The Weis Wave Indicator is a technical analysis tool based on Richard D. Wyckoff’s theory. It works on various time frames, including range and tick bar charts, and can be applied to any market, making it versatile for traders. This indicator expands on the traditional Weis Wave by incorporating features such as auto waves, five different wave types, and the Speed Index for a more robust analysis.

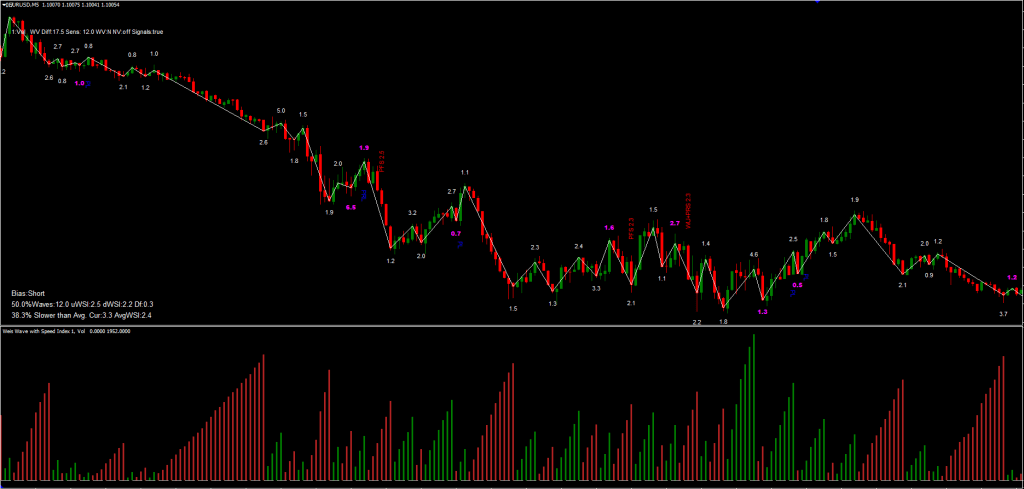

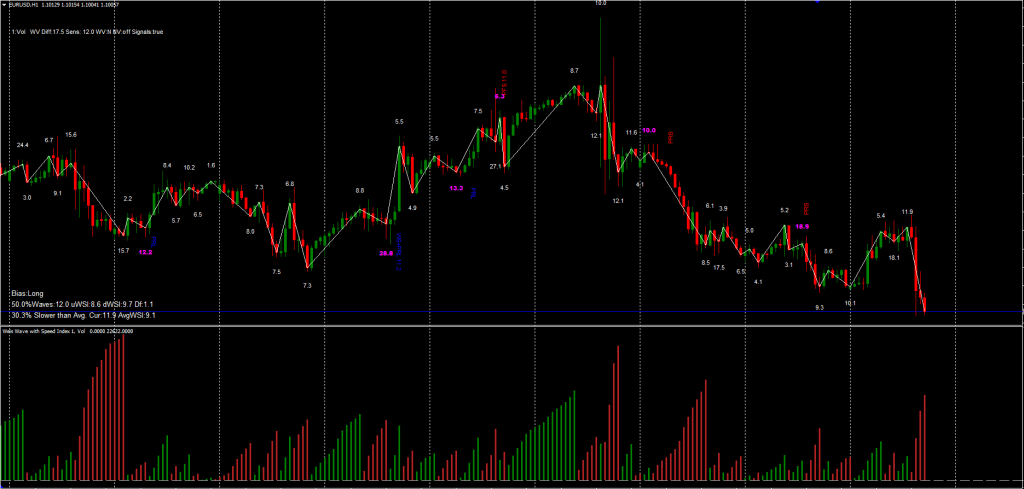

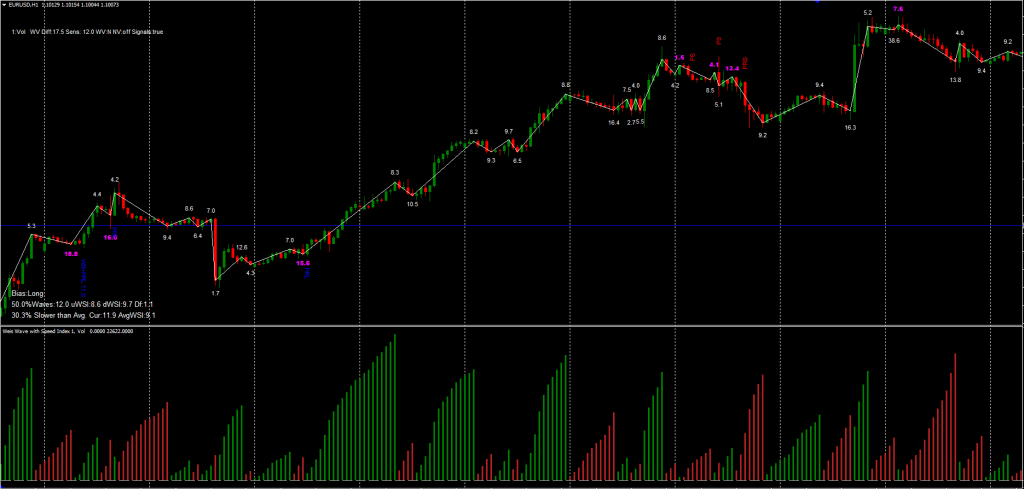

Each price wave represents market movement in a specific direction—either up or down—until a reversal occurs. For a wave to reverse, the price must exceed a set number of points (pip * 10), as defined in the indicator’s parameters. While the most recent wave may repaint based on new price data, the idea behind this method is to predict market direction by analyzing previous wave structures.

What is Weis Wave?

The Weis Wave Indicator is rooted in the Wyckoff Method, a market analysis approach developed by Richard D. Wyckoff in the early 20th century. This method aims to understand market trends by examining supply and demand through price and volume movements.

The Weis Wave Indicator simplifies Wyckoff’s theory by calculating price waves and visualizing them in a way that traders can use to identify potential reversals, trends, and market sentiment. It highlights significant turning points in price action, which helps traders make informed decisions based on historical price wave patterns.

One of the defining features of the Weis Wave is its ability to automatically calculate waves. It offers various wave types and includes a Speed Index, which measures the intensity of price movement in each wave. This allows traders to quickly assess whether a trend is gaining or losing momentum, helping them forecast market direction.

This currency strength indicator isn’t a standalone trading indicator System. Still, it can be very useful for your trading as an additional chart analysis, for finding trade exit positions (TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

The indicator works across all time periods, making it versatile. You can use it for both short-term and long-term forex trading strategies. It can help day traders capture quick market movements when applied to smaller time frames. It can help swing traders identify more sustained trends in larger time frames.

Download a Collection of Indicators, Courses, and EA for FREE

How to Use the Weis Wave Indicator in Forex Trading

