The Trend Plus Breakout strategy is a robust trading system that builds on the principles of the London Breakout strategy, similar to the Hans Breakout method but with modifications aimed at enhancing the box size from which trading signals are derived. This guide will explore the mechanics of the Trend Plus Breakout strategy, which is ideal for traders who focus on the Forex market and seek to capitalize on the specific movements during the early London session.

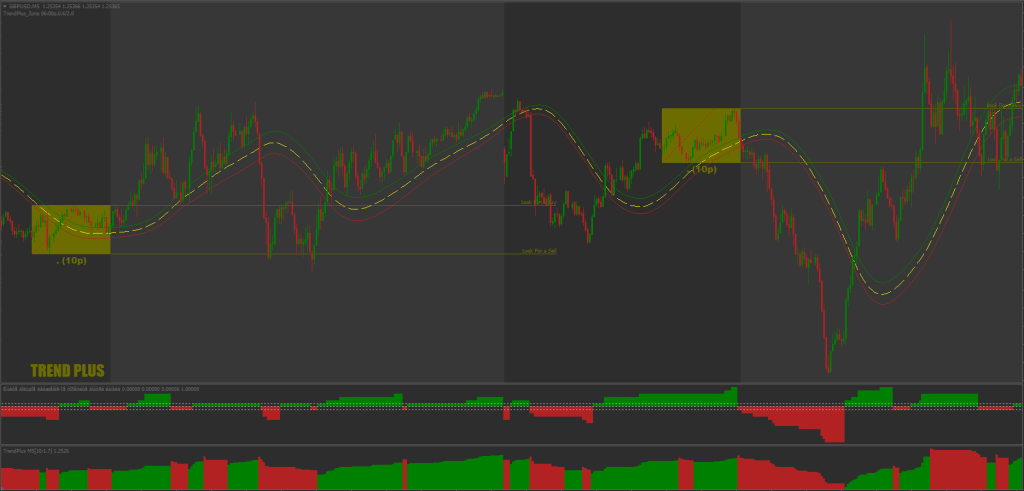

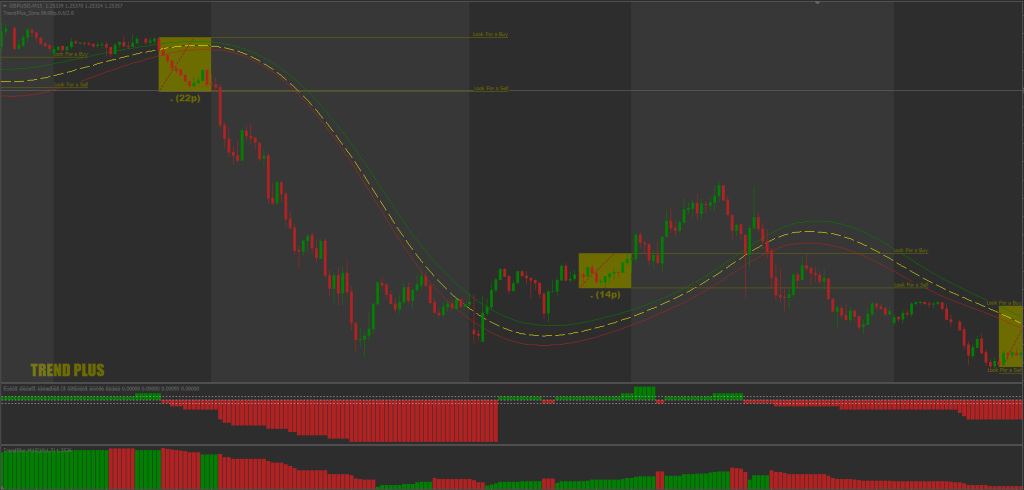

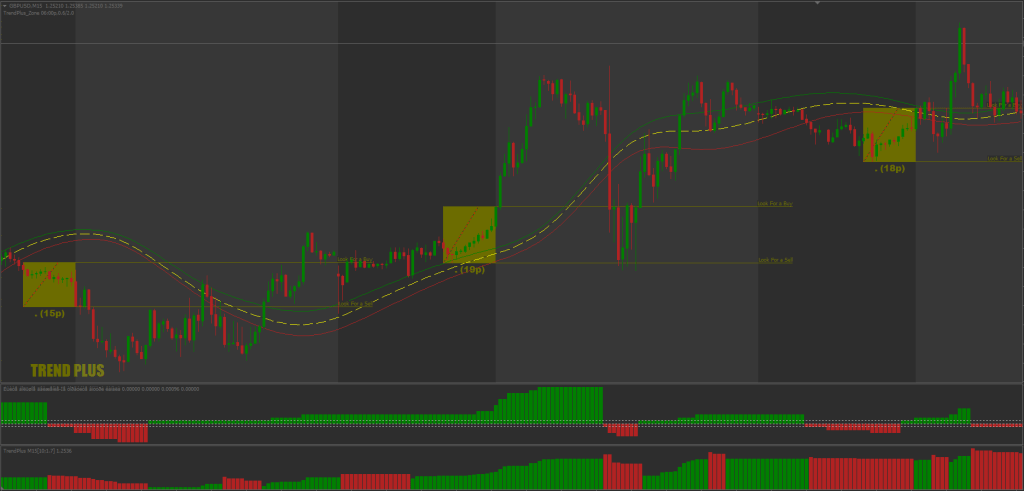

The strategy operates on a 15-minute timeframe, focusing on the period from 6 to 9 AM GMT, corresponding to early trading hours in Berlin. During these hours, the strategy identifies a ‘box’—a range that encapsulates the high and low price movements. The goal is to determine breakout points as the market moves beyond this established range.

This London Breakout Strategy is entirely manual. The indicators produce the signals, but any decisions to enter the market and set protection or profitable exit stops will depend on the trader. Therefore, the trader must be familiar with the principles of risk and reward and use initial support and resistance areas to set entries and exits.

This Breakout Strategy can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

Components of this Breakout Strategy

Trend Plus Breakout Strategy incorporates several trend-momentum indicators that aid in deciphering the direction and strength of the breakout. These components ensure that trades are executed not just based on price movement but are supported by underlying trends. Here’s how these components come together:

- Box Formation: The box is formed between 6 AM and 9 AM GMT Berlin Time. Make sure the box time matches according to your broker time, so adjust it using the indicator settings.

- Trend-Momentum Indicators: The strategy uses specific indicators such as the Trend Plus NR bar (which appears in green for buy signals and red for sell signals) and the Trend Plus bar (color-coordinated in the same way), which help confirm the direction of the market trend.

This London Breakout Strategy can be used on any currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. You can also use it on any time frame that suits you best, from the 1-minute to the 1-month charts.

