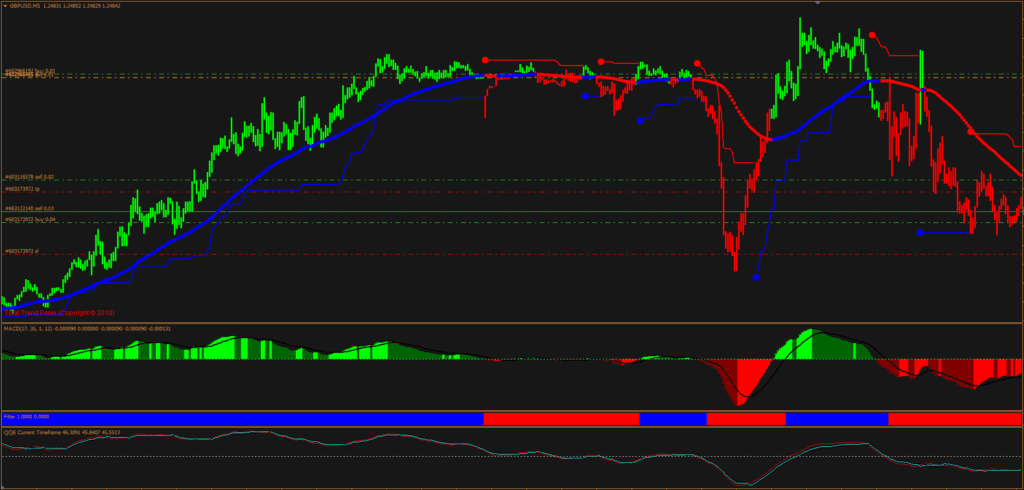

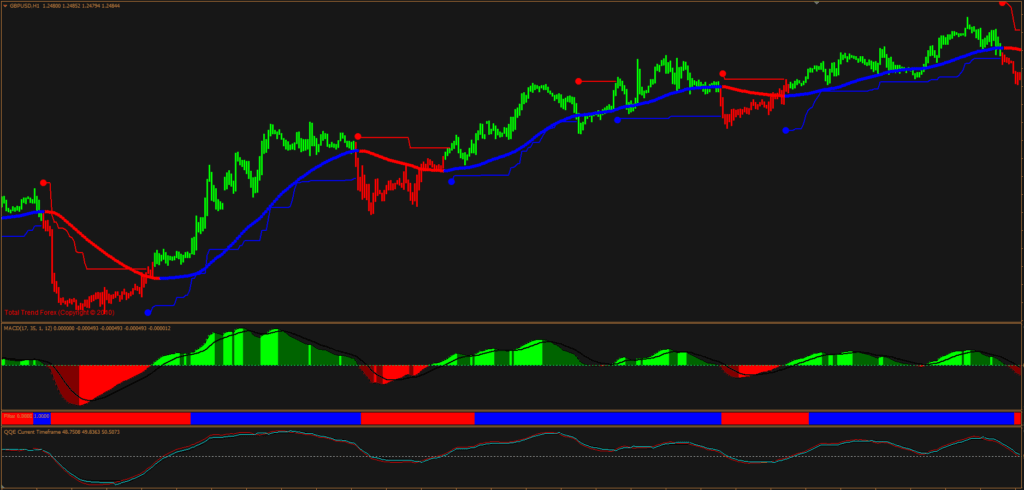

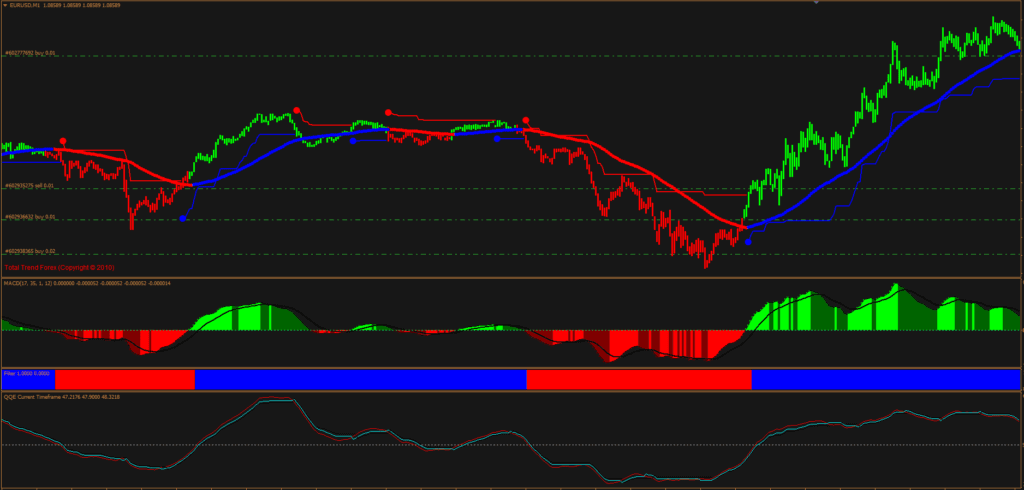

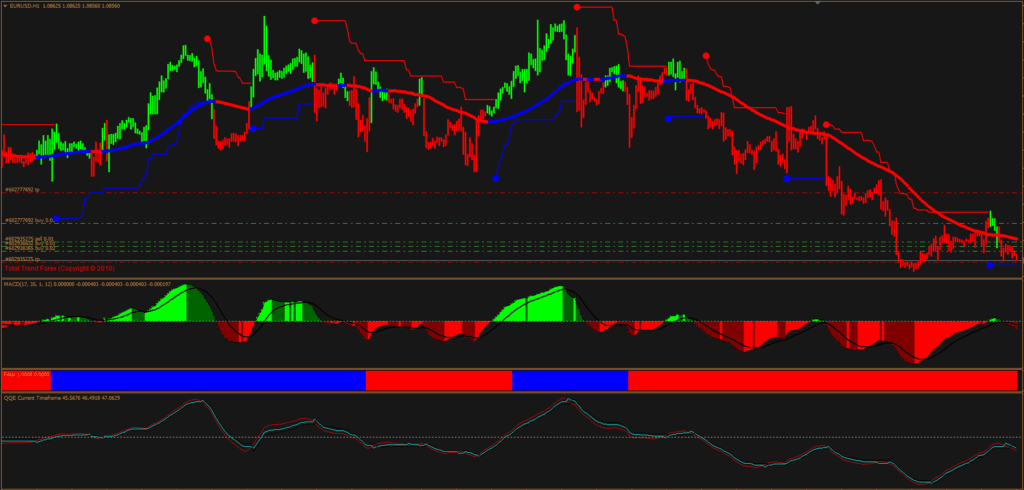

Buy Entry

- The primary Volty Channel indicator gives BLUE Dot Signal.

- Red and Blue Moving average Indicator showing uptrend with BLUE.

- The MACD has crossed GREEN upward.

- The Red and Blue second window indicator is BLUE.

- QQE above the 50 lines.

Sell Entry

- The primary Volty Channel indicator gives RED Dot Signal.

- Red and Blue Moving average Indicator showing downtrend with RED.

- The MACD has crossed RED downward.

- The Red and Blue second window indicator is RED.

- QQE below the 50 lines.

Trade Exist

Any positions with this Trend Trading System can be liquidated using a fixed profit target. Alternatively, the profit target should be set using previous support, resistance, or high-low level as a reference point. You may also exit the trade manually if the system conditions reverse.

It is recommended to use a stop loss. Set SL below the entry price using previous support/resistance as a reference point Or on the previous high/low swing. Using fixed stop loss settings without any reference points is not advocated.

- Read More CrazyCTrader EA For FREE Download

Conclusion

The Total Trend Trading System is a comprehensive technical analysis methodology that leverages multiple tools to identify potential trading opportunities. Integrating moving averages, momentum indicators, and volatility measures provides a multifaceted view of market trends, thereby equipping traders with the necessary insights to navigate the dynamic financial markets.

Hi , Where is teh File for this ?

seems he forgot or a trick to drive traffic

All the files are available for download above, and I just checked that they are still working fine. Does it give you an error?