Using the Weis Wave Indicator in forex trading can provide insights into market dynamics and potential reversals. Here are a few key steps to effectively incorporate it into your forex strategy:

- Set the Parameters – Before using the indicator, configure the parameters, including the number of points (pip * 10) required for a reversal. This step allows you to tailor the indicator to specific currency pairs and time frames.

- Identifying Trends – By observing the waves, traders can easily spot trends. Upward waves indicate a bullish trend, while downward waves suggest a bearish trend. Forex traders can use this information to align their trades with the overall market direction.

- Wave Reversals – One of the key aspects of the Weis Wave Indicator is its ability to signal potential reversals. In Forex trading, spotting reversals early can be crucial for minimizing losses and maximizing profits. When the price surpasses the number of points set in the indicator parameters, the wave direction changes, indicating a potential shift in the market trend.

- Determining Market Strength – The Speed Index can be used to determine the strength of a particular wave. A fast wave indicates strong momentum, while a slow wave may suggest a weakening trend. This helps traders gauge whether they should stay in a trade or exit before a reversal occurs.

- Use with Volume – Pairing the Weis Wave with volume indicators can enhance its effectiveness. For example, increasing volume during an upward wave may suggest strong buying interest, while decreasing volume might indicate weakening momentum.

- Trade Timing – By using the indicator to understand the current wave, traders can effectively time their trades. For instance, they may choose to enter a trade at the start of a new wave in the direction of the trend or exit when a reversal is detected.

By understanding how to interpret the waves and applying them alongside other technical indicators, traders can use the Weis Wave Indicator to improve their decision-making process in the forex market.

- Read More Supply and Demand EA FREE Download

Conclusion

The Weis Wave Indicator is a powerful tool for analyzing market trends and momentum. Its ability to detect waves automatically, combined with features like multiple wave types and the Speed Index, makes it a valuable addition to any trader’s toolkit. Whether you’re trading Forex or other markets, the Weis Wave Indicator provides a structured approach to understanding price movements, helping you make informed trading decisions.

REPAINTING, like about 5 candles backwards, showing past result when the opportunity has already gone, useless.