Download a Collection of Indicators, Courses, and EA for FREE

Trading rules for this London Breakout Strategy

Remember to tighten your Stop Losses around High Impact News Releases or avoid trading at least 15 minutes before and after these events when using London Breakout Strategy.

As always, to achieve good results, remember about proper money management. To be a profitable trader, you must master discipline, emotions, and psychology. It is crucial to know when and when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility, beyond major sessions, exotic currency pairs, wider spread, etc.

Buy Signal

- Candle Close: A candle must close above the upper line of the box.

- Price Position: The price should be above the trend medium and high.

- Indicator Confirmation: Both the Trend Plus NR bar and the Trend Plus bar should show green, indicating a bullish momentum.

Sell Signal

- Candle Close: A candle must close below the lower line of the box.

- Price Position: The price should be below the trend medium and low.

- Indicator Confirmation: Both the Trend Plus NR bar and the Trend Plus bar should show red, indicating a bearish momentum.

Exit Strategy

- Stop Loss: A stop loss should be placed between 18 and 25 pips from the entry point, depending on the volatility and characteristics of the currency pair.

- Profit Target: The minimum profit target should aim for a 1.4 ratio to the stop loss. This risk/reward ratio helps in maintaining a profitable trading edge even if not all trades succeed.

Conclusion

The Trend Plus Breakout strategy is an effective approach for traders looking to exploit the momentum and trends, specifically during the early hours of the London trading session. By combining price breakouts with trend-momentum indicators, this strategy provides a structured way to make informed trading decisions. As with any trading strategy, testing it on a demo account before applying it to live trades is vital to ensure it fits one’s trading style and risk tolerance. With careful management and adherence to the rules, the Trend Plus Breakout strategy can be a valuable addition to a trader’s arsenal.

Credit to forexstrategiesresources

Thanks admin looks good

hello i like the The Trend Plus Breakout strategy

I want try it, thanks